Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Causeway portfolio manager Fusheng Li can glimpse Shanghai street life from his quarantine hotel window. Physically barricaded inside his room, he is halfway through two weeks of isolation upon his return from the US. Outside his hotel, thanks in part to these strict travel protocols, residents of China’s most populous city generally have resumed their pre-Covid activities, although insulated within national borders. Schools have been open for months, hotel bookings have fully recovered, and lines for luxury goods wrap around street corners. When Li is released from quarantine, he will rejoin his team’s Shanghai-based analysts, meeting with company managements, valuing businesses, and feeding insights about China to Causeway investment professionals in the US.

Key insights

- Promising investments in Causeway's view include companies upgrading to higher value-add goods and services and benefitting from Chinese onshoring.

- Investing on a five-year horizon, emphasizing founder-led businesses, and concentrating capital in high conviction positions may mitigate Chinese market risks.

- A local presence in Shanghai reveals potentially attractive investments and provides valuable information to Causeway's equity team stateside.

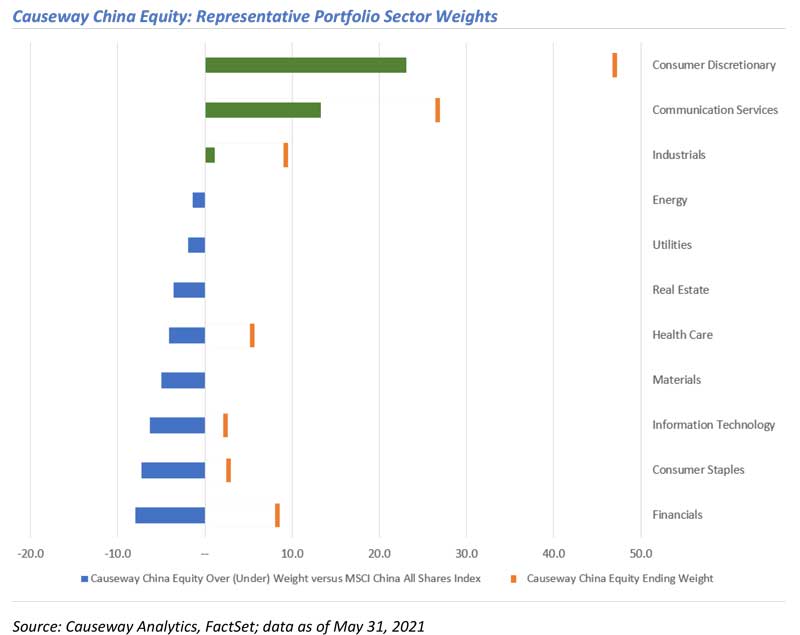

After nearly two decades of covering China from Los Angeles, Causeway determined that a physical presence in China is vital for our comprehensive global equity research. Despite Covid presenting literal barriers to entry, the firm established a Shanghai research subsidiary in January 2021, headed by Li and staffed with a growing team of research analysts fluent in Mandarin. In March 2021, Causeway launched our first dedicated China equity strategy, featuring a concentrated portfolio that may invest in Chinese A-shares (through Stock Connect), Hong Kong-listed H-shares and depositary receipts of Chinese companies. Li is well placed to lead Causeway’s China research. After a childhood in China’s Shandong province, he pursued an advanced education in China and the US, earning the international equivalent of an MD, an MS in Pathology, a PhD in Pharmacology, an MBA and a CFA charter. He joined Causeway in Los Angeles in 2012, spending years analyzing health care and technology stocks before focusing his efforts on Chinese companies.

From Shanghai, Causeway has direct exposure to China’s economic evolution. This includes e-commerce trends emanating from China’s rural regions, advancements in solar technology that could challenge Western competitors, and industrial manufacturers leapfrogging to highly efficient automated processes.

Such local insights reveal potentially attractive investments and provide valuable information to the firm’s equity team stateside. Even witnessing firsthand China’s rapid recovery from the pandemic is beneficial, enhancing our understanding of Covid-sensitive businesses and demonstrating a model for reopening in other economies. Causeway believes its investment in China research will pay dividends to clients in all its equity strategies, fundamental and quantitative.

Investors avoiding the Chinese market for its casino-like volatility and reputation for weak corporate governance may be missing out on valuable investment returns and portfolio diversification. The vast Chinese equity market includes many relatively well managed and competitively advantaged companies escaping the notice of local and global investors. There are over 2,100 Chinese companies with market capitalizations greater than US$1 billion, yet a database of over 46,000 sell-side analysts reveals zero coverage of nearly a quarter of these companies. The risks of investing in Chinese companies are real and material, but we believe the opportunities are even greater if vetted through diligent research and thorough risk analysis. Like all its equity strategies, Causeway’s investment philosophy for China is rooted in valuation. To seek to overcome market volatility and other risks, Causeway’s China equity strategy typically invests on a five-year horizon, emphasizes founder-led businesses, and concentrates capital in high conviction positions.

Investors avoiding the Chinese market for its casino-like volatility and reputation for weak corporate governance may be missing out on valuable investment returns and portfolio diversification.

