Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

In the early weeks of January, after morning commutes to corners of bedrooms and repurposed dining room tables, we conducted our first client portfolio reviews of 2021. The approval of highly efficacious Covid-19 vaccines in the fourth quarter 2020 had, as we expected, halted the long-running outperformance of quality/momentum/growth stocks. The cyclical value exposure Causeway had increased throughout the pandemic ignited an enormous rebound in November. Our clients asked, how much further can these cyclical stocks run? We believe there is still meaningful upside in client portfolios, particularly in operationally geared companies on the verge of revenue increases. These companies, poised to regain the market’s attention, are our highest conviction examples of what should be a broader recovery ahead for cyclical and value stocks.

Key insights

- In our view, markets have greatly underestimated the earnings and cash flow recovery potential from many companies hard hit by the pandemic—to us, that represents the opportunity for future performance.

- We remain focused on not paying a price for a stock that reaches beyond its future earnings recovery and growth.

- Beyond the immediate recovery, we anticipate more defensive positioning and investors’ renewed focus on valuation.

We recognize that undervaluation without any prospects for growth is insufficient for outperformance. That is why, in our clients’ fundamental portfolios, we have emphasized companies with substantial operational gearing that allows them to deliver outsized profits as a percentage of revenues. We have identified, and continue to vet, portfolio companies run by talented management teams who are using the Covid crisis to make their firms more profitable as business improves and revenue growth resumes. In our view, markets have greatly underestimated the earnings and cash flow recovery potential from many companies hard hit by the pandemic—to us, that represents the opportunity for future performance.

Undervaluation without any prospects for growth is insufficient for outperformance. That is why we have emphasized companies with substantial operational gearing that allows them to deliver outsized profits as a percentage of revenues.

For several portfolio companies in economically cyclical industries, 2020 was supposed to be the end of a multi-year investment cycle, with ensuing years of capital return to shareholders. Covid replaced those plans with a scramble for liquidity. Portfolio companies with revenues most affected by lockdowns, in aerospace, aviation, and travel/leisure, have used this crisis to dramatically reduce their costs. Most have implemented efficiency programs, accelerated implementation of advanced information technology, and migrated computing to the cloud. We spent much of last year gaining exposure to many companies undergoing what we estimate will generally be the most effective operational restructurings.

From our valuation models, we share examples of these companies to highlight this recovery potential.

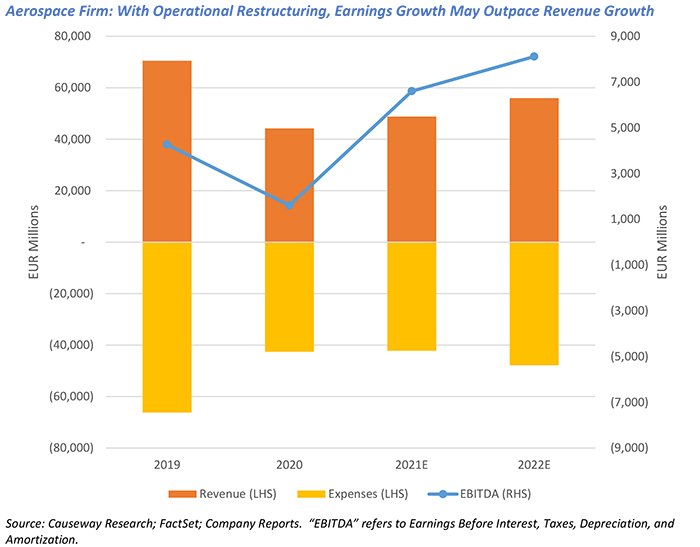

Last year, an aerospace manufacturer began a large restructuring program to right-size its production system to lower levels of demand. Based on our analysis, production capacity is expected to be cut by about 40% on wide-body aircraft and 15-20% on narrow-body aircraft. As production ramps back up in 2022-23, we expect the business’ significant operating leverage will drive earnings above pre-Covid levels of 2019 before revenues have fully recovered.

