Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

March 9, 2021

As long-term investors, we typically avoid making short-term market observations. However, after a blistering run upward, the technology stocks with little but revenues and aggressive growth predictions have fallen back to earth. We believe a chain reaction is occurring in what have been “consensus long” positions in this very crowded area of global markets. Selling leads to passive rebalancing (and, more selling), triggers margin calls, and encourages short positions.

From market close on February 12, 2021—NASDAQ’s 2021 peak—to yesterday’s close, a representative Causeway Global Value Equity portfolio outperformed the MSCI ACWI Index by 964 basis points, net of fees*. The portfolio’s information technology and communication services stocks contributed nearly 40% of that total outperformance.

In this period from mid-February, as bond yield globally have risen, the high-growth software and Internet stocks that analysts viewed thematically as Covid-19 winners, as well as semiconductor stocks whose valuations reached all-time-highs in anticipation of a strong cyclical upturn, have largely suffered the greatest downward pressure. With bond yields falling, valuation seemed like a quaint concept. Yet, we believe that signs of an economic recovery have made valuation paramount. Rising bond yields undermine long-duration equities—those valued on lofty price-to-sales multiples—promising to deliver cash flows at some hazy point in the future.

Rising bond yields undermine long-duration equities—those valued on lofty price-to-sales multiples—promising to deliver cash flows at some hazy point in the future.

The Causeway Global Value Equity portfolio has emphasized companies that have historically (pre-pandemic) generated abundant free cash flows versus their peers and that, in our view, have the potential to resume this pattern as recovery accelerates. We believe that our portfolio companies are well-managed, have resilient balance sheets and are well-positioned for economic recovery.

The fundamental analysis from our Technology and Communication Services research cluster has led us to emphasize the following areas:

Software: Infrastructure software companies with large, high-retention customer bases transitioning to cloud computing versus pure-play cloud stocks that have already been benefiting from Covid-19. We also have identified attractively valued travel-related software companies whose revenue declined 50-70% on a year-over-year basis in 2020 due to Covid-19 but that, in our view, are poised for a strong recovery in 2021-2023.

FinTech: An established fintech company diversified across multiple business segments over newer, pure-play upstarts

IT Services: Under-the radar companies with economically defensive recurring revenue and a rapidly growing mix of digital transformation contracts versus digital transformation pure-plays

Semiconductors: Memory companies, which we believe will be more valuable in a data-centric economy, and companies with strong business “franchises” and order visibility versus secular thematic growth stocks in data centers and artificial intelligence.

Through diligent fundamental analysis rooted in primary research, we believe we have exposed client portfolios to attractively valued technology stocks. As valuation reasserts its importance in the technology sector, we expect a meaningful rerating in this segment of Causeway global value equity portfolios.

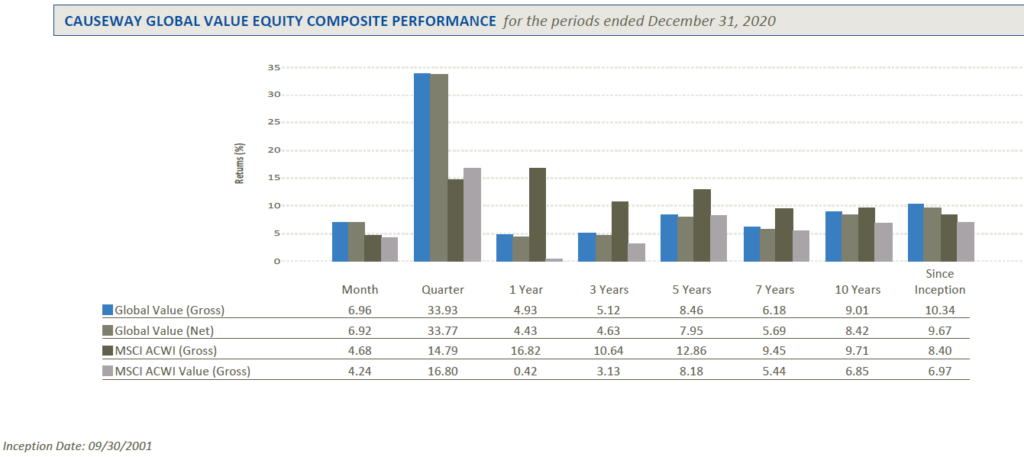

*Past performance is not an indication of future results. Historical performance of Causeway’s Global Value Equity Composite appears below.

Returns are in USD. Index returns are presented gross or net of tax withholdings on income and dividends. The gross composite performance presented is before management and custody fees but after trading expenses. Net composite performance is presented after the deduction of actual management fees, performance-based fees, and all trading expenses, but before custody fees. Composite performance is primarily net of foreign dividend withholdings. Annualized for periods greater than one year. This information supplements the composite presentation which is available at: https://www.causewaycap.com/wp-content/uploads/Global-Value-Equity.pdf and which contains important disclosures regarding the composite. Performance quoted is past performance.

This market commentary expresses Causeway’s views as of March 8, 2021 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy or completeness of such information.

Attribution is based on the return of a representative Global Value Equity portfolio, gross of management fees. Attribution attributable to information technology and communication services stocks (which includes stocks classified as Information Technology and Communications Services sector stocks by GICS) is based on the equity portion of the portfolio (i.e., excluding cash).

The MSCI ACWI Index is a free float-adjusted market capitalization index, designed to measure the equity market performance of developed and emerging markets, consisting of 23 developed country indices and 27 emerging market country indices.

MSCI has not reviewed, approved or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not distribute the MSCI data or use it as a basis for other indices or investment products.