Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Members of Causeway's research team explore investment opportunities in Chinese healthcare from fundamental and quantitative angles.

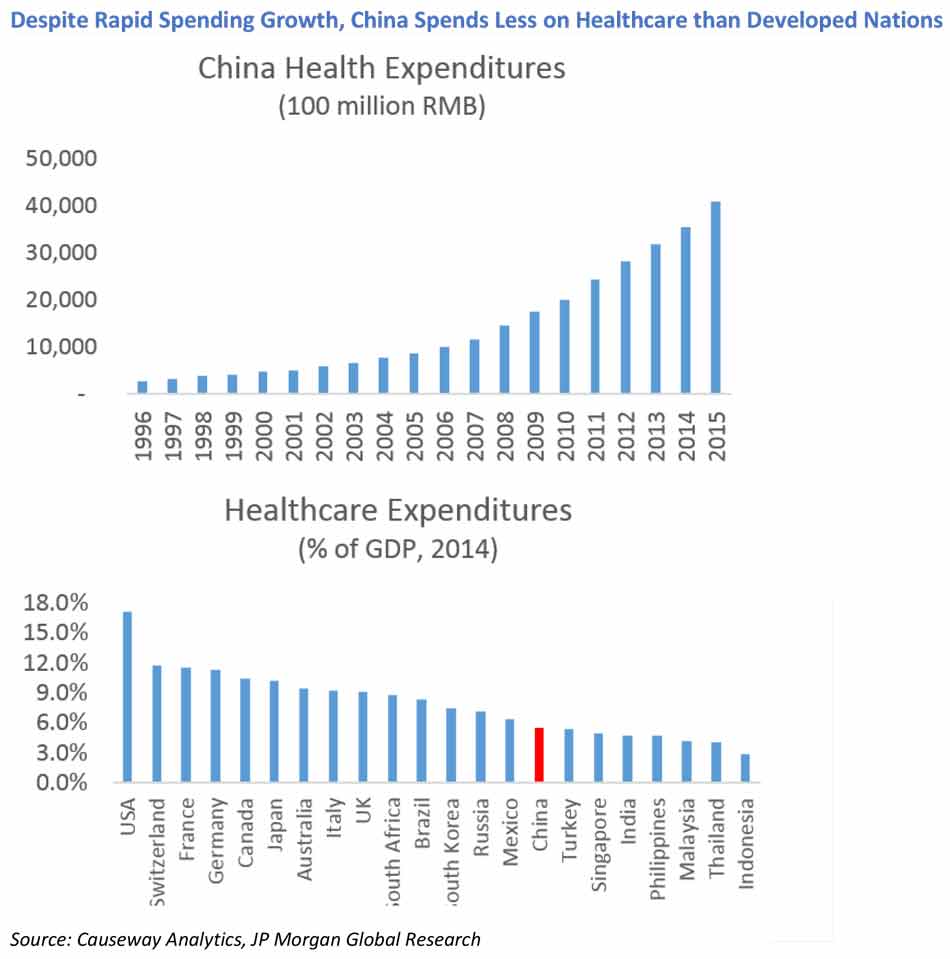

Transitioning from an emerging to a developed country, China cannot escape its demographics. As a byproduct of the one-child policy, China’s enormous population has grown at an average of only 0.6% per year from 1996 to 2015. The US population expanded 0.9% per year over the same period. Low growth implies an aging population – one increasingly subject to chronic diseases. Aging plus disease has its societal costs. Many Americans are struggling to pay for healthcare, and the Chinese are facing an even bigger tab. By 2050, roughly a quarter of China’s citizens will be over age 60. With less than 6% of gross domestic product spent on healthcare (compared to 9-12% in most developed countries), the Chinese will likely devote more of their resources to staying healthy.