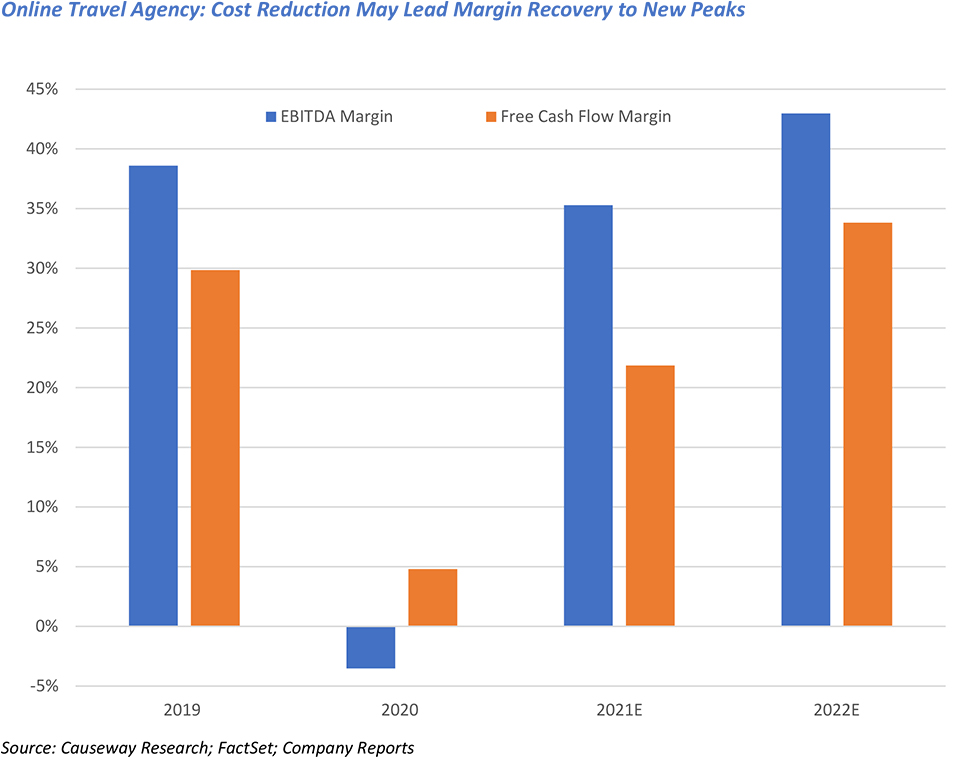

We added a large online travel agency to client global value portfolios last year. Based on our analysis, the travel information technology sector is experiencing long-term secular growth. In the years leading up to 2020, this company’s earnings and free cash flow reached new heights. 2020 was understandably a brutal year for travel businesses, and the company’s profitability plummeted. In response, company management undertook an ambitious cost savings plan in 2020 that, by our forecasts, will help them achieve earnings and free cash flow margins in 2022 that may surpass their prior peaks. We believe its competitive position post-Covid will be stronger than ever.

We also are seeing moves to more sustainable business practices from many of these companies, which may feed into virtuous cycles of efficiency, for example, by using less resources per unit of output. We are optimistic that client portfolio companies will use their replenished liquidity to return surplus cash to shareholders in the form of dividends and share buybacks in 2021. We believe some of the stocks most acutely affected by the pandemic should have a multi-year recovery ahead.

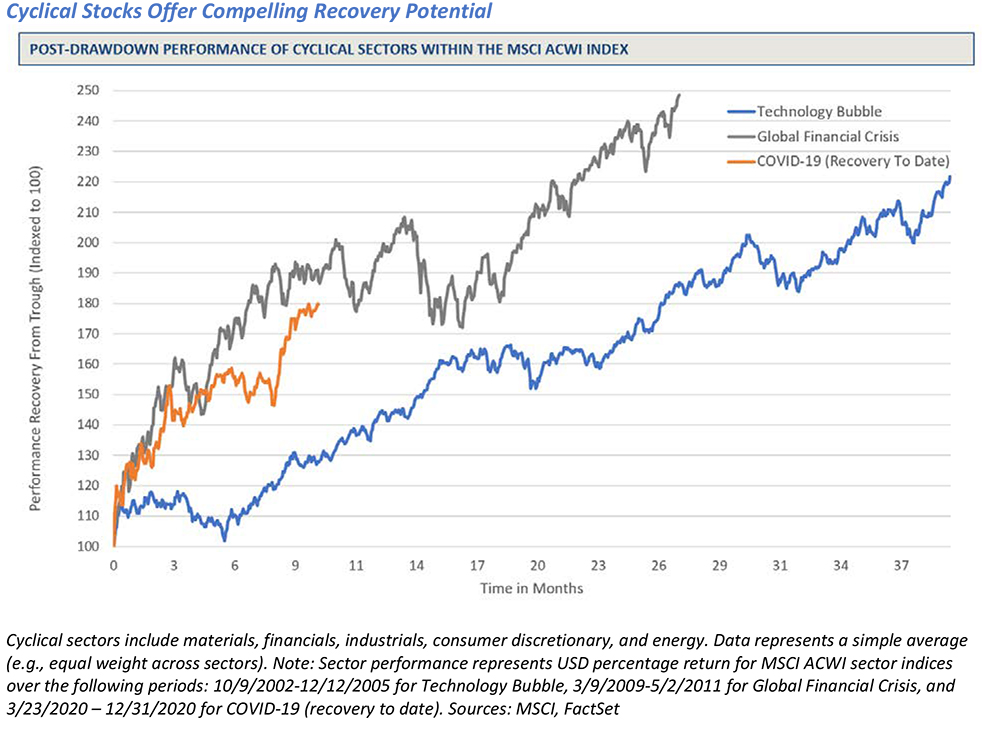

With vaccinations and the end of lockdowns, we expect a boost to demand and then orders, which should translate to revenue recovery for economically sensitive companies. Private sector consumption should surge. An incremental $11 trillion of global monetary and fiscal support from March 2020 to mid-2021 should provide an economic booster shot. We believe the pandemic relief and infrastructure spending worldwide will increase consumer confidence in most regions globally and stimulate real gross domestic product growth. The beginning of an upturn in economic activity, albeit not yet in the data, has invigorated investor interest in cyclical stocks from last November. Even after impressive performance in the fourth quarter 2020, cyclical stocks continue to demonstrate considerable recovery potential, particularly when viewed in a historical context.

