Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

As a value manager, when prices plunge, we buy what we view as the best companies available at low valuations for client portfolios. And when prices soar, we take profits and reinvest those proceeds into our highest expected return opportunities. Covid-19 brought the bull market to its knees in March 2020, then promising vaccine news in early November sparked a buying stampede. Three Causeway portfolio managers share their perspectives on cyclicals leading the pandemic reopening rally, and how they are repositioning client portfolios as a result.

Key insights

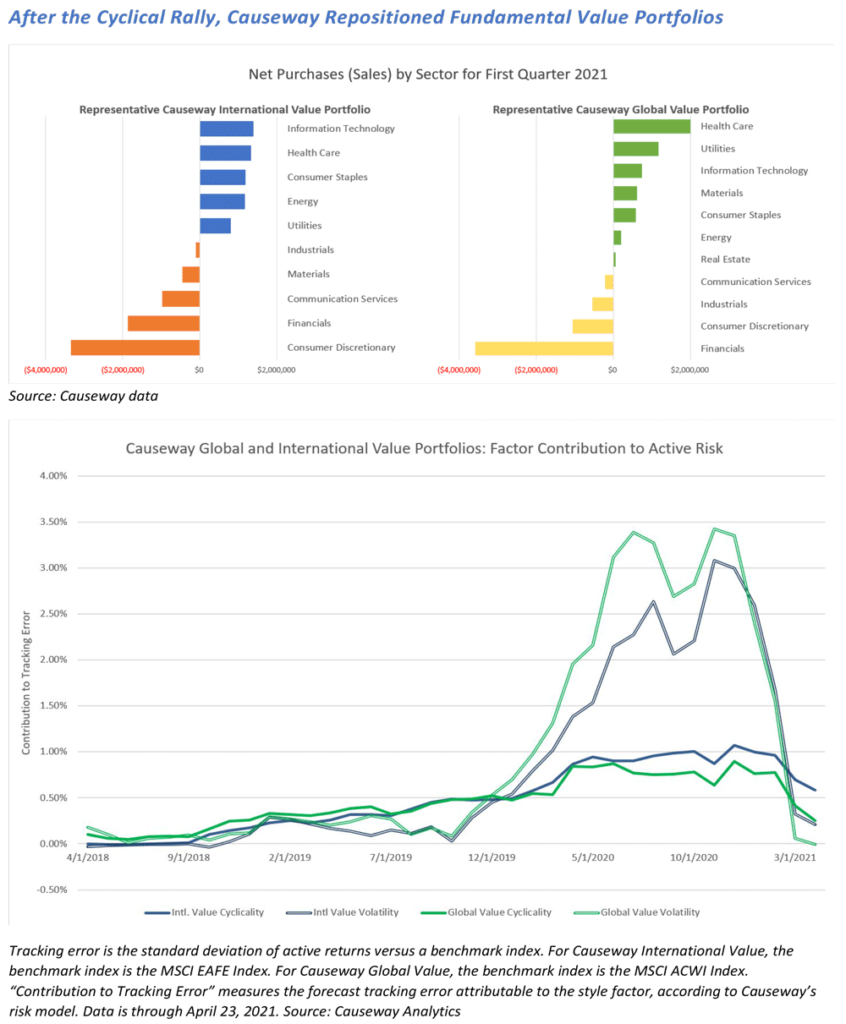

- Causeway has been seeking to reduce fundamental portfolio cyclicality on price strength; cyclical exposure will remain price dependent

- For fundamental portfolios, the opportunity set includes defensive laggards like utilities and pharmaceuticals stocks

- Value factor characteristics are converging with momentum and growth characteristics used in Causeway quantitative strategies

To invest in cyclicals, I look for areas of doubt. We entered the pandemic more cyclical-heavy than we would have liked. As Covid lockdowns intensified, we added even more cyclicality, buying shares of what we view as great franchises at trough valuations. It was fertile ground, but it took guts. Our positioning in the industrials sector was reminiscent of how we invested through the Global Financial Crisis (“GFC”), but in 2020 we emphasized travel. We bought airlines, aerospace firms, and an airport sundries retailer.

