Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

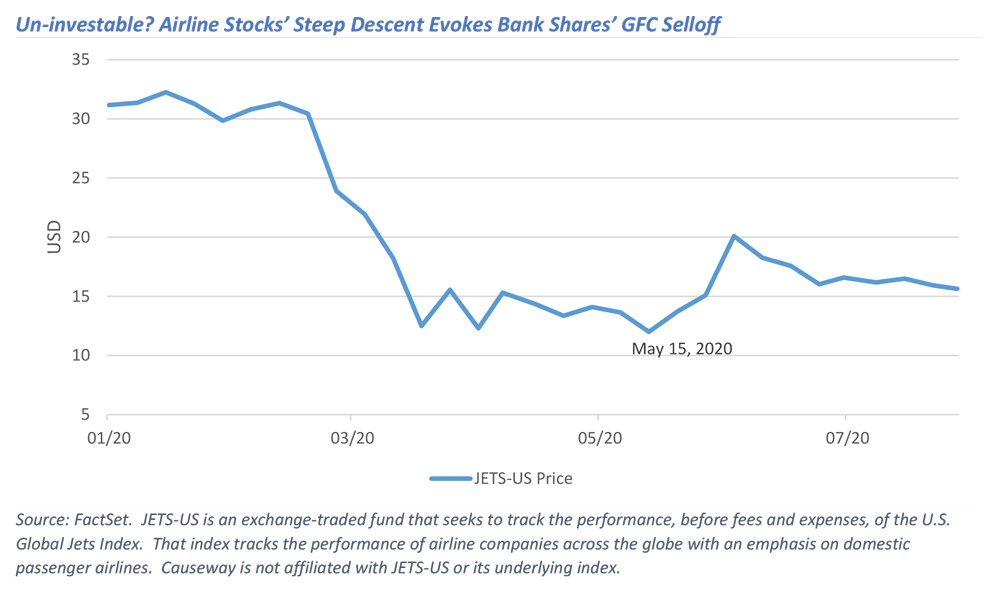

The travel and leisure industry is having its worst year on record. It’s as though the Global Financial Crisis (“GFC”) of 2008-2009 has returned, with airlines, hotels, travel-related software, theme parks and other travel segments experiencing the most acute pain. But a recovery in travel-related stocks may be in sight.

The GFC sent shockwaves through the global capital markets and dragged the global economy into severe recession. Recognizing the potential for an even worse economic shock, during Covid-19, national governments and central banks have intervened with trillions of dollars of fiscal support, securities purchases, and lower interest rates—all to soften the economic blow from the pandemic. Many listed travel and hospitality companies have raised debt or equity to alleviate liquidity problems.

Even as they raise plentiful financing, formerly outstanding business franchises in these Covid-19-afflicted industries have become the investment pariahs of 2020.

Even as they raise plentiful financing, formerly outstanding business franchises in these Covid-19-afflicted industries have become the investment pariahs of 2020. Despite their likely recovery and rock bottom valuations, travel-related stocks have struggled to attract investors. The global travel industry likely will not return to 2019 levels of revenues until late 2023 or 2024. Yet we are observing drastic cost cutting in travel-related companies, not to mention the reduction in travel & leisure capacity—both voluntarily and from the collapse of smaller players. As a result of this restructuring, the return to profitability of the higher-quality, best-managed travel franchises may be surprisingly rapid. In 2021, we currently expect more than one FDA-approved, widely available Covid-19 vaccine, as well as treatments to mitigate symptoms.

Key insights

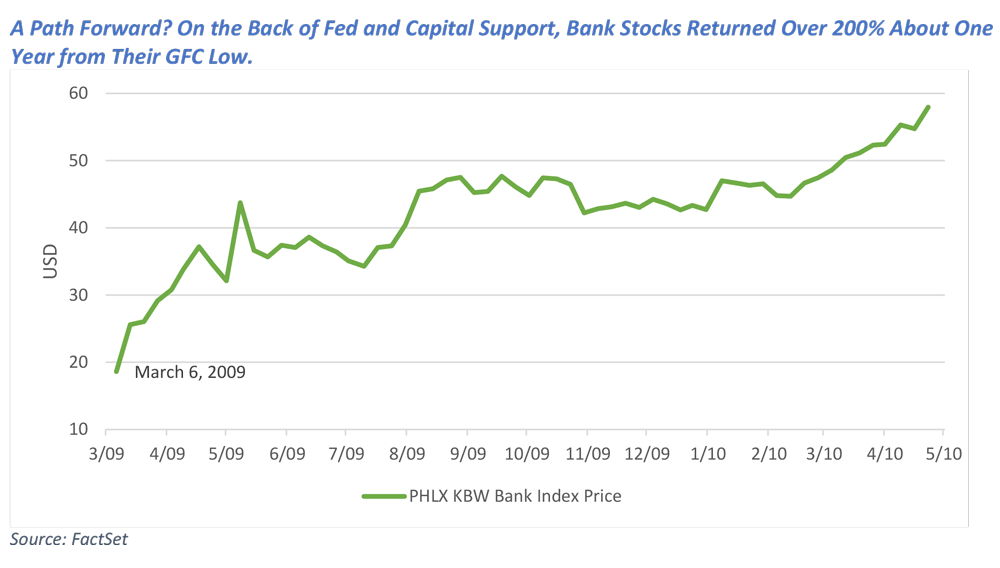

- Bank stocks provide an example of what can happen to the most despised segment of global markets through a crisis. On the back of Fed and capital support, bank stocks returned over 200% about one year from their GFC low.