If these cyclical stocks re-rate upward to our two-year price targets, we know not to overstay our welcome. We expect to deploy capital into more defensive stocks, thus reducing portfolio volatility risk and prospective beta. Portfolio expected return must more than compensate for expected risk. Defensive stocks in the portfolio and the consequent reduced volatility and beta should help position the portfolio, relative to broad markets, for a sharp withdrawal of fiscal support in countries globally. Barring another market crisis, we believe this positioning will ultimately prove advantageous for clients in the period ahead.

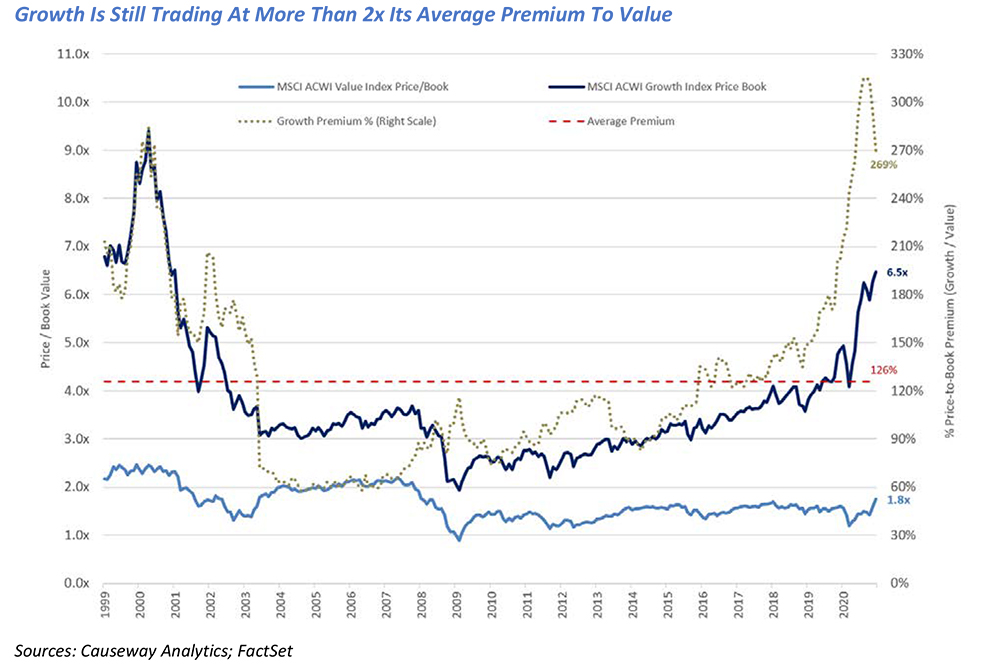

Growth stocks have been trading at over twice their long-term average premium to value stocks. Overpay, and returns will, by definition, underwhelm.

Growth stocks—especially those trading at over 10x revenues—continue to monopolize media attention. Easy money, amplified by government action, and outsized returns have made speculating a very profitable activity in most markets from the March 23, 2020 market lows. On a price-to-book-value basis, growth stocks have been trading at over twice their long-term average premium to value stocks. Overpay, and returns will, by definition, underwhelm. As many investors appear to have abandoned valuation discipline in this prolonged bull market, we remain focused on not paying a price for a stock that reaches beyond its future earnings recovery and growth.

Beyond the immediate recovery, we anticipate more defensive positioning and investors’ renewed focus on valuation.

This June, Causeway will celebrate its twentieth anniversary. Senior members of our investment team, tracing back through predecessor firms, enter their thirty-first year of value investing. Decades of stalwart value investment may elicit groans from readers who have grown weary of value’s prolonged struggle. Yet approaching this milestone, our team is more energized and enthusiastic than ever before. As we enter 2021 and emerge from the pandemic, we believe in a near-term case for economically cyclical and Covid-impacted stocks and their amplified profit potential. Beyond the immediate recovery, we anticipate more defensive positioning and investors’ renewed focus on valuation. It is our fundamental, bottom-up research process that, in our view, allows us to adeptly manage client fundamental portfolios across various points of the economic cycle. We thank our clients for entrusting us as stewards of their assets as we seek to deliver satisfying returns in the recovery ahead.

This market commentary expresses Causeway’s views as of February 2021 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Our investment portfolios may or may not hold the securities mentioned, and the securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. Information and data presented have been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

The MSCI ACWI Index is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world and is comprised of stocks from 23 developed countries and 27 emerging markets. The MSCI ACWI Value Index is a subset of the MSCI ACWI Index, and targets 50% coverage of the MSCI ACWI Index, with value investment style characteristics for index construction using three variables: book value to price, 12-month forward earnings to price, and dividend yield. The MSCI ACWI Growth Index is a subset of the MSCI ACWI Index and targets the remaining 50% coverage.

These MSCI indices are gross of withholding taxes, assume reinvestment of dividends and capital gains, and assume no management, custody, transaction or other expenses. It is not possible to invest directly in an Index.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.