Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

“People should value manufacturing—the world of atoms vs. the world of bits—far more. It is looked down upon by many, which is just not right.” -Elon Musk

Although less controversial than some of Mr. Musk’s recent tweets, markets appear to disagree with his tribute to the physical over the digital. This year-to-date’s sector winner in the MSCI ACWI Index (“ACWI”) is information technology, with software & services devouring the world of atoms. In the volatile first five months of 2020, these companies trafficking in bits rose nearly 10%, overcoming the pandemic, lockdown-induced market correction, falling interest rates and ballooning government debt. In contrast with information technology, the industrials sector declined 15% during this period, weighed down by capital goods. Other economically sensitive sectors, including energy and financials, have fared even worse.

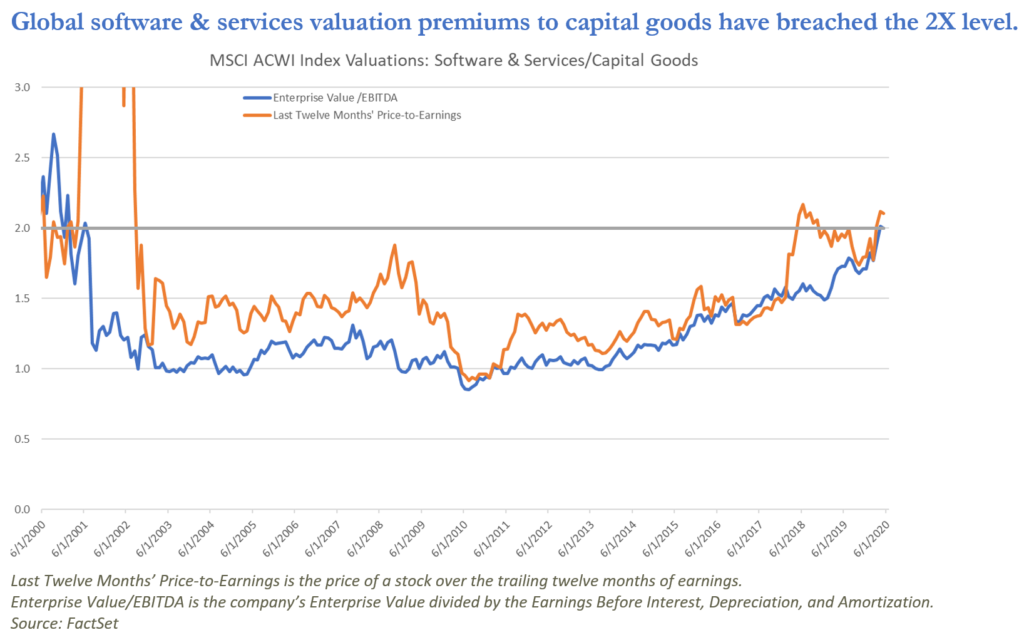

New-economy glamour is only one driver of information technology’s outperformance. As interest rates have fallen in the years following the 2008-09 global financial crisis (“GFC”), investors have preferred long-duration growth stocks. In recent years, as global central banks used increasingly unconventional monetary policy tools to prolong post-GFC economic expansion, growth stocks became even more coveted. In the three years to December 31, 2019, the ACWI information technology sector gained 98% cumulatively while industrials rose a respectable 38% and financials 31%. Global software & services companies trade at approximately twice the valuation levels of capital goods companies as of end-May 2020, as shown in the chart below. The earnings multiples for capital goods may even be temporarily inflated because of depressed profits from lockdown-afflicted economies.

Key insights

- If economically sensitive stocks lead the market recovery, as we expect, history would repeat itself.

- Many cyclical companies, such as global industrial conglomerates, capital-rich banking institutions, and travel & leisure companies, should experience a substantial rerating.

- With over 50% of the ACWI index invested in the lowest Covid-19 beta sectors, passive index investors appear to be underexposed to upside recovery.