In this pandemic crisis, governments supplied more stimulus than we expected, and deployed it quickly. Unlike in 2008-09, banks were structurally sound and could provide liquidity. The liquidity is likely why the rotation into cyclicals was so powerful. Now, some cyclical share prices are declining on good news whereas over the past twelve months, prices often would bounce if reported results were less negative than anticipated. To me, this share price response indicates that a lot of good news is already priced in. We are trying to take advantage of price strength to reduce portfolio cyclicality. We are paring back travel exposure where our analysis shows diminished upside. We have reduced our airline exposure but continue to see competitive return potential in aerospace. We may re-enter some of these stocks if prices pull back too far. We will continue to be very price dependent.

Outside of travel, we sold other strong performing cyclical positions. We substantially reduced one of the largest portfolio weights in our global value and international value portfolios, an auto manufacturer that finally was recognized for its electric vehicle transition. We exited a heavy truck manufacturer, purchased in the depths of the crisis, when its share price rallied to our estimate of fair value. We have reduced our exposure to automation on outperformance. The complexion of the portfolio has changed a lot.

In the next leg of cyclical performance, I think the market will be more discerning, differentiating between stages of the economic cycle. The leadership will be different. Autos led through the first part of the cycle and we have reduced our exposure. Energy might be later cycle. I am pleased to see the participants in the energy sector—from shale companies in the US to OPEC—are focusing on generating cash flow and returns. The integrated oil firms we hold in client portfolios are increasing share repurchases and dividend payments, but the market has not rewarded them for capital discipline. I also think the market has yet to recognize the return potential in their renewable energy strategies.

In the next leg of cyclical performance, I think the market will be more discerning, differentiating between stages of the economic cycle.

History shows that consolidation often follows the rally out of a crisis. We have been scrutinizing the rail transport industry, which looks poised to benefit from a trifecta of consolidation, environmentally inspired government spend, and automation-driven margin increases. We bought shares of a French-listed rail stock that should have more pricing power after its recent merger. We identified a US-listed waste management firm that is improving pricing amid industry-wide mergers and acquisitions. My colleague Conor Muldoon initiated a position in a packaging company, a near-term beneficiary of consolidation in the North American corrugated packaging industry with, in our view, long-term structural growth potential from sustainability trends. Garbage and cardboard—your eyelids are probably getting heavy—but we can potentially yawn our way to alpha. Investors might appreciate a break from the most speculative growth excitement.

There is more differentiation in value today than when we founded Causeway twenty years ago. A portfolio built on simple value metrics alone may not meet our clients’ performance objectives. With cyclicals, we are accustomed to value stocks appearing expensive because their earnings cycles are bottoming. Covid spread that distortion across more of the portfolio as earnings plummeted and companies paused dividend payments. In my view, true value-driven alpha is found in consolidation, in operational restructuring, and in timing companies’ earnings cycles—that is where we are focusing our research.

The portfolio opportunity set includes economically defensive stocks that lagged the early stage recovery, as they have in the past. We are focused on areas that have underperformed the market, including utilities and pharmaceutical firms. In our view, these stocks have upside potential with the added benefit of lowering prospective portfolio beta and volatility.

