Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Imagine the light beer commercial, "All the calories - without much taste." This unfortunate beverage would never leave the shelves. Fully valued banking stocks have also been duds in the shopping aisle. In order to take the risk of owning leveraged business models (such as banks), investors need sufficient return. Bank stocks can make a sizable impact on portfolio performance, beta (index sensitivity) and volatility. Banks currently represent almost 9.5% of the MSCI World Index and are the single largest industry group after software & services. That is where the similarities end. Software & services stocks in the MSCI World Index have outperformed bank stocks over the calendar year-to-date, rising 36% versus 16% for banks; during the same period the MSCI World Index rose 18%. In contrast, MSCI World Index bank stocks increased well above market averages in the fourth quarter of 2016, returning 19% compared to an MSCI World Index return of 2% during that period. Since then, post-US election fiscal optimism has subsided and developed country yield curves have flattened. The gap between 10-year and 2-year US Treasury yields has contracted to the narrowest spread since 2007. A flattening yield curve typically depresses net interest margins and crimps bank earnings. The US bond market is signaling late-cycle slowing of growth, albeit not a recession. Theories abound to explain this flattening, including the prevalence of foreign demand for long-term US treasury bonds, as well as the impact of futures-only leveraged bond traders, particularly those implementing risk parity strategies that add to long positions as volatility falls. Pension fund demand may have risen for long-dated US Treasury zero coupon bonds. Based on statements from the US Treasury Department, government debt financing will increasingly be skewed towards shorter maturities, signaling less supply in longer maturities. Cyclical or structural, the shrinking net interest margin appears likely to haunt banks, first in North America, then in Europe, Japan, and China. For more details on the opportunities and challenges facing bank stocks in the developed equity markets, we spoke to Causeway fundamental portfolio manager, Conor Muldoon, and—for input on bank stock risk characteristics—quantitative portfolio manager, Duff Kuhnert.

Developed market banks have enjoyed a period of modest bad debts and strong credit demand, without serious financial technology disruption to their business models. All of this will likely change.

Q: Conor, why does reducing portfolio exposure to banks make sense if the US Federal Reserve (“Fed”) is tightening and the European Central Bank soon will reduce its asset purchases?

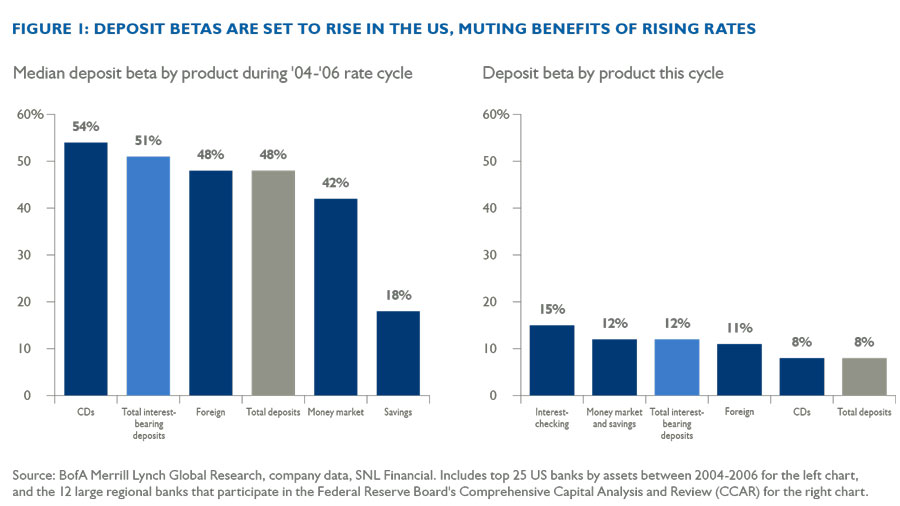

CM: Remember, banks are cyclical. Developed market banks have enjoyed a period of modest bad debts and strong credit demand, without serious financial technology disruption to their business models. All of this will likely change. The recent weakness in bank stock prices may indicate investor expectations for a sizable jump in deposit betas, which measure the sensitivity of bank and money market deposit rates to short-term interest rates. Following initial rate hikes, savers have not been incentivized to move their deposits, but by a third or fourth increase, they likely will expect their money to earn the going rate. In order to attract depositors in a rising short-term interest rate environment, banks will need to compete with each other across the full spectrum of savings products, from CDs to money market funds, for deposits.

We believe the best operating leverage for banks from interest rate hikes is behind them.

We witnessed this behavior in the last upturn in US interest rates in 2004-2006. And, if banks are to partially replace the Fed as owners of mortgage-backed bonds and US Treasury bonds, they will need to fund those purchases with deposits, further increasing competition. We believe the best operating leverage for banks from interest rate hikes is behind them.

Q: But aren’t you ignoring the benefit to US banks of the potential US corporate tax cut?

