Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

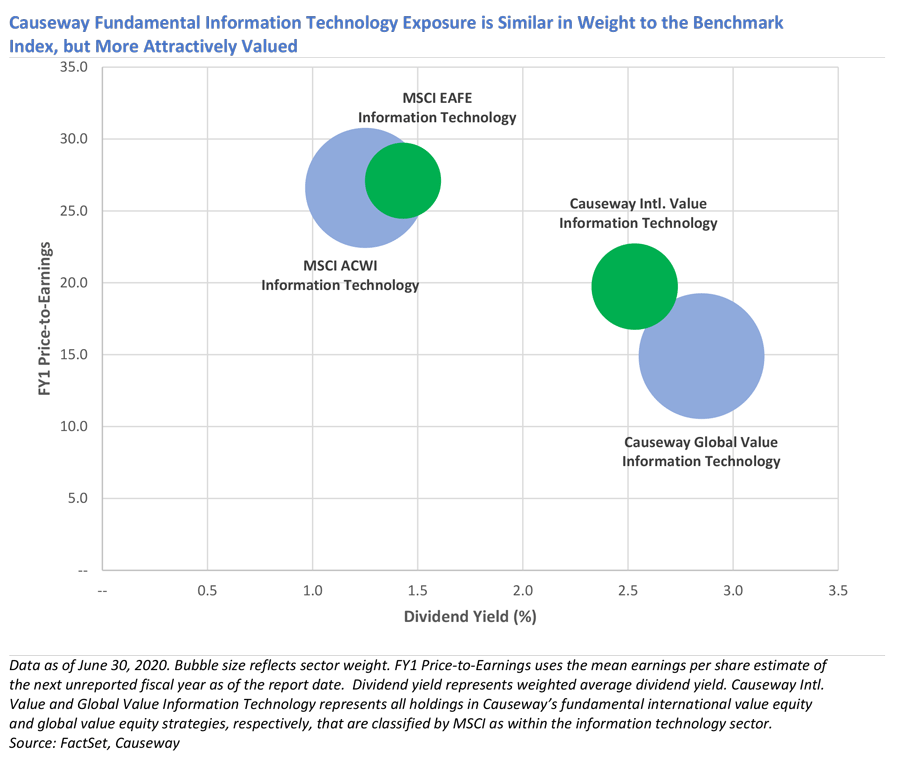

With valuations inviting dotcom bubble comparisons, the information technology sector may seem like hostile territory for a value investor. The sector includes some of the world’s most highly valued companies, trading at multiples in excess of what our team considers reasonable and lower risk. Yet in this large and rapidly changing segment of global equities—at 20% weight at June 30, the biggest sector in the MSCI ACWI Index—Causeway is finding attractive investment opportunities. We spoke with Senior Analyst Brian Cho, who leads Causeway’s fundamental technology and communications services research, to learn how a value investor can identify technology stocks with promising return potential.

Key insights

- Value investing in technology, in our view, falls into two categories: turnaround opportunities and cyclical recoveries.

- We are seeking to identify attractively valued companies exposed to Covid-19-driven structural growth potential.

- Widely favored technology stocks carry with them substantial mis-execution risk that investors often overlook.

Brian, as a disciplined value investor, what kind of technology stocks meet your criteria?

Value investing in technology, in my view, falls into two categories: turnaround opportunities and cyclical recoveries. Many of the turnaround companies are trading at low valuations because investors believe their struggles stem from structural decline. For these companies, our job as a value manager is to determine whether the perceived structural challenges are real and permanent, and if they are not, assess whether management can improve the business. Cyclical recovery opportunities are often in information technology hardware firms, like semiconductors, components, and equipment manufacturers. Here, we focus on trying to identify the cycle bottom and seeking to time our investment for the inflection point. These value investments may not have the glamour of the best-known (and highest valued) technology firms, but they are compelling in our view. Through diligent fundamental analysis rooted in primary research, we believe we have exposed client portfolios to attractively valued technology stocks.

How do you assess structural threats to technology companies?

The threat of disintermediation, which would eliminate middlemen in favor of direct consumer-to-business transactions, exists almost everywhere. Many investors evaluate the potential for a player to disrupt an industry, but fail to consider the likelihood. Our assessment of structural threats relies on primary research: interviewing current managements, former employees, competitors, customers, and industry experts to better understand how entrenched the current technology is.

In travel information technology, for example, the market expects Google and airlines to disintermediate travel global distribution systems (“GDS”), software that connects corporate travelers with airlines, hotels, and rental cars. Travel GDS company valuations appear to reflect this overhang. We recognized that, if these GDS networks are resilient, we could buy these companies at a valuation discount. We needed to understand the competitive threat from Google and various airlines—not just their ability to bypass the GDS networks, but also their motivation. Compared to Google’s core search businesses, creating and running a GDS network is labor-intensive and should dilute their core search profit margins. Airlines would need to collaborate with their competitors and partners to match the comprehensive travel options that GDS firms offer today. We also recognized that current end users significantly value the current GDS products. Travel agents swear by GDS networks and seem to have no intention to switch. The disintermediation concern may come and go but we do not believe it will ultimately materialize. In our current view, the resilience of the GDS providers and the network effect should survive during our investment horizon.

