Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Emerging markets have quietly moved from being “cheap for a reason” to potentially “set-up for a multi-year run.” After years of US dominance, conditions appear to be aligning to make EM particularly attractive for allocators.

By Duff Kuhnert, Quantitative Portfolio Manager, Causeway Capital Management

November 2025

First and foremost, valuation…

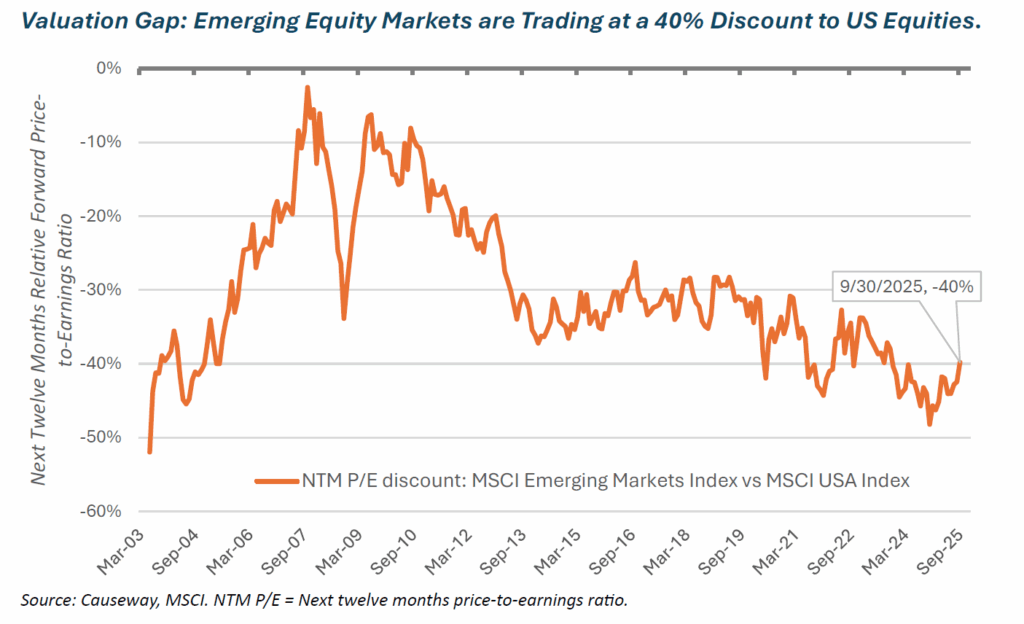

US equities appear stretched across nearly every valuation measure, while emerging markets currently remain compellingly priced. Historically, valuation gaps between EM and US equities have closed in sharp bursts, marking periods of EM outperformance—most notably in the aftermath of the Global Financial Crisis. Today’s extreme discount of roughly 40%, even after strong year-to-date gains, suggests another inflection point may be approaching.

Key insights

- Valuations remain compelling: Emerging markets (EM) trade at roughly a 40% discount to US equities — near historic extremes — suggesting potential for mean reversion.

