Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

While they promise faster payments and global reach, stablecoins remain riskier and less useful than central bank money. Their real value may lie not in disruption, but in helping traditional banks modernize how money moves.

By David Khoo, Senior Fundamental Research Analyst, Financials and Real Estate

Proposed in 1991, blockchain technology is as old as the public internet, and over time has proven effective as a digital ledger for issuing and transferring tokens, ranging from speculative assets like Bitcoin to less volatile cryptocurrencies known as “stablecoins.”

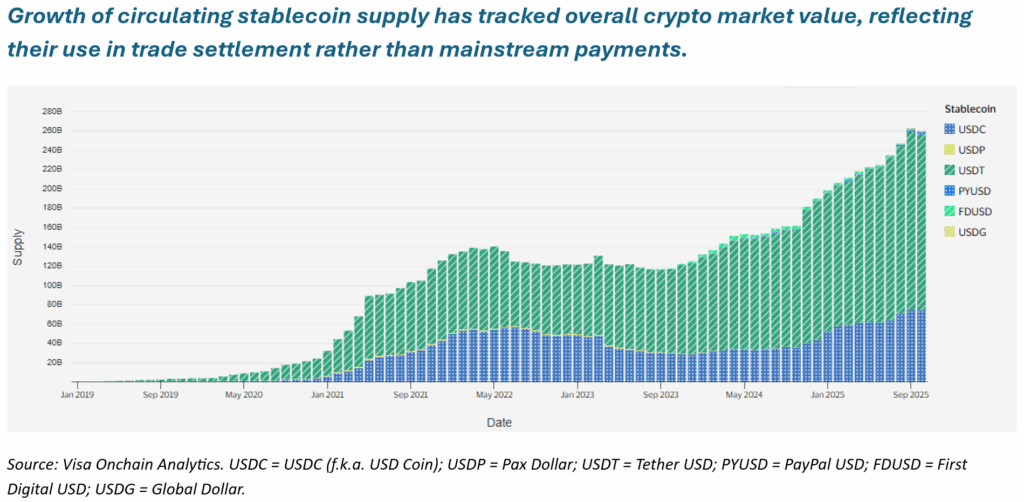

Stablecoins are designed to maintain a stable value by linking to traditional currencies such as the US dollar. They promise fast, low-cost, around-the-clock payments across borders. With the market value of circulating stablecoins reaching $262 billion and new legislative support through the GENIUS Act, Causeway’s financials cluster assesses how stablecoins could affect the profitability and structure of financial services companies.

At Causeway, we see stablecoins as a limited but meaningful innovation. They have potential to improve cross-border payments but remain inferior to central bank money in both safety and utility. For most financial transactions, stablecoins are unlikely to replace existing systems. Meanwhile, many of the world’s banks—including several currently represented in Causeway client portfolios—are well positioned to innovate with central bank money and even issue their own tokenized assets.

Stablecoins do not guarantee a 1:1 dollar exchange

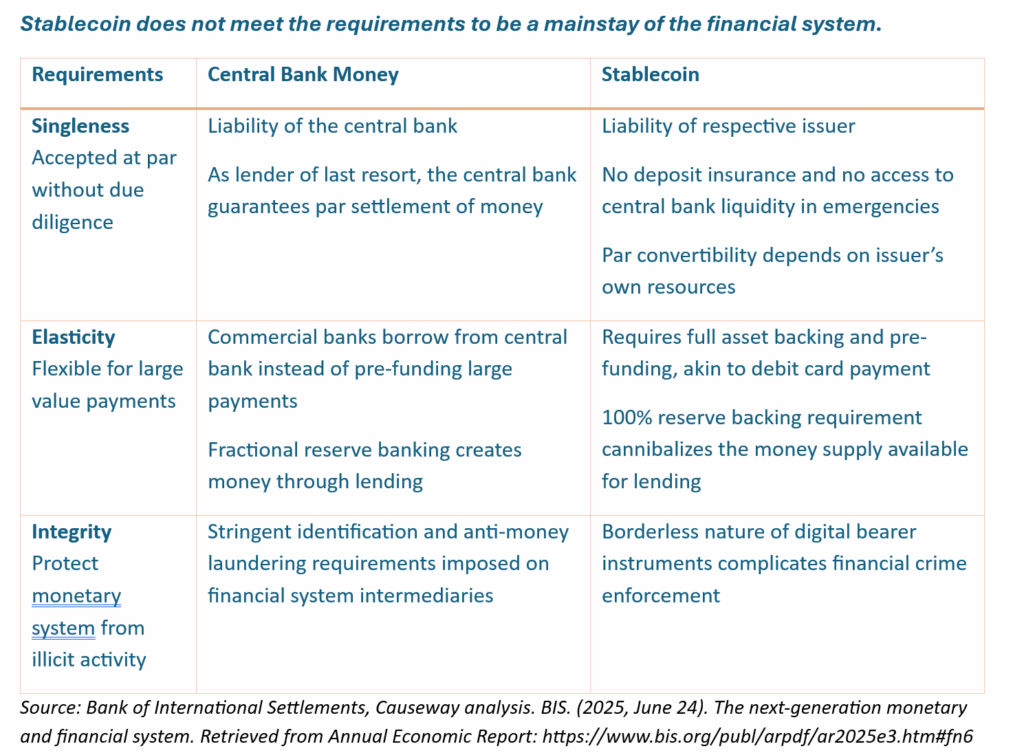

The GENIUS Act introduces basic protections for US dollar stablecoin holders by requiring that tokens be 100% backed by cash-like assets and that issuers be regulated and transparent. Other jurisdictions, including the European Union and Hong Kong, have implemented similar frameworks. Still, a fundamental limitation remains: each stablecoin is a liability of its private issuer, not a claim on the government or central bank.