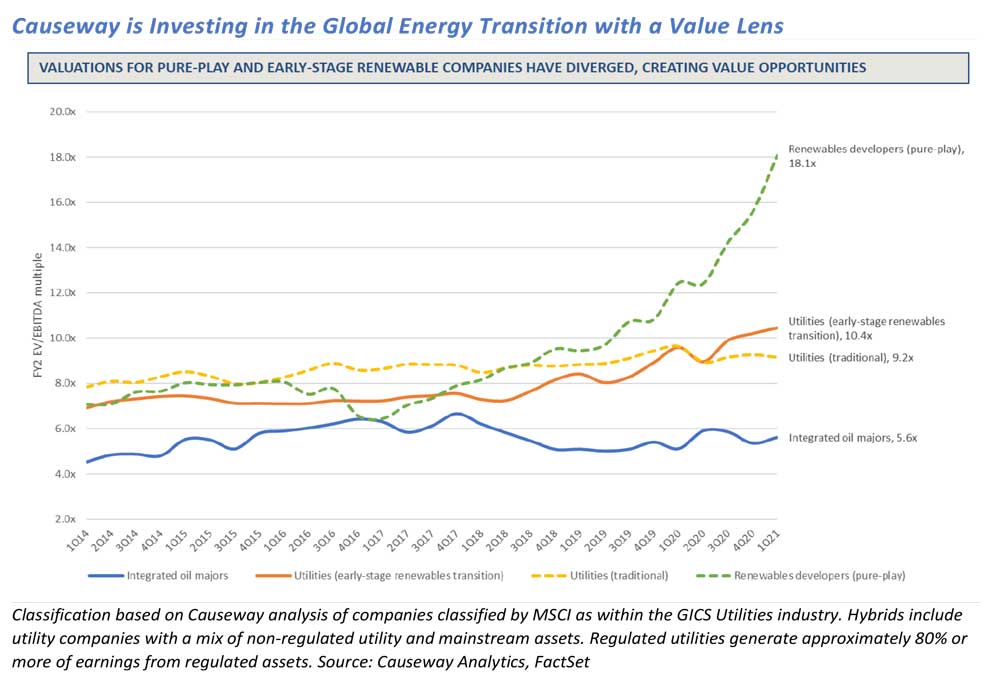

The utilities sector has transformed since I began covering these businesses for Causeway nine years ago. Back then, European utilities were conglomerates, empire builders that relied on thermal power-generation business models. The sector has shifted: first towards regulated networks and more recently to renewable energy, which is its future. Renewable energy drives our optimism for utilities because we believe climate change initiatives will increase demand for electricity from clean energy sources, which should boost these businesses for years to come. We try to identify the intersection between secular tailwinds from the energy transition and sensible valuations. Utilities are generally valued between lowly valued oil companies and expensive pure play renewables firms. We see opportunities where the market has not yet recognized how much utilities should benefit from the energy transition. They generate strong cash flow and are paying our clients to wait for their re-ratings, often with dividend yields of 3-5%. That income is attractive, especially in economies with ultra-low interest rates. The energy transition has become such a pervasive theme that our research is relevant to every Causeway research cluster. Industries including capital goods and technology are benefiting from the expansion of the renewables supply chain, while industries like mining could face longer-term business model challenges from decarbonization initiatives. As more companies in every sector disclose greenhouse gas emissions targets, the utilities and renewables cluster helps the team determine the right questions to ask.

Pharmaceutical stocks have lagged the broader market, and to me it makes sense. I prefer to understand why a stock is weak than to be mystified. The specter of lower drug pricing creates an overhang for these stocks.

Currently, the spirited debates in our portfolio management meetings are about stock-specific return expectations and capital allocation across our rank sheet—the essence of what we do.

Our health care cluster embeds that pricing risk in our valuations and we still see upside. We have been building positions in innovative pharmaceutical companies with capable management teams that we believe can deliver both top-line growth and free cash flow. We have selected globally diversified pharmaceutical companies less reliant on US revenue—particularly US government spending—and therefore may be less vulnerable to US drug pricing policy changes. As the market vacillates and cyclicals rise and slip back, these pharmaceutical stocks have been holding their value.

We currently expect the Biden administration to enact moderate healthcare reform and drug pricing measures. The potential elimination of more draconian policy outcomes should help the sector recover from multi-decade valuation lows. In addition, company-specific catalysts, such as positive pipeline data and progress on efficiency initiatives, should help drive returns of Causeway’s pharmaceutical holdings.

We will continue to take advantage of other market dislocations. It is nice to return to more of a stock picker’s market from one dominated by macro themes. Currently, the spirited debates in our portfolio management meetings are about stock-specific return expectations and capital allocation across our rank sheet—the essence of what we do.