Many investors evaluate the potential for a player to disrupt an industry, but fail to consider the likelihood.

How do you evaluate the turnaround potential of technology companies?

We need to have confidence in the management team. Our experience helps us assess management quality and vision. I’ve known some company managements for over a decade and understand that they are conservative but forward-looking operators. And, again, primary research is key: we speak with channel partners and customers for a well-rounded perspective. A lot of the turnaround opportunities we identify are tied to acquisition activity. As the technology sector matures, industry consolidation is gaining momentum. Sometimes, the market may not like the acquisition rationale or the asset the company purchased, providing a potential investment opportunity. We evaluate the quality of the acquired asset and assess how well management can integrate it.

We typically give these companies two to three years for marked improvement and expect to see an inflection in revenue trends within a year of our investment. A successful “self-help” story can lead to a meaningful “rerating” of the stock. But the progress is often uneven and requires patience, something we have found the market lacks, especially in a low-interest rate environment. The market has penalized mis-execution and handsomely rewarded growth. At Causeway, we may take advantage of sudden declines in share prices to add to a stock’s weight in client portfolios.

Where are the best self-help opportunities today?

We believe that many areas hit hard by Covid-19 have significant upside potential. Some of the Covid-impacted companies we have identified have strong intellectual property and technology, and capable management teams. Our research indicates they have the financial wherewithal to survive this pandemic.

Covid-19 presents two types of investment opportunities. The first is seeking to identify the survivors in the most Covid-sensitive industries. In technology and communication services, that includes online travel agencies and global distribution systems, or entertainment companies with underutilized assets (such as theme parks). During lockdowns, in some cases revenues for these Covid-sensitive companies have plunged 80-100%. Before investing in these affected companies, we scrutinize their balance sheets to assess whether they can survive this period. We made additions to well-managed companies in this category because we believed they will emerge from this crisis stronger than before, even if the market has priced them for failure.

The second category includes companies that could benefit from a change in people’s behavior. It seems foolish to think that everything is going to reverse to exactly the way it was. I believe that in the future people will stream media, telecommute, and order goods online more often than they did pre-Covid. Some stocks are obvious beneficiaries of these changes—for example enterprise video communications, videogaming, and online retail—and they are priced accordingly. Double-digit percentage revenue growth is appealing, but the valuations that accompany many of these stocks leave no room for disappointment. Value investors must be creative. We see opportunities in accelerating digital transformations after Covid-19. For example, Covid-19 revealed the fragility of many supply chains. US dairy farmers were dumping their product while supermarket shoppers jostled for milk cartons. Covid-19 is catalyzing moves from manual to digitized processes to fortify companies’ operations against external shocks. For supply chains, digital transformation services aim to organize and analyze massive amounts of company data for real-time predictions of weaknesses in delivery and logistics. Business-wide, these companies design digitized processes, converting paper records to electronic and seeking to improve administrative workflows. We invested in a digital transformation company with decades of experience helping companies automate processes and become more agile. And, for virtually any process that this company cannot automate, it will provide outsourcing for its customers. With thousands of customers and highly trained employees, it offers to run these processes more efficiently and cost effectively.

Another US-listed Causeway portfolio holding provides customer service solutions powered by artificial intelligence (“AI”). Credit card customers were on hold for hours because Covid-locked-down call centers in India and the Philippines stood empty. As anyone who has interacted with a computerized customer service agent can attest, these AI calls are imperfect. But chatbots and self-service solutions can reduce call volume and alleviate these overloads. I believe we are in the early innings of digitization, and Covid-19 will accelerate it.

I believe we are in the early innings of digitization, and Covid-19 will accelerate it.

There are also investment opportunities among the platform companies that facilitate exchanges between businesses and consumers. For example, the mom and pop restaurant around the corner, temporarily shut down by Covid-19, needs to be able to take orders and be searchable online. There will be more e-commerce, so we are researching payment processors. Some of these businesses currently have decent valuations. They are not the cheapest stocks in our investable universe, but they demonstrate value in the context of their structural growth potential and the defensiveness of their platform. I believe they deserve to be ranked among our portfolio candidates.

How have you had to adapt your investment approach in this crisis?

Over the last six months, with cyclical revenues under threat from lockdowns, in my view, financial strength has become paramount. If I were to generalize technology investors, I’d say we focus first on revenue growth, then analyze gross and operating margins to estimate earnings per share (“EPS”). We apply a historical price-to-earnings multiple to our EPS estimate—and that forms the core of our investment case. However, in the depths of the pandemic crisis, we needed to understand how factory shutdowns and rampant cancellations would impact a company’s cash flow and balance sheet. Our broader research team was invaluable for this analysis. Our analysts experienced in financial strength assessment helped identify and analyze important metrics. In the early months of the crisis, I grilled technology managements about their cash burn rates and how their debt covenants were impacted. Only later did we begin to hear similar questions from other equity investors. I believe the speed and acuity with which our team could evaluate the financial strength of these firms gave us an advantage, allowing us to buy stocks with confidence at the most depressed valuations.