In the US, unlike bank deposits, stablecoins don’t have FDIC insurance or access to Federal Reserve liquidity. In periods of market stress, there’s no guarantee that one stablecoin will always equal one US dollar. This lack of “par convertibility” makes stablecoins riskier than Federal Reserve money, which limits their suitability for the trillions of dollars in daily financial transactions that depend on certainty and trust.

Stablecoins do not offer unique payment features

Supporters often highlight stablecoins’ ability to settle transactions instantly, 24/7. But that feature is not unique to blockchain.

Modern payment networks such as The Clearing House’s RTP, the Federal Reserve’s FedNow, and Citi’s 24/7 Clearing already offer real-time settlement—with the added safety of central bank money.

In fact, the very speed of stablecoins could create new risks. Instant redemption during periods of financial stress could trigger rapid outflows, breaking the peg and making redemptions difficult. Since issuers of US dollar stablecoins cannot borrow from the Federal Reserve in emergencies, stablecoin systems could face liquidity crunches precisely when confidence matters most.

Where stablecoins might actually help: cross-border transactions

For domestic payments, stablecoins face an uphill battle. They lack the scale, merchant acceptance, and consumer familiarity of existing debit and credit card networks. And once issuance, redemption, and blockchain transaction fees are included, stablecoins are not cheaper than regulated debit systems, which already operate at low cost in the US and Europe.

However, for cross-border payments, stablecoins may offer an advantage. By cutting out intermediary correspondent banks, they can make international transfers faster and less complex—though not necessarily cheaper, since foreign exchange conversion costs still apply.

Stablecoins may be most useful when the recipient wants to hold US dollars or other G7 currencies, or when the destination currency is illiquid or unstable. In these niche cases, blockchain-based settlement could indeed provide incremental benefit.

Stablecoins are unlikely to replace bank deposits

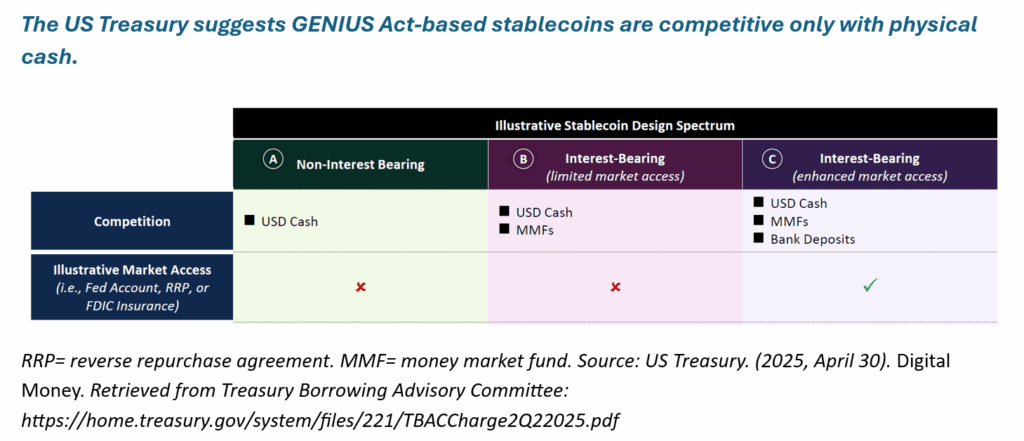

Despite rapid growth, stablecoins are unlikely to pull deposits away from the banking system. With no interest payments allowed under the GENIUS Act and greater risk than insured bank deposits, US consumers and businesses have little incentive to shift funds.

The experience of China’s e-CNY, the digital yuan, underscores this point. Despite government support and incentives, the digital currency represented just 0.006% of China’s M2 money supply by mid-2023 (latest available data)—a negligible share that highlights the difficulty of driving mass adoption of new forms of digital money.

Financial institutions are well-positioned to compete in a tokenized system

Traditional banks can be beneficiaries of blockchain innovation. They already have customer trust, regulatory access, and scale, giving them an edge in offering blockchain-based financial products safely.

Many large financial institutions, including several currently held in Causeway global and international value portfolios, already provide real-time liquidity and payment solutions, and are exploring how tokenized deposits can replicate the speed and efficiency of stablecoins while preserving the safety and reliability of central bank–backed money.

Across major financial centers, these institutions are participating in regulated stablecoin and tokenization pilots, including initiatives to develop euro-denominated stablecoins through cooperative banking frameworks. By combining trust and technology, banks can replicate many of stablecoin’s advantages, without its fragilities.

Stablecoins represent evolution, not disruption

Stablecoins represent real progress in the application of blockchain technology. They demonstrate that digital ledgers can move real money, not just speculative tokens. Yet for now, their practical role is narrow, limited to cross-border and niche applications.

The next phase of financial innovation may not come from crypto start-ups, but from regulated banks using blockchain to modernize traditional money. In that sense, stablecoins may not disrupt the financial system, but help it evolve.

This market commentary expresses Causeway’s views as of October 2025 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.