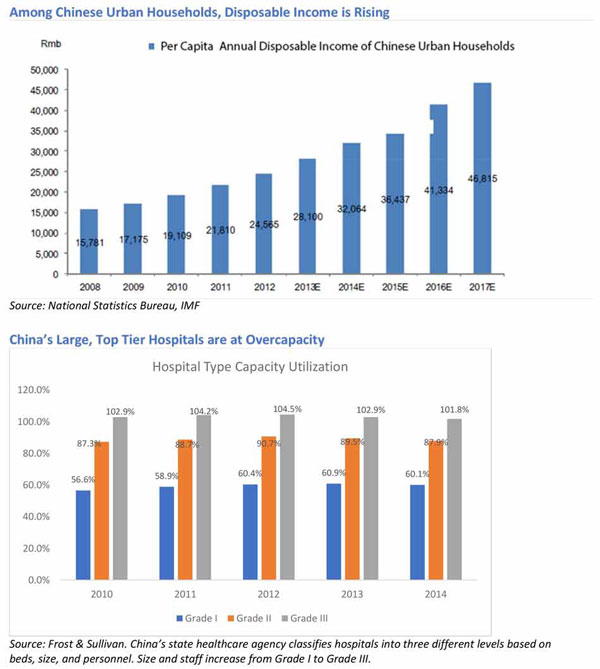

With its rising disposable income per capita, China’s demand for healthcare, in particular top tier hospital services, already exceeds supply.

The central government recognizes the problems, and aims to relieve congestion at the most reputable public hospitals by welcoming private capital into the nation’s hospital industry. This flow of funds should improve conditions and spawn many higher-quality private hospitals. Causeway research, both fundamental and quantitative, recognize that some companies should benefit from these changes. Reforms that have caught our attention include the elimination of unneeded middlemen in drug distribution, and prohibitions on the markup of drug and medical devices. Hospitals had become heavily dependent on drug sales to keep the lights on. To supplement their relatively low salaries, doctors often accepted prescription-related, unrecorded payments from pharmaceutical manufacturers. After a successful pilot program, zero markup of drugs is becoming a reality for most hospitals across the country. To speed up the approval process for efficacious drugs, the China Food and Drug Administration (CFDA) quadrupled its staff in 2015-16, and is on track to increase staff by 50% this year. The CFDA has recently elevated the requirements for generic drugs, compelling pharmaceuticals firms to prove efficacy compared to existing drugs. Drugs that fail the new higher standards should not receive approval, freeing up regulator time to work on approving the better medicines.

China’s healthcare industry reforms—combined with the inevitable consolidation or demise of smaller or weaker players—should result in greater efficiency and profitability in areas such hospital management, drug and medical equipment distribution, private supplemental health insurance, and new drug discovery and launch. To complement reforms, China boasts a rising supply of young scientific talent. These professionals earn about a third as much as their peers in the developed world. Add to the mix a “preferred industry” 15% corporate tax rate plus government subsidies to spur innovation, and we believe the investment landscape looks promising for Chinese healthcare companies. To learn more, we spoke to Causeway quantitative portfolio manager, Arjun Jayaraman, and senior analyst, Fusheng Li.

As investors, we see the government’s goal as our guiding light for stock selection.

Q: Fusheng, with your scientific and medical background, plus finance and language skills, Chinese healthcare seems like a natural place for you to identify buy candidates.

FL: I have multiple industry assignments, but Chinese healthcare is an especially interesting area for Causeway—and for me. As investors, we see the government’s goal as our guiding light for stock selection. If a company can provide medical resources at a diminishing cost, the company should be well positioned to enjoy significant demand for its products or services.

Q: Ok, let’s get specific. How can Causeway’s portfolios take advantage of the societal goals of the Chinese government?