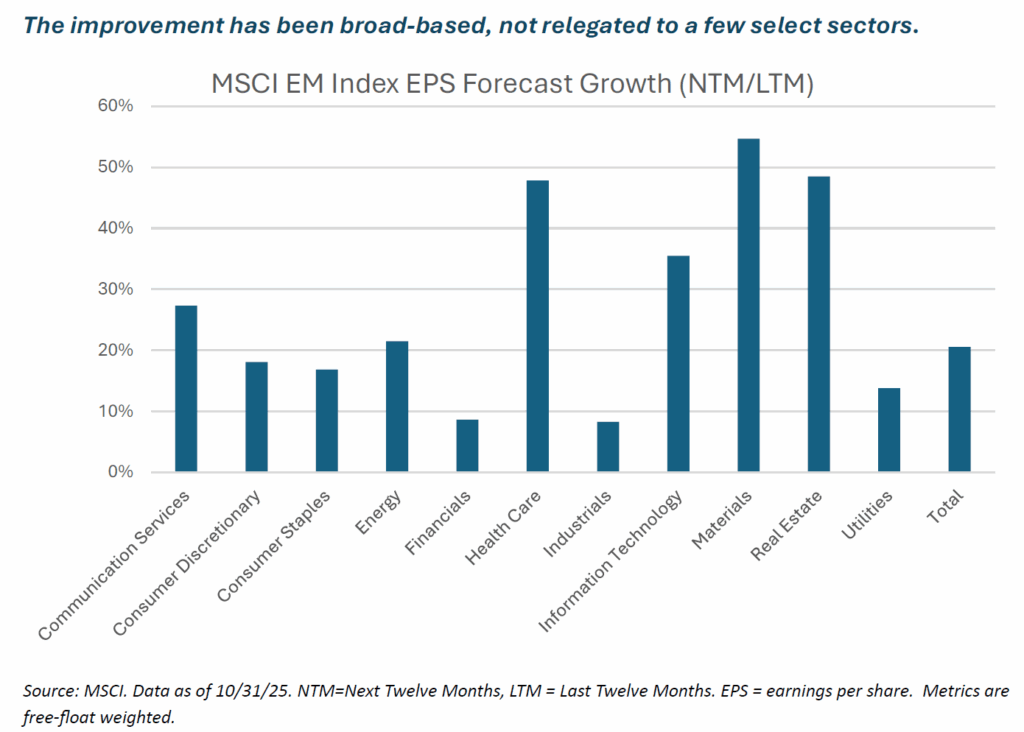

- Earnings growth is broad-based: EM companies now show comparable or stronger earnings momentum than the US, with positive revisions across all 11 sectors.

- Asia leads the charge: China, Taiwan, South Korea, and India make up three-quarters of EM and can offer AI exposure, governance improvements, and domestic growth drivers.

- Currency and macro tailwinds: A weaker US dollar, stronger EM fiscal positions, and lower rates could potentially amplify capital flows into EM assets.