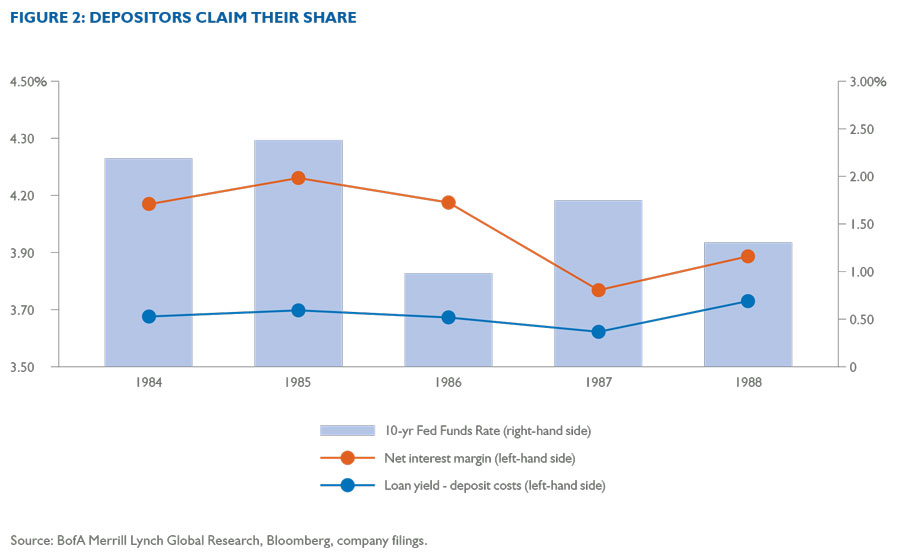

CM: Probably not. In 1986, just after the most significant and far-reaching tax reform in recent US history, bank tax savings were competed away. Net interest margins actually declined in 1987 despite a rising Fed funds rate and a steeper yield curve.

Q: To your point about bank cyclicality, where are we in the credit cycle, especially in the United States?

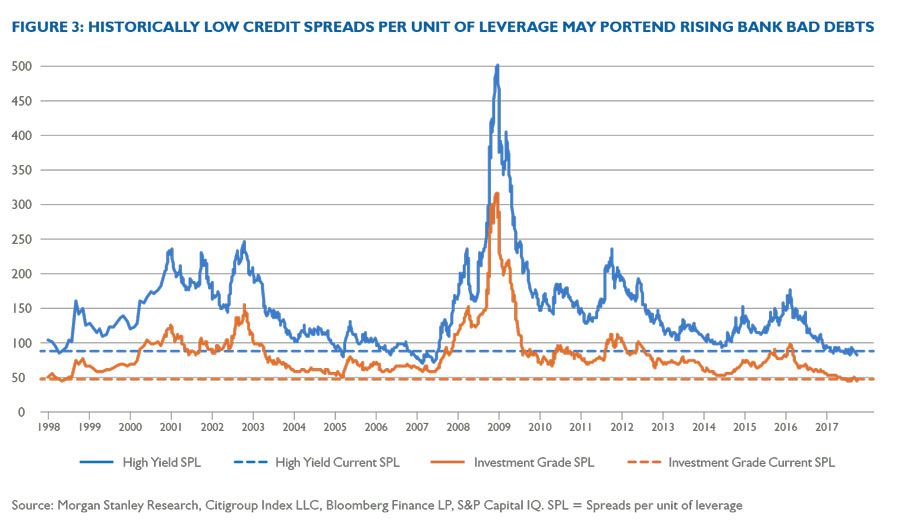

CM: Despite the massive increase in major central bank balance sheets over the past decade, we do not believe that the flood of liquidity has eliminated economic cycles. When investment grade and high yield spreads to US Treasuries as a percent of outstanding system-wide leverage fall to historically low levels, we get nervous. The level of bank bad debts may have only one direction to go: up.

Q: Duff, how does Causeway evaluate the risk of portfolio bank stocks?

DK: Using our multi-factor risk model, bank stocks tend to contribute large quantities of systematic risk factors such as volatility and cyclicality to portfolios, and have high predicted betas. We disaggregate the marginal contribution to risk of banks to evaluate this incremental volatility across such risk dimensions as region-sector, style, and currency. Curiously, we have not observed a significant decline in bank stocks’ risk scores, despite rolling off the 2008 period in our model’s eight year estimation window. At first glance, that seems odd, and indeed our research team questioned the data. Although banks have “de-risked” their balance sheets, more than doubling required capital while facing layers of regulation in response to the financial system meltdown, new risks appear to have replaced those related to capital adequacy.

CM: We suspect that investors, already wary of technology-related disruption across most industries, believe traditional banks are under a threat of disintermediation. Several of the most profitable services today’s banks provide will encounter formidable competition from financial technology capabilities buried within a broader, more digitally connected way of life. Widespread adoption of block chain technology may also threaten the intermediary nature of banking. All we really know is that banking won’t be the same.

Our few remaining bank stocks trade at valuations that do not yet incorporate substantially improved returns on equity from balance sheet and operational restructuring.

DK: Many of the tools that can be used in quant research—advanced data analytics, artificial intelligence, connected devices, application programming interfaces (“API”) and cloud technology—can combine with voice authentication to create a new type of banking experience. Based on our experience in quantitative research, we know that investments in software and data areas can be very expensive for the banks, and likely counterproductive to their cost-cutting programs.

CM: Over the next decade, traditional banks will face new competitors and a likely radical shift in how banking is done. Unless a bank stock has sufficient upside potential, given the cycle ahead and inevitable technological disruption, it would not merit inclusion in client portfolios. Our few remaining bank stocks trade at valuations that do not yet incorporate substantially improved returns on equity from balance sheet and operational restructuring. These banks have large investment banking and capital markets businesses, and should be able to generate fee income as securities volatilities and fixed income and currency trading revenues revert to more normal levels. Lastly, we do not believe bank regulation will become any stricter in this cycle, and it may become more lenient. Coming off of this regulatory peak could create a relative tailwind for the most diversified, heavily regulated banks.

Important Disclosures

This market commentary expresses Causeway’s views as of November 17, 2017 and should not be relied on as research or investment advice regarding any investment. These views and any portfolio holdings and characteristics are subject to change, and there is no guarantee that any forecasts made will come to pass. Any securities referenced do not represent all of the securities purchased, sold or recommended by Causeway. The reader should not assume that an investment in any securities referenced was or will be profitable. Forecasts are subject to numerous assumptions, risks and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy or completeness of such information.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.