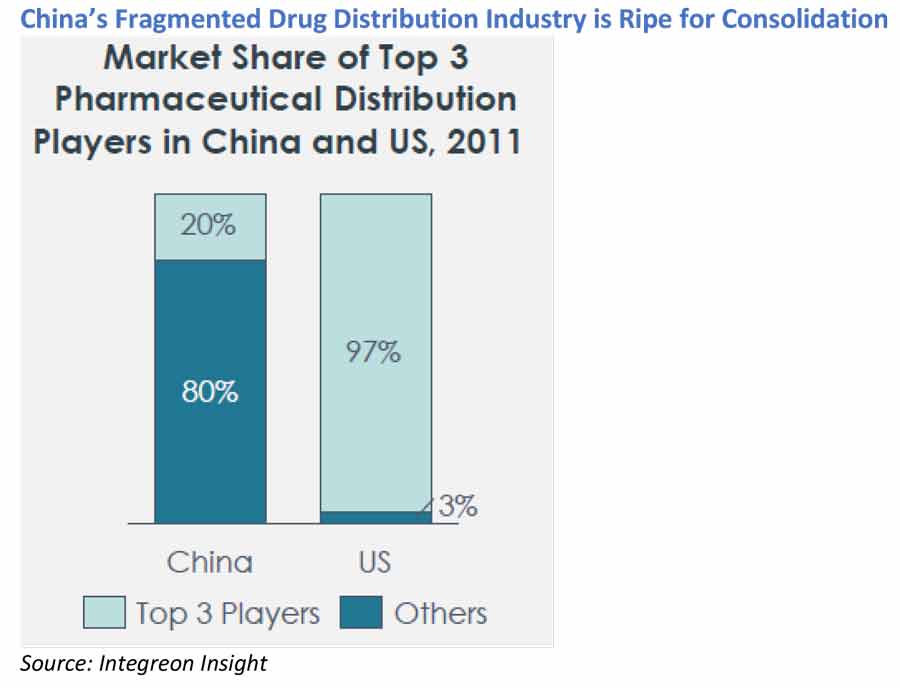

FL: We currently like the pharmaceutical distribution industry, as the pace of industry consolidation is increasing. In contrast with a very fragmented industry in China, three companies account for approximately 90% of all revenues from drug distribution in the United States. Consolidation in China should afford the largest players substantial economies of scale in almost all areas of their business from purchasing to logistics. Furthermore, the “winners” should have minimal debt and plenty of financial flexibility. The drug distributors play a critical role as financial intermediaries between manufacturers and hospitals. Despite a low default risk for public hospitals, the accounts payable turnover of public hospitals is typically long. Successful drug distributors must have plenty of working capital and access to low cost capital to fund their expansion.

Q: Arjun, what other types of Chinese healthcare stocks are favored by Causeway’s quant model?

AJ: Some of the distributors and drug companies score well in our quantitative alpha model. These stocks look attractive on a variety of metrics, but principally on valuation criteria such as price-to-earnings ratios, dividend (plus share buyback) yield, cash flow yield, and sell-side percentage upside. Keep in mind that we look at valuation on a country and sector-relative basis. While Chinese pharmaceutical stocks do not look particularly “cheap” relative to the Hong Kong market, they do look cheap relative to emerging markets pharmaceutical industry averages, which are dominated by an expensive group of Indian drug companies.

We search for innovators with effective products, rather than “me too” copycat drugs unable to provide substantial improvement in patient outcomes.

FL: When we meet with the Chinese drug companies, we are looking for detailed information to supplement our quantitative assessments. We search for innovators with effective products, rather than “me too” copycat drugs unable to provide substantial improvement in patient outcomes. As research staffing expands, we believe the quality of research and resulting productivity should bolster drug pipelines with potentially novel therapies.

Expense reduction should be a key element to success in Chinese healthcare. We have spent time with representatives of a Chinese hospital management company that is China’s largest listed medical group in terms of licensed hospital beds. By owning and/or operating increasing numbers of hospitals, the company can obtain valuable cost synergies, not to mention improve the efficacy and outcomes for hospitals nationwide. At an attractive price entry point, we believe that stock could deliver long-term benefits to shareholders.

AJ: As China’s behemoth healthcare sector grows and reshapes, we rely heavily on our integrated fundamental and quantitative research to identify investment opportunities. Our quantitative analysis seeks to uncover attractive combinations of valuation, growth, and momentum within this vast landscape. The in-depth analysis of our fundamental colleagues allows us to hone in on the most compelling companies, avoiding pitfalls that lurk outside the scope of quantitative models. Using these disciplines together, our investment team researches those segments that stand to benefit most from supportive demographic trends and industry reforms.

Important Disclosures

This market commentary expresses Causeway’s views as of October 24, 2017 and should not be relied on as research or investment advice regarding any investment. These views and any portfolio holdings and characteristics are subject to change, and there is no guarantee that any forecasts made will come to pass. Any securities referenced do not represent all of the securities purchased, sold or recommended by Causeway. The reader should not assume that an investment in any securities referenced was or will be profitable. Forecasts are subject to numerous assumptions, risks and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy or completeness of such information.