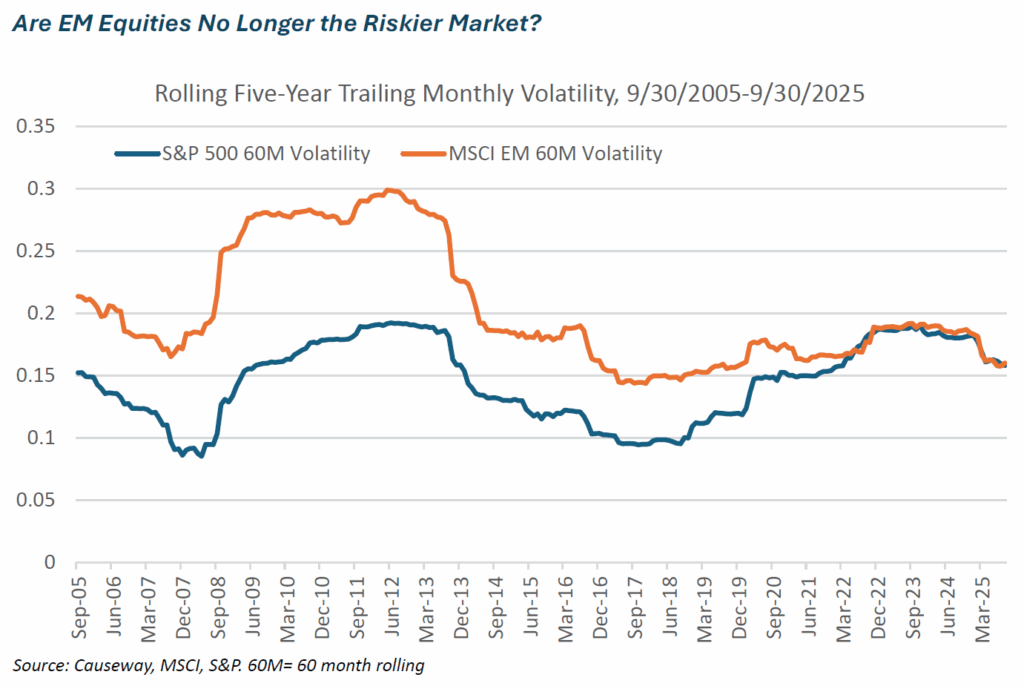

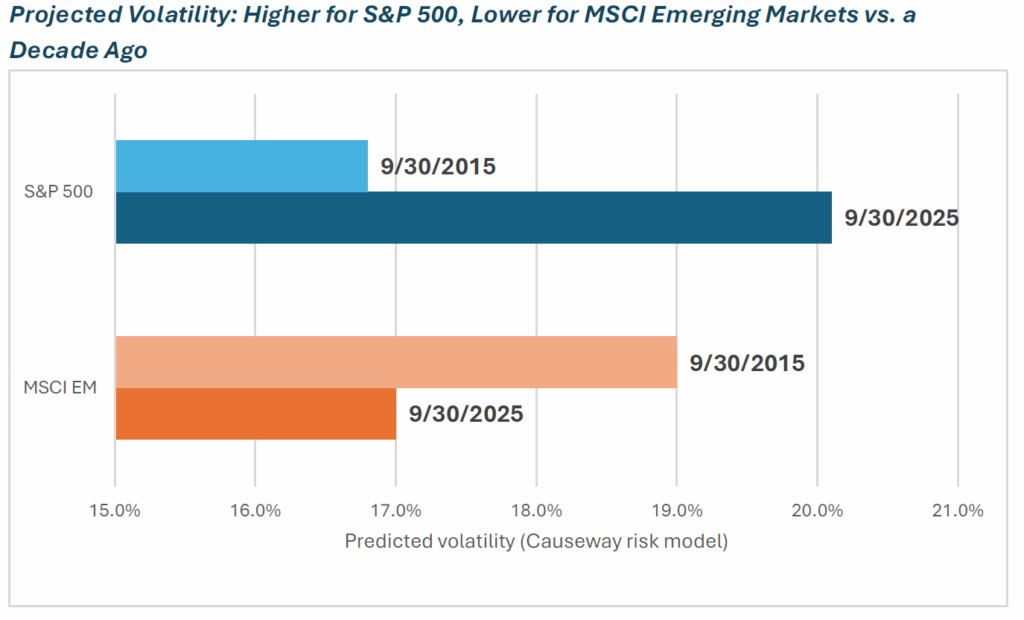

- Risk profile improving: EM volatility has fallen below US levels in some measures, we believe reflecting stabilizing fundamentals and greater internal diversification.

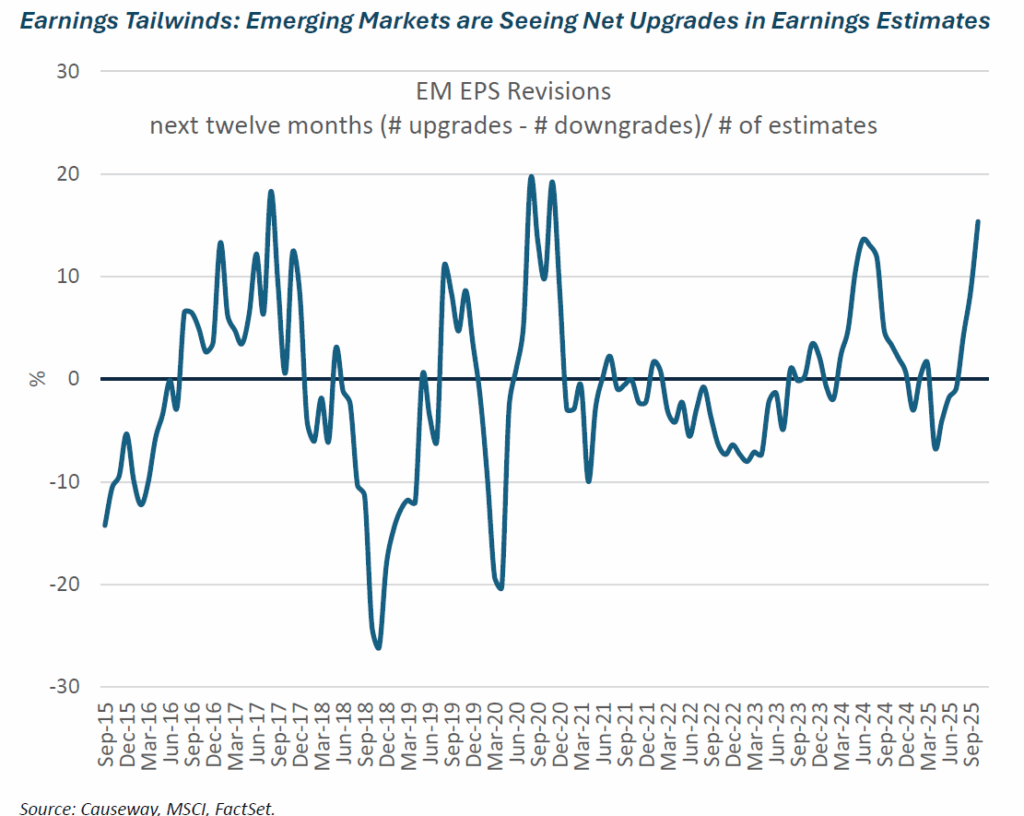

…paired with broad-based earnings growth

Valuation alone rarely sustains EM outperformance—earnings must follow. According to MSCI, as of October 31 2025, emerging markets’ earnings growth projections are now comparable to the US (20%+ year-over-year), and realized EM earnings-per-share growth has already surpassed the US over the past year.