You mentioned cyclical recovery is another investment theme available to value investors. How does Causeway try to time these cycles?

Yes, there are value investment opportunities in cyclical segments of the sector: semiconductors, hardware and components. We’ve been adding exposure to these areas since the middle of last year because we believed the industry was going through an inventory correction, with a cyclical trough expected in the first half of 2020. Covid-19 extended the cycle and we took advantage of share price declines to buy semiconductor and technology hardware stocks. Looking forward, we believe inventory dynamics in most segments should eventually normalize, and the stocks we hold should benefit from secular growth. For example, we hold a power semiconductor manufacturer with automotive and industrial applications that should be well positioned for society’s growing focus on energy efficiency (e.g., electric vehicles, energy-efficient appliances and data centers, renewable energy). We initiated a position in a component supplier that should benefit from the mobile industry’s transition from LTE to 5G data transmission. Covid-19 has not hindered these cyclical trends. The European Union is embracing more electric-vehicle-friendly policies, and telecommunication carriers are continuing 5G deployment. Disruptions in operations and supply chains due to Covid-19 are accelerating companies’ adoption of cloud computing. We believe our cyclical technology holdings are poised to benefit from these multi-year trends as industry supply/demand conditions normalize.

These cyclical themes may be especially attractive to investors interested in non-US technology stocks. Relative to the US market, other developed markets have far fewer technology stocks. International technology services and software companies have tended to trade at valuation premiums to their US counterparts because of their scarcity value. But, in our view, there are some impressive hardware and semiconductor companies outside the US that can be bought for attractive valuations at the right point in the cycle.

In our view, there are some impressive hardware and semiconductor companies outside the US that can be bought for attractive valuations at the right point in the cycle.

How does being a value investor in technology differ from value investing in other sectors?

Often the addressable market for technology products is growing, and a technology investor needs to be able to incorporate the role of secular growth into a multi-year time horizon. When I evaluate a company’s acquisition of another, there are a lot of intangibles, such as improved competitive positioning, that do not easily translate into a good near-term return on investment. I think a value technology investor needs to have some flexibility in analyzing these acquisitions. I am comfortable with a company paying a premium for a best-in-class asset. In that respect, I think I differ from value analysts in other sectors. I like the push back and interaction between our portfolio managers across sectors. That debate enhances our process.

Other value investors hold high-flying tech stocks. What do you think about using a relative approach to valuing a sector that is more expensive?

Many active investors justify the valuations of technology giants by using huge revenue trajectories over decade-plus timelines and focusing on the cost and competitive benefits of achieving dominant scale. This low interest rate environment further helps them defend premium valuations. I think your investment philosophy will dictate your comfort with that approach. Philosophical differences aside, I believe investors in those companies fail to recognize that the widespread popularity of these stocks may undermine the long-term success of the investments. Most alpha (return above a benchmark) from information technology stocks comes from multiple re-rating. An already well-liked stock has little room for an upward rerating, but plenty of downside risk if the company disappoints. Widely favored stocks carry with them substantial mis-execution risk that investors often overlook.

An already well-liked stock has little room for an upward rerating, but plenty of downside risk if the company disappoints.

Causeway views technology as a shared resource across the research team. Why is technology sector knowledge valuable in this respect?

Every sector is undergoing some form of digital transformation, so our research is relevant to each cluster, or subset, of our team. In our financials cluster, we talk about the transition to mobile banking and online payment processing, and cryptocurrencies. Our energy and utilities analysts are studying the transition to renewable energy. To store those renewable energies, you need more batteries and power semiconductors. I work closely with our industrials cluster, which covers the key consumers of electrification and automation technology. And, of course, technology and the consumer are inextricably linked. In a recent portfolio management meeting, I shared booking statistics from one of the online travel agencies we cover, because that is relevant for our hotels research. Analysts in our technology cluster belong to other research clusters, facilitating this information sharing. For example, one of our analysts also focuses on medical technology in our health care cluster. I believe the breadth of technology’s impact is phenomenal. It is a reason I love the information technology sector. There is just so much to learn. It’s like being hungry and finding yourself at an endless buffet.

This market commentary expresses Causeway’s views as of July 14, 2020 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Our investment portfolios may or may not hold the securities mentioned, and the securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. Information and data presented have been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

The MSCI ACWI Index is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world and is comprised of stocks from 23 developed countries and 26 emerging markets. The MSCI EAFE Index is a market capitalization weighted index designed to provide a broad measure of equity-market performance across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada. These MSCI indices are gross of withholding taxes, assume reinvestment of dividends and capital gains, and assume no management, custody, transaction, or other expenses. It is not possible to invest directly in an Index. MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations, and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.