Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Causeway head of quantitative research and portfolio manager Arjun Jayaraman shares six reasons why he believes EM equities are exhibiting a new, more diverse vitality.

1. Low valuations, higher relative growth rates, and the prospect for lower interest rates combine for the most attractive EM equities performance potential we have seen in years.

Emerging markets trade at a 40% forward price-to-earnings discount and a 60% price-to-book discount[1] to the US market. Yet consensus estimates indicate higher per share earnings and sales growth for EM versus the US over the next couple of years. Expected volatility continues to be higher for EM than the US, but the current differential is in-line with longer-term averages. If the Federal Reserve lowers benchmark rates in 2024, the yield curve should begin to normalize, global liquidity should improve, and the USD should weaken—all historically good indicators for EM asset class outperformance. In our view, because inflation rates are subdued, EM central banks should be able to lower interest rates to support growth.

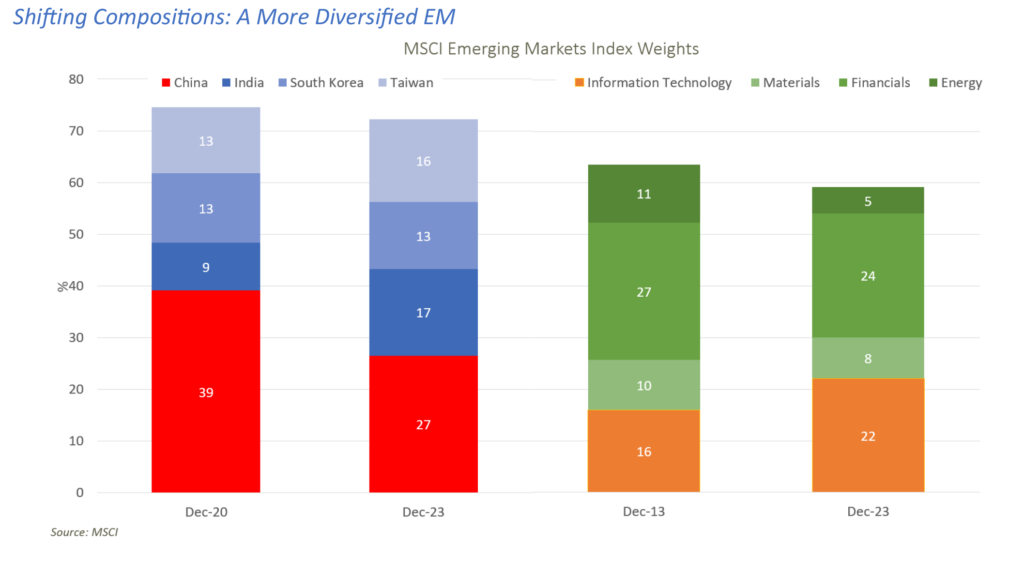

2. EM is no longer simply a China bet. Today, China can be thought of as one of the “big four” countries in EM, alongside India, Taiwan, and Korea. China’s dominance of the MSCI Emerging Markets Index (EM Index) has diminished: at the end of 2020, it was nearly 40% of the EM Index by weight and over 50% of the big four by weight. At the end of 2023, its weight had shrunk to 27% of the EM Index and 36% of the big four.

3. The EM Index has become less cyclical. Over the past ten years, the combined weight of the energy and materials sectors has declined from 21% to 13%. The information technology sector weight has increased the most over this period (from 16% to 22%), largely due to recent outperformance on artificial intelligence themes. Long-term structural growth in information technology should offset some of the asset class cyclicality. Admittedly, financials, an economically sensitive sector, remains the largest sector weight at 24%. But while ten years ago the sector was dominated by Chinese banks and insurers, today, Indian financials—generally less cyclical—are almost the same weight as Chinese financials.

4. EM liquidity has improved significantly. Greater liquidity is most notable in India, Taiwan, and the Gulf Cooperation Council markets (Saudi Arabia, UAE, Qatar, Kuwait). Our investable universe, consisting of stocks with average daily trading volumes greater than $4 million, has grown by over 40% over the past ten years. We believe the improved breadth of the asset class should continue to be a tailwind for quantitative strategies like Causeway’s.

5. Diversification is key to investing in China. In the late-2010’s, investors gravitated towards technology-oriented stocks such as the BATs (Baidu, Alibaba, Tencent), which led to very narrow market leadership. But recently, regulatory and growth headwinds for these stocks have contributed to relative outperformance of sectors such as energy, banks, materials, and infrastructure. These “traditional economy” stocks also tend to pay meaningful dividend yields; the short duration of these stocks should be attractive to investors concerned about China’s long-term prospects. Causeway emerging market portfolios currently hold a combination of technology-oriented and traditional economy China stocks.

6. Quantitative, active management can emphasize multiple EM return drivers. Causeway’s Emerging Markets strategy combines value, growth, momentum, and competitive strength factors to seek to exploit varied sources of alpha. As a result, Causeway’s representative EM portfolio currently trades at valuation discount to an already inexpensive MSCI EM Index, while experiencing net earnings upgrades at a faster pace[2]. The current portfolio also has meaningful exposure to small capitalization stocks. Exhibiting greater breadth and stock price inefficiencies than large caps, we believe small caps have outsized alpha potential.

[1] As of 1/31/2024, using valuation characteristics of the MSCI Emerging Markets Index and the MSCI USA Index.

[2] As of 1/31/24, Causeway Emerging Markets representative account v. the MSCI Emerging Markets Index characteristics: Price-to-book value 1.2 v. 1.6; Next-twelve-months (“NTM”) price-to-earnings 7.8 v. 11.2; NTM earnings-per-share revision (%) 9.9 v. -1.3.

The Causeway Emerging Markets strategy uses quantitative factors that can be grouped into seven categories: valuation, growth, technical indicators, competitive strength, macroeconomic, country-sector aggregate, and currency. This market commentary expresses Causeway’s views as of February 2024 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information. The securities identified and described do not represent all of the securities purchased, sold, or recommended for client accounts. Our investment portfolios may or may not hold the securities mentioned. The reader should not assume that an investment in the securities identified was or will be profitable. For full performance information regarding Causeway’s emerging markets strategy, please see www.causewaycap.com/strategy/emerging-markets-equity-strategy/.

The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries.

MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.