For growing or transforming companies, five years generally provides adequate time for profit margins to mature or recover, and valuations to positively incorporate earnings improvements. On a five-year horizon, quarterly earnings announcements, frequent trading, and rumors should cede to fundamentals as the primary driver of share prices. Causeway generally avoids companies with poor corporate governance, preferring to invest alongside business owners who respect minority shareholder interests. Additionally, the team seeks financially strong businesses generating ample cash flows. Li and his Shanghai-based research colleagues can benefit from frequent management access and onsite visits to evaluate these company characteristics. A concentrated portfolio of 15-30 stocks allows Causeway to know its holdings inside and out. Causeway’s investment philosophy can also provide a recruiting advantage in a job market notorious for high turnover. China fund managers can trade frequently, causing analysts to concentrate on short-term news flow and quarterly estimates without developing relationships with management or accessing a full complement of fundamental research tools. In addition to this rigorous analysis, Causeway also offers quantitative screening and risk analytics, including a rapidly growing ESG database and scoring system. The teams, both in China and the US, work collaboratively to help analysts develop as investors.

Some of the most promising investments in Li’s view are what he dubs “local champions,” beneficiaries of at least one of two Chinese economic trends: quality upgrades and local substitution. China’s economy has entered a quality growth period, transitioning from cheap manufactured exports to higher value-add goods and services, particularly in the technology, health care, consumer, and industrials sectors. These improvements have made China a formidable competitor to developed economies, escalating trade tensions that give way to the second trend, local substitution. As China replaces imports with homegrown goods and services, well-positioned Chinese companies can use their massive domestic market to reach scale—and then become low cost competitors globally.

Some of the most promising investments in Li’s view are what he dubs “local champions,” beneficiaries of at least one of two Chinese economic trends: quality upgrades and local substitution.

Li’s local champions include a world class printed circuit board (PCB) manufacturer that benefits from both trends: it is implementing higher-margin automated processes while growing market share as China on-shores PCB production. This company, despite operating for thirty years, employing a 13,000-plus workforce, and generating more than RMB7 billion (US$1 billion) in revenues in 2020, is not currently represented in any major China equity index. Other champions include a medical device company that produces high quality diagnostic equipment and is exposed to secular growth from China’s aging population, and an appliance manufacturer quickly scaling the technological curve to compete in the US and Europe.

Whereas some local champions are beyond the scope of most research analysts, other attractive investments hide in plain sight. Li sees underrecognized potential in certain Chinese internet giants, especially for their advancements in artificial intelligence (AI). China-based research team members experience how ingrained e-commerce has become in everyday life, from the near ubiquity of digital payment systems to emerging trends like group buying, where shoppers team up via online platforms for discounted bulk grocery purchases. Large China technology companies are recycling cash from mature businesses into technology research & development, reducing near-term profits. With a five-year investment horizon, Li and the team believe AI will generate attractive revenue and earnings will ultimately recover. Causeway Los Angeles-based analyst Victor Liu, who has covered technology stocks for 16 years, and focuses on Hong Kong listings and depository receipts of Chinese companies, gets excited about the opportunity to buy Chinese technology companies that, in his view, are at least as sophisticated, forward-facing, and customer-centric as their US peers, but available at significantly lower valuations.

“It’s magical” he says, “once they give their managers equity, the operating profit margins often improve 5-10%.”

Some opportunities in China are more fleeting, and the team is prepared to try to take advantage of them. While Causeway prefers private ownership, Li believes there is low-hanging fruit in certain state-owned enterprises that decide to incentivize their managers with stock compensation. “It’s magical” he says, “once they give their managers equity, the operating profit margins often improve 5-10%.” The pandemic presented rare investment opportunities, as it did for other Causeway strategies. Li and his China colleagues identified two hot pot restaurant chains, typically profitable businesses that have been deeply discounted as communal in-restaurant dining takes longer to recover from the pandemic than other Covid-sensitive businesses.

Given that he spent much of his adulthood moving east to west, Li’s path to Shanghai might seem circuitous. But he now travels to China as an experienced investor, an equity member of Causeway’s parent holding company, and a US citizen, prepared to cultivate local insight from an international perspective. Li observes that he and many of China’s corporate management teams are of the same generation. During their lifetimes, China emerged from near destitution to become one of the world’s largest economies. “We have a common language,” he says of this remarkable shared experience. With Causeway, he looks forward to participating in China’s next chapter.

To learn more about Causeway’s China Research capabilities, please submit a contact form via the Contact Us button at the top of this post.

This market commentary expresses Causeway’s views as of June 2021 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Our investment portfolios may or may not hold the securities mentioned, and the securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. Information and data presented have been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

The MSCI China All Shares Index captures large and mid-cap representation across China A‐shares, B‐shares, H‐shares, Red‐chips, P‐chips and foreign listings (e.g. ADRs). The index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen and outside of China. The index is gross of withholding taxes, assumes reinvestment of dividends and capital gains, and assumes no management, custody, transaction or other expenses. It is not possible to invest directly in an Index.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.