Is a dollar of earnings from a software firm that has yet to return capital to shareholders twice as valuable as a dollar of earnings from a global industrial conglomerate with over a century of brand building and operational expertise? Even giving technology firms full credit for their disruptive potential, we believe these differentials are unsustainably wide. We have been taking advantage of this market dislocation to add to capital goods stocks and other economically sensitive companies. From a valuation perspective, it is perversely reassuring to hold securities that trade at GFC valuation troughs—or lower—but with more admirable characteristics, such as stronger balance sheets and more profitable business mixes than they had during the last recession.

From a valuation perspective, it is perversely reassuring to hold securities that trade at GFC valuation troughs—or lower—but with more admirable characteristics than they had during the last recession.

Many industrial companies found themselves on the wrong side of the Covid-19 shutdowns, but adept managements are not letting this crisis go to waste. For many companies in our clients’ fundamental value portfolios, managements are cutting costs, reorganizing operations, and employing automation tools that should allow them to reach high levels of efficiency. In the meantime, they are ensuring they have sufficient liquidity to weather a prolonged shutdown. Driving down costs makes a return to revenue growth even more profitable. Like a coiled spring, this expansion in latent profitability should ultimately warrant outperformance from quality cyclical stocks as economies reach recession lows and markets anticipate economic recovery.