Across our models, EM companies are generally showing more positive earnings revisions than their developed-market peers. In Causeway’s proprietary EM allocation model, this is currently the strongest signal for increased emerging markets exposure.

Earnings revisions have been broad-based, rather than concentrated in a handful of sectors. As of the end of October, forecasted earnings for the next twelve months exceed trailing earnings across all eleven GICS sectors. This breadth suggests a durable, diversified earnings recovery driven by multiple underlying factors, rather than simply the technology momentum linked to the US market.

Asia in focus: AI, governance gains, and Labubus

The largest emerging markets—China, Taiwan, India, and South Korea—together account for more than three-quarters of the MSCI Emerging Markets Index (as of September 30). Any meaningful exploration of EM must begin here, as these markets represent the core of the current opportunity set.

Collectively, we believe they offer a diverse mix of catalysts: rerating potential from improving corporate governance and stronger shareholder focus, differentiated AI exposure, access to domestic growth, and participation in vibrant consumer trends, like the impish plush Labubus that sparked a consumer frenzy.

Emerging Asia, in our view, provides investors with a distinctive complement to US technology exposure. Beyond serving as the “picks and shovels” of the global AI buildout—through semiconductor, server, and memory manufacturers in Taiwan and South Korea—these markets also offer participation in China’s expanding AI ecosystem. This diversification should enable investors to capture global AI growth while reducing reliance on the concentrated US “Magnificent Seven.”

South Korea has already benefited year-to-date from strong AI-related memory demand. Yet the market’s opportunity extends beyond technology exports. Long-term upside may come from improving corporate governance under the Korea Commercial Act, which enhances minority shareholder rights and supports the government’s “Value-Up” program. Undervalued domestic firms could rerate as these reforms take effect.

While India’s long-term prospects remain compelling, we are more cautious in the near term. Earnings momentum and revision trends have lagged those of other large Asian markets, and current valuations offer less margin for error. Over the longer run, however, structural reforms and domestic growth potential should sustain India’s role as a key EM growth driver.

Geopolitical tension between China and Taiwan remains a long-term consideration, but both the US and China appear motivated to maintain stable trade relations, evidenced by Presidents Trump and Xi avoiding the Taiwan issue at their recent APEC meeting. As of September 30, 2025, Chinese equities traded at a 41% discount to the US market, while Taiwan’s 22% discount remains notable given its stronger earnings outlook. These valuations offer a cushion against geopolitical uncertainty.