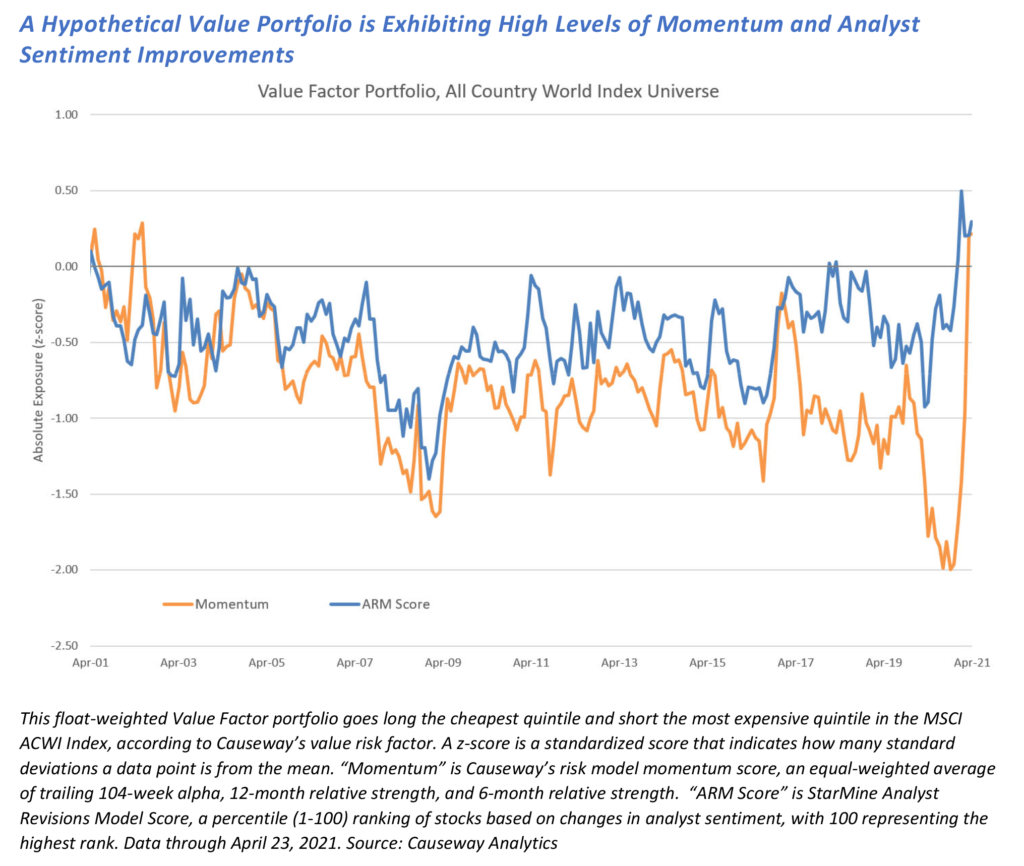

The cyclicals rally created rare, even unprecedented factor behavior at the intersection of value and price momentum. At the end of last quarter, correlations between our value and momentum factors reached new heights in our history of recorded factor data, in developed and emerging markets. We constructed a hypothetical value portfolio, long the cheapest and short the most expensive stocks in the MSCI ACWI Index, and examined its exposures to both momentum and positive changes in sell-side analyst sentiment. Both were roughly at 20-year highs.

What does this convergence of value and momentum mean for investors? It could mean an influx of capital into value stocks from momentum-chasing equity strategies. But it is also important to recognize momentum’s vulnerability to crashes. After strong performance, our fundamental colleagues are seeking to safeguard global and international value portfolios by reducing volatility and adding defensive exposure. In our quantitative emerging markets and international small cap strategies, multi-factor approaches seek to diversify factor risk. For our international small cap strategy, where momentum sensitivity is elevated, we enhanced our momentum factor by adding “network momentum” to the alpha model. For each company, the network momentum factor also considers the price performance of related companies, linked via supply chains, customer bases, and competitors. We believe our research and testing shows that this approach is an effective technical indicator and helps protect against momentum reversals. It has done particularly well in Japanese small cap stocks, a large segment of the small cap universe where traditional momentum factors have often failed.

We maintain a deep value bias in our international small cap portfolios that we complement with growth, momentum, and quality.

Stocks that are attractive based on value characteristics are increasingly converging with attractive growth and momentum characteristics.

The breadth of the investable universe, over 4,000 stocks, helps us construct a portfolio of 120-200 stocks that can meet our specifications across multiple dimensions. Our value exposure has increased as we added to stocks in value-oriented sectors like industrials, financials, and materials.

In 2020, it was difficult to balance value with growth and momentum in our emerging markets portfolios because the factors were so bifurcated. This year, after value and cyclicals reflated, these factors are no longer mutually exclusive. Stocks that are attractive based on value characteristics are increasingly converging with attractive growth and momentum characteristics. In emerging and developed markets, next twelve months’ earnings revisions, a proxy measure for growth, are currently higher for value stocks than growth stocks. This means that analysts generally are upgrading the value universe.