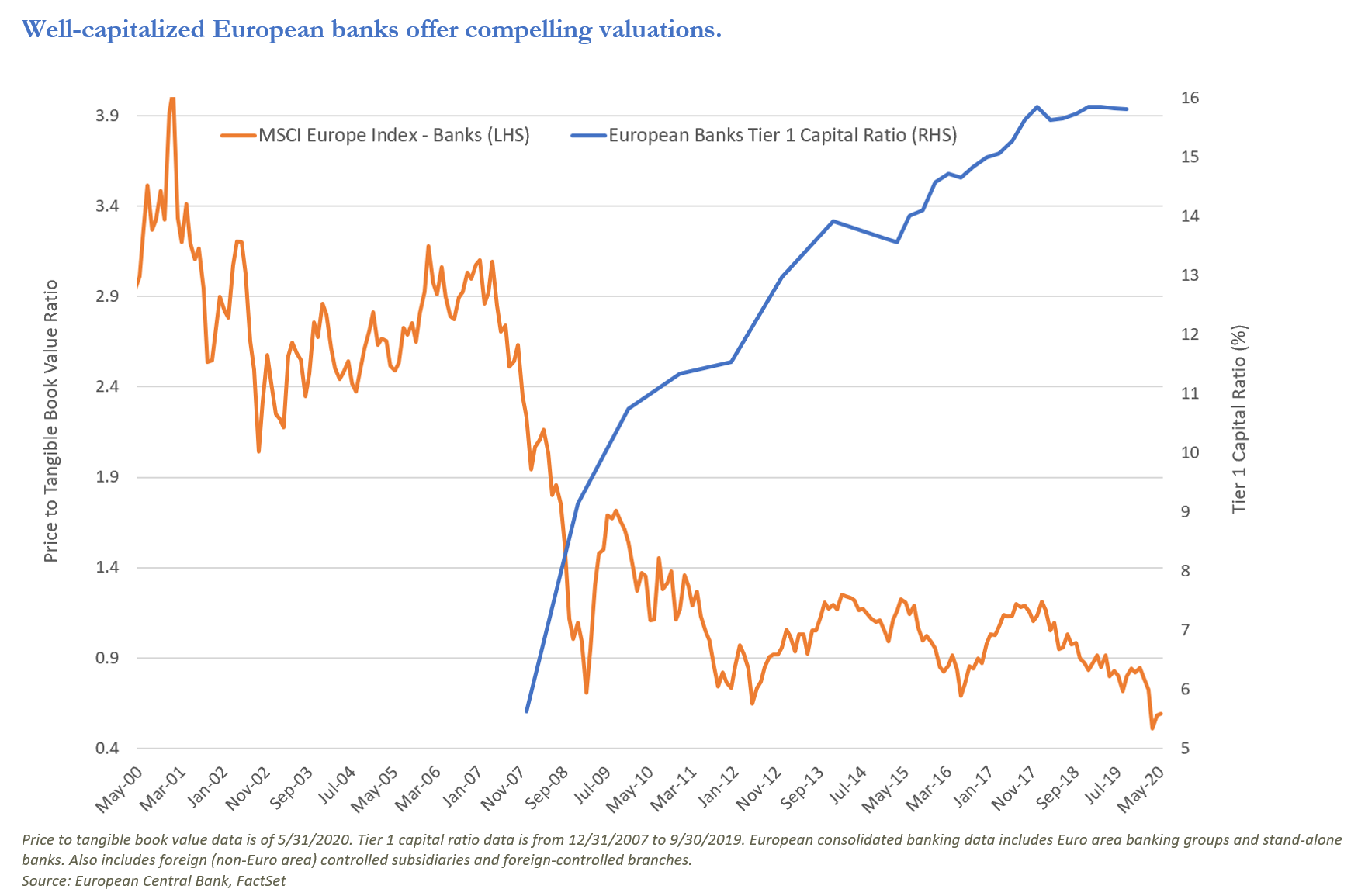

Investors can find attractive cyclical investments beyond the world of durable goods. Banks, particularly those headquartered in Europe, may be the most misunderstood. Some banks trade at valuations equal to (or less than) their surplus capital, implying that the banks themselves—including their interest-rate-resilient wealth management divisions, trading and operations segments, and automobile and mortgage lending businesses—are free. Global markets have priced most bank stocks as if a surge of bad debts will wipe out pre-provision profits and consume capital, as occurred in the GFC. Yet banks in many geographies have spent years shrinking bad debts, diversifying loan books, exiting many risky or low return lines of business, and decreasing leverage by beefing up capital. No longer culprits at the locus of government aid, banks provide essential liquidity to businesses struggling with precipitous cash flow declines.

Banks need to provision for expected losses, but we believe we have identified organizations that have the financial strength to survive and take market share from weaker competitors. We have assumed low or zero interest rates and conservative net interest margins in our valuation models. Even without rising interest rate support, at current valuations we believe the prices of some of the most deeply discounted bank stocks, especially in Europe, could significantly appreciate with the prospect of economic recovery. As Covid-19-induced weakness diminishes in severity, we expect many of the better-managed banks to exit the current crisis with sufficient capital to satisfy regulators and resume paying dividends and/or buying back shares.

No longer culprits at the locus of government aid, banks provide essential liquidity to businesses struggling with precipitous cash flow declines.

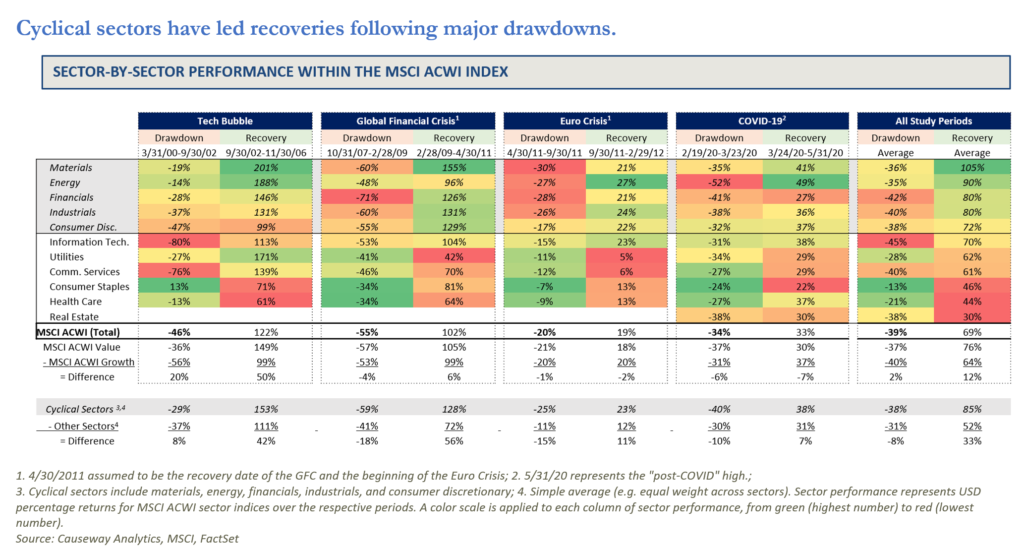

Investors may already be recognizing the undervaluation of cyclical stocks. Much of the poor performance from cyclical sectors occurred in the first quarter, especially in March. Since then, sectors most exposed to economic changes have led global equity markets upward. Barring another wave of lockdowns, we expect this rotation to continue. If cyclicals lead the market recovery, as we expect, history would repeat itself. Economically cyclical sectors have led global markets in each of the past four market rebounds, including this year’s recent upswing from the March 23 bottom.