- We believe that the best capitalized and best competitively positioned travel companies have significant upside.

- Waiting for the pandemic to end is not, in our view, a strategy if investors want to capture the full recovery potential of the hardest hit stocks.

Bank stocks provide an example of what can happen to the most despised segment of global markets through a crisis. During the GFC, bank stocks collapsed. The KBW Bank Index, which represents US exchange-listed stocks of national money center banks and leading regional institutions, reached its GFC low on March 6, 2009, the same day that the US jobless rate registered 8.1% (the rate peaked at 10% in November 2009, not to be surpassed again until the Covid-19-induced economic collapse in early 2020). Back then, U.S. Federal Reserve (“Fed”) Chair Ben Bernanke proclaimed the world was suffering from the worst financial crisis since the 1930s. The Fed announced in mid-March 2009 that it would buy $1.2 trillion of debt to boost lending and promote economic recovery and would purchase toxic assets to repair bank balance sheets. Major central banks spent the early part of 2009 cutting interest rates and expanding the money supply. Nearly all Group of Twenty or “G20” countries enacted fiscal stimulus plans to support economic activity. Several large banks raised equity to meet regulatory capital requirements. Governmental support and banks’ own capital raisings generally added to investor confidence and fueled the demand for cyclical stocks, especially bank stocks. From that March 2009 low, the KBW Bank Index rebounded 211% by April 23, 2010, just over a year later.

Banks today, although they face uncertain loan losses, have revenue-generating activity that looks healthy compared with the 80%-90% plunge in revenues for many travel-related businesses. Have we reached the bottom for travel stocks? We don’t know. Renewed upturns in Covid-19 cases weigh heavily on their forecasts. Yet this uncertainty and accompanying share price volatility provide attractive entry points for investors with some patience. Whereas bank loan losses have not yet materialized, we estimate that most travel-related industries experienced the greatest revenue reductions in the second quarter of this year. We believe the worst is over for travel, as governments currently appear unlikely to re-instate nationwide lockdowns.

According to our research, airlines with dominant positions in low-cost and short-haul flights should provide the highest near-term payoffs.

The most visible travel businesses impacted by Covid-19 include airlines and hotels. Of the two, Causeway fundamental portfolios have greater exposure to air travel companies, as well as the aerospace manufacturers who supply their airplanes and jet engines. At least the airlines can haul cargo, unlike hotels who cannot fill rooms with anything other than people. Given the advance bookings and resulting stream of advance payments, airline operators can experience massive swings in working capital. We estimate that the bulk of refunds for cancelled travel have already occurred, paving the way for new bookings and cash inflows. We wrote about the recovery potential of aviation and aerospace stocks in April. We chose, in our view, the best-managed airline companies with access to enough financing to absorb the cash burn that will prevail until travel demand recovers. According to our research, airlines with dominant positions in low-cost and short-haul flights should provide the highest near-term payoffs. “Budget” carriers with narrow-body planes can return to the sky with less expense than peers operating heftier aircraft. And, we believe consumers’ renewed appetite for air travel will begin with shorter flights. Even without a vaccine, demand for short-haul travel ticked upward in most regions in May and June, especially in China. Carriers servicing these short domestic routes should be early beneficiaries of pent-up air traffic demand, particularly for leisure travel. We recognize the upside potential in airlines whose management can improve fleet efficiency and cut expenses more than peers. One of our portfolio companies, a US-listed budget airline, claims that they have cut cost-per-available-seat-mile enough to maintain 2019 levels of profitability in 2023, even with only a partial recovery in revenues from 2019 levels. As is the case for all the Covid-19-impacted businesses in which we invest, we prioritize financial strength. We believe that the airlines with the best balance sheets can sustain this period without the need for government loans.

Flying further under the radar are attractive travel-exposed businesses in industries such as specialty retail, transportation infrastructure, and information technology services.

Flying further under the radar are attractive travel-exposed businesses in industries such as specialty retail, transportation infrastructure, and information technology services. Investment opportunities include an airport sundries retailer with an extensive network, an experienced regional airport operator, and oligopolist providers of travel support services such as booking software. These companies are of enviable quality, but near-term Covid-19 concerns have decimated their share prices. As with airlines, the most capable management teams have spent recent months shoring up liquidity to ensure longevity for their businesses and continue to improve efficiency and reduce costs to improve operating leverage. We believe that some of these companies will emerge from this pandemic more profitable than they were last year, albeit with passenger or guest traffic only recovering to 90% of 2019 levels by end 2023.

What could go wrong for the travel-related companies and their suppliers? Even after the launch of multiple vaccines, a prolonged period of border restrictions would likely result in continued weakness in long haul international traffic. Some of the airlines receiving state financial subsidies may compete irrationally to gain market share. We believe that the best capitalized—and best competitively positioned—of these companies have significant recovery potential within three years. If the second quarter 2020 was the bottom in demand, then investors may be well rewarded for waiting. As evidenced by the bank stock relief rally that began in 2009, investors have in the past started buying when they expected a sustainable rebound in the prospects for downtrodden industries. Stock prices have typically anticipated outcomes many months in advance of publicly available data. Waiting for the pandemic to end is not, in our view, a strategy if investors want to capture the full recovery potential of the hardest hit stocks.

This market commentary expresses Causeway’s views as of August 19, 2020 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Our investment portfolios may or may not hold the securities mentioned, and the securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. Information and data presented have been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

The KBW Bank Index is designed to track the performance of the leading banks and thrifts that are publicly traded in the U.S. The Index includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions. It is not possible to invest directly in an Index.