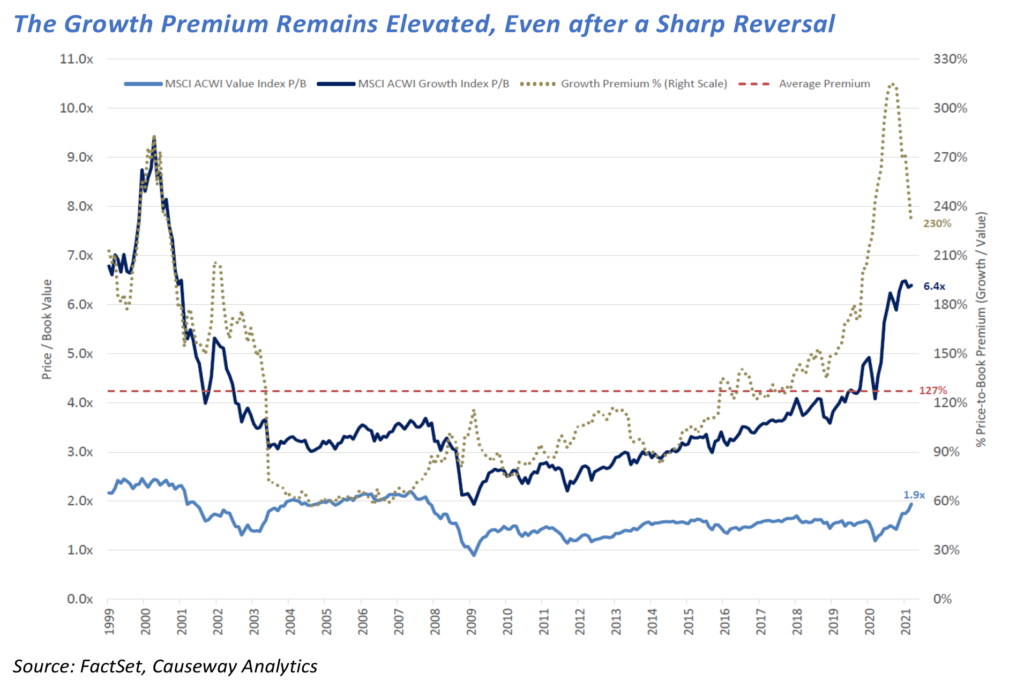

Some clients are asking us, is there more room for value to run? We believe so. Across equity markets, growth premiums have retreated from their peaks but remain materially above their long-term averages.

Of course, nothing moves in a straight line—the partial unwind of the reopening trade in April is evidence of that. There may be fits and starts, but we believe the value recovery should continue.

Adhering to our value-focused investment disciplines throughout the pandemic allowed Causeway equity strategies to participate actively in the recent market recovery. But, as our portfolio managers’ comments demonstrate, we are not complacent on the heels of recent outperformance. In developed and emerging markets, across the market capitalization spectrum, we continue to identify portfolio candidates for Causeway equity strategies that we believe will generate alpha for our clients. Price is everything, and an unwavering focus on valuation will continue to guide our investments.

This market commentary expresses Causeway’s views as of May 2021 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

Risk Model. Causeway’s risk model analyzes multiple factors for each holding (excluding certain portfolio ETFs, fixed income, and commodities and other derivatives) to calculate an account’s style exposures, forecast an account’s volatility, forecast an account’s tracking error and forecast an account’s beta.

The Causeway Emerging Markets strategy uses quantitative factors that can be grouped into eight categories: valuation, growth, technical indicators, competitive strength, macroeconomic, country, sector, and currency. The Causeway international small cap strategy uses quantitative factors that can be grouped into six categories: valuation, earnings growth, technical indicators, competitive strength, macroeconomic, and country. The return attributed to a factor is the difference between the equally weighted average return of the highest ranked quintile of companies in the strategy’s emerging markets universe based on that factor and that of the lowest ranked quintile of companies. “Alpha” means performance exceeding the benchmark index.

The MSCI ACWI Index is a free float-adjusted market capitalization index, designed to measure the performance of the large and mid-cap segments across 23 Developed Markets and 26 Emerging Markets countries. The MSCI ACWI Value Index is a subset of the MSCI ACWI Index, and targets 50% coverage of the MSCI ACWI Index, with value investment style characteristics for index construction using three variables: book value to price, 12-month forward earnings to price, and dividend yield. The MSCI ACWI Growth Index is a subset of the MSCI ACWI Index and targets the remaining 50% coverage.

The MSCI EAFE Index is a free float-adjusted market capitalization index, designed to measure the performance of the large and mid-cap segments across 21 Developed Markets countries. These MSCI indices are gross of withholding taxes, assume reinvestment of dividends and capital gains, and assume no management, custody, transaction or other expenses. It is not possible to invest directly in an Index.

MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.