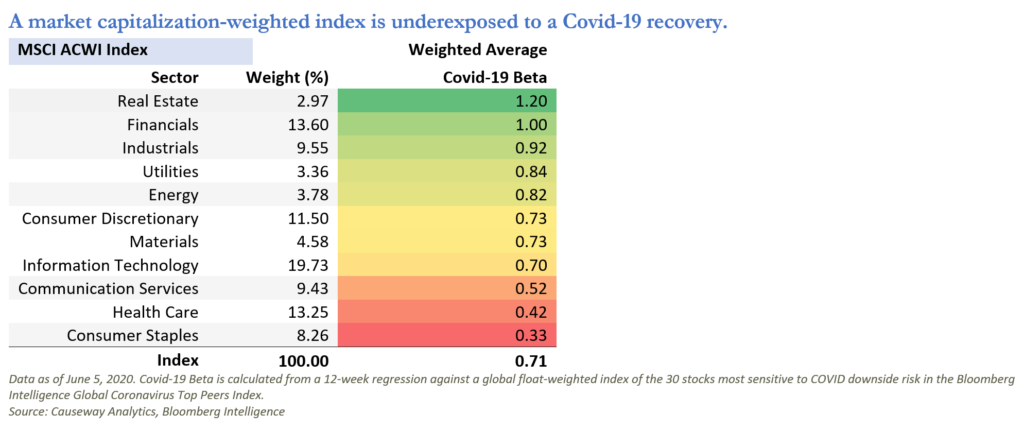

How do the stocks most impacted by Covid-19 fit into this pattern of cyclical recovery? Causeway quantitative research developed a risk factor to monitor beta (share-price sensitivity) to Covid-19 downside risk. The consumer staples, health care, communication services, and information technology sectors, in developed and emerging markets as detailed in the table below, exhibit the lowest betas. They appear to be the most resilient to Covid-19 downside risk—but also the least exposed to upside recovery. Real estate, financials and industrials exhibit the highest betas. In positive return days for equity markets from late March, high Covid-19 beta stocks have delivered the greatest returns. With over 50% of the ACWI index invested in the lowest beta sectors, passive index investors are underexposed to Covid-19 beta. With lockdowns ending and healthcare systems more able to cope with cases than at the outset of the crisis, passive strategies may struggle to outperform more cyclical, higher Covid-19 beta strategies in the months ahead.

Passive strategies may struggle to outperform more cyclical, higher Covid-19 beta strategies in the months ahead.

Sectors with economic sensitivity have in the past created significant value for shareholders in those companies. For many cyclical companies, such as global industrial conglomerates, capital-rich banking institutions, or travel & leisure companies at the economic epicenter of the Covid-19 crisis, global equity markets have taken a short-term view of profitability as if full recovery will never occur. As the healthcare crisis abates and economic activity normalizes, these companies should experience a substantial re-rating. Economic cycles change, and interest rates change with them. We suggest central banks cannot suppress interest rates indefinitely. Demand for government bonds may wane as global savings refuse to finance ever-expanding fiscal deficits. Moreover, a recovering global economy will likely push interest rates higher. Under such a scenario, we believe cyclical stocks would have an even greater impetus to extend their market-beating rally.

This market commentary expresses Causeway’s views as of June 8, 2020 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented have been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

The MSCI ACWI Index is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world and is comprised of stocks from 23 developed countries and 26 emerging markets. The MSCI ACWI Value Index captures large and mid-cap securities exhibiting overall value style characteristics across these countries. The MSCI ACWI Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics across these countries. These MSCI indices are gross of withholding taxes, assume reinvestment of dividends and capital gains, and assume no management, custody, transaction, or other expenses. It is not possible to invest directly in an Index. MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations, and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.