Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

What are the implications of adding new markets ─ China A-shares or Saudi Arabia ─ to the widely followed MSCI Emerging Markets benchmark? And how does Causeway’s Emerging Markets strategy adapt to an ever-changing investable universe? We examine the effects of adding these "graduating" markets to the emerging markets opportunity set.

Last week, as students across the United States marched in commencement ceremonies, MSCI acknowledged the possible future inclusion of China A-shares in its Emerging Markets (EM) Index and declared its plans to track investors’ experiences in trading the recently opened Saudi Arabian equity market. MSCI’s announcements raise several questions: What are the implications of adding new markets ─ China A-shares or Saudi Arabia ─ to a benchmark that is so widely followed? And how does Causeway’s Emerging Markets strategy adapt to an ever-changing investable universe?

Let us begin with a look at the Chinese equity market. Currently, there are generally three main share types of large-capitalization Chinese companies: locally listed A-shares, Hong Kong-listed H-shares, and US-listed American Depositary Receipts or “ADRs.” Historically, foreign investors could only buy the latter two share types, but the Chinese government recently eased foreign access to the mainland A-share market. Last November, a trading link was established between the Hong Kong Exchange and the Shanghai Exchange (the Shanghai-Hong Kong Connect) that allowed foreign investors to buy Shanghai-listed shares. A second step, expected later this year, should provide a similar point of access to the Shenzhen market. These efforts to facilitate cross-border investment are in addition to the existing Qualified Foreign Institutional Investor (QFII) program, which has allowed institutional investors (very) limited access to the A-share market from 2002. However, all paths to A-shares are subject to quotas on capital flows. These quotas have been the chief barriers to broader foreign investment.

While we believe the Chinese government favors more accessible capital markets and will continue its gradual opening, it still needs to make further sizable changes ahead.

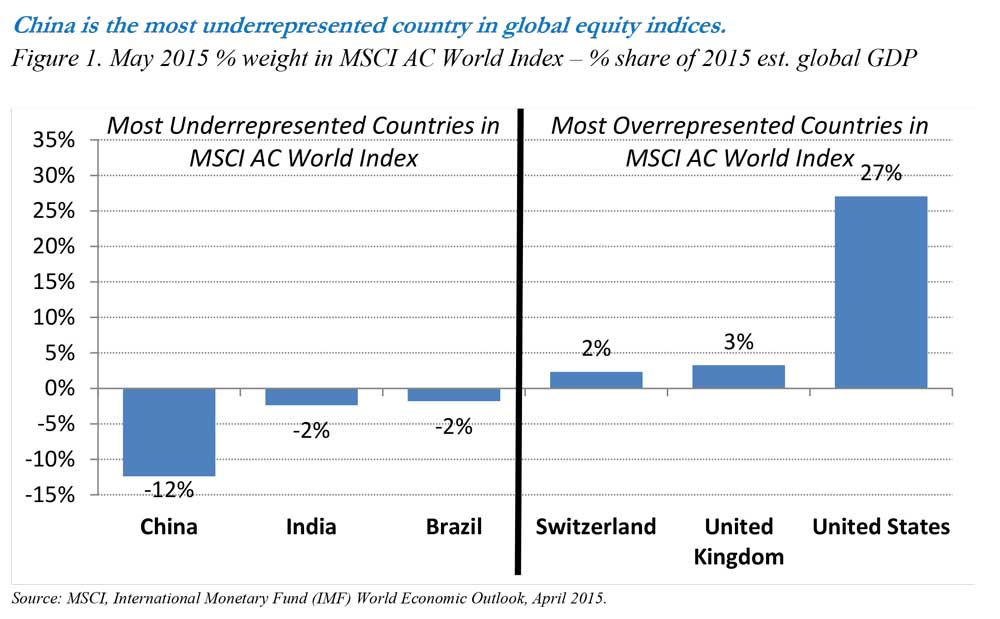

With over US$1.7 trillion tracking its Emerging Markets Index, MSCI (and competing index providers) perpetually struggles to balance the need for representativeness with accessibility for its investor clients. On one hand, China is the most underrepresented country in equity market indices if one compares its current weight in the MSCI All Country World Index (3%) to its share of world gross domestic product (15%).

On the other hand, historical restrictions on foreign ownership and current quotas on foreign flows into A-share equities continue to sideline most foreign investors. Before adding A-shares to its indices, MSCI will likely want to be confident that there are enough A-shares available to foreign investors to replicate its indices. This consideration would favor some small inclusion factor (a haircut from its market-value-defined weight) in the future when A-shares are first added: A 5% inclusion factor, which MSCI mentions in its “roadmap,” would translate into a 1.3% weight for A-shares in the current EM Index. MSCI also has concerns about capital mobility (currently, capital may only be repatriated weekly subject to a quota) and beneficial ownership (though the China Securities Regulatory Commission sought to assuage these concerns at the end of May). MSCI will need to resolve these concerns before including mainland shares. While we believe the Chinese government favors more accessible capital markets and will continue its gradual opening, it still needs to make further sizable changes. For this reason, we do not expect inclusion of A-shares in the EM Index in at least the next 12 months. MSCI mentioned May 2017 as the most probable date, but also stated that it would consider a market addition at a date earlier than its normal review cycle.

Causeway does not allow MSCI to limit the investable universes for our equity strategies. Since its inception, the Causeway Emerging Markets strategy has included in its universe all stocks in emerging and frontier markets that meet minimum liquidity constraints (currently we screen for at least $4 million average daily trading volume) and trade in markets with transparent trading costs and trading terms, as well as adequate market access. Of course, inclusion in our universe does not necessarily translate into representation in our portfolio. Once in our universe, we screen stocks based on their value, growth, and technical factors, in addition to the relative attractiveness of the countries, currencies, and sectors in which they operate.