Currency strength and capital flows may bolster EM performance

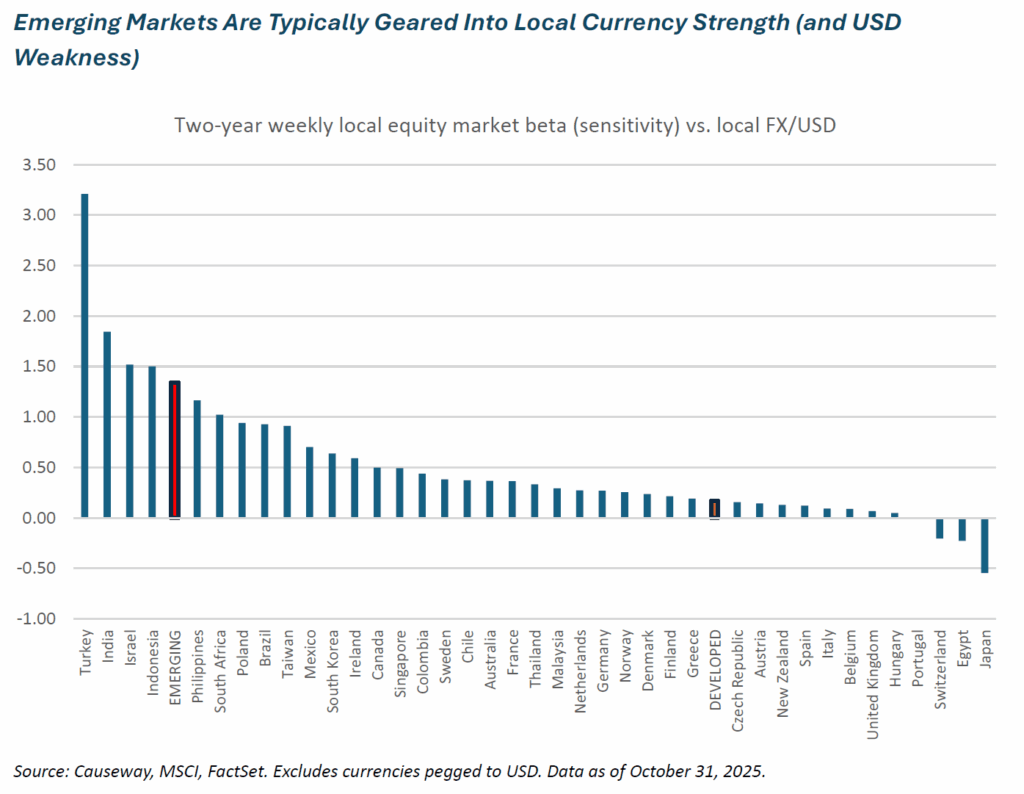

The macro backdrop, in our view, is amplifying EM opportunities. The US dollar has been weakening for much of the past nine months, while many EM currencies have appreciated. At the same time, interest rates are falling both in the US and across EM economies. A weaker dollar and lower rates tend to be a powerful combination for emerging market performance, easing financial conditions and supporting capital flows into risk assets.

Looking ahead, we see fundamental reasons why EM currencies should remain strong relative to the US dollar. Fiscal discipline is a key differentiator: China, Korea, Taiwan, and India are in stronger fiscal positions than the US, where the fiscal deficit exceeds 6% of GDP. This imbalance could act as a drag on the dollar over time. In addition, EM central banks have built credibility through early and decisive rate adjustments. Together, we believe these dynamics create a foundation for sustained EM currency strength, in turn a key tailwind for EM equities, which typically are geared into their currencies more than are developed markets.

From risk to resilience: the changing volatility profile of EM

While emerging markets have long carried a reputation for higher risk, both forecast and realized volatility tell a different story today. Forecast volatility for EM has been trending lower, even as US volatility forecasts have risen. The same holds true for realized volatility—actual market swings recently have become milder in EM and more pronounced in the US.

Why? We believe it is from stabilizing fundamentals within EM economies and improving internal diversification. The reduced weight of cyclical energy and commodity exporters, combined with a higher share of technology and interactive media, may have reduced cyclicality in the EM index. More orthodox monetary policy frameworks across major EM economies have also stabilized local markets.

Currency plays a role here as well: EM currencies today are less correlated with each other than a decade ago, and represent 16% of total forecast MSCI EM Index volatility versus 24% in 2015.

Source: Causeway Risk Lens

Source: Causeway Risk Lens

Conclusion: A multi-year opportunity emerging in EM equities

Even after a strong rally, the case for EM remains compelling. Attractive valuations, improving earnings revisions, favorable currency and macro dynamics all suggest a multi-year opportunity taking shape for emerging markets investors.

The Causeway Emerging Markets strategy uses quantitative factors that can be grouped into seven categories: valuation, growth, technical indicators, competitive strength, macroeconomic, country-sector aggregate, and currency. “Alpha” means performance exceeding the benchmark index.

This market commentary expresses Causeway’s views as of November 2025 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information. For full performance information regarding Causeway’s strategies, please see www.causewaycap.com.

In addition to the normal risks associated with equity investing, international investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors, as well as increased volatility and lower trading volume. Current and future holdings are subject to risk. For further information on the risks regarding investing in Causeway’s strategies, including unique risks relevant to emerging markets including China and investment structures of certain Chinese companies, please go to https://www.causewaycap.com/wp-content/uploads/Risk-Disclosures.pdf

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index, designed to measure equity market performance of emerging markets, consisting of 24 emerging country indices. The MSCI ACWI ex US Index is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 22 developed and 24 emerging markets excluding the United States. The MSCI World ex US Index captures large and mid cap representation across 22 of 23 Developed Markets countries excluding the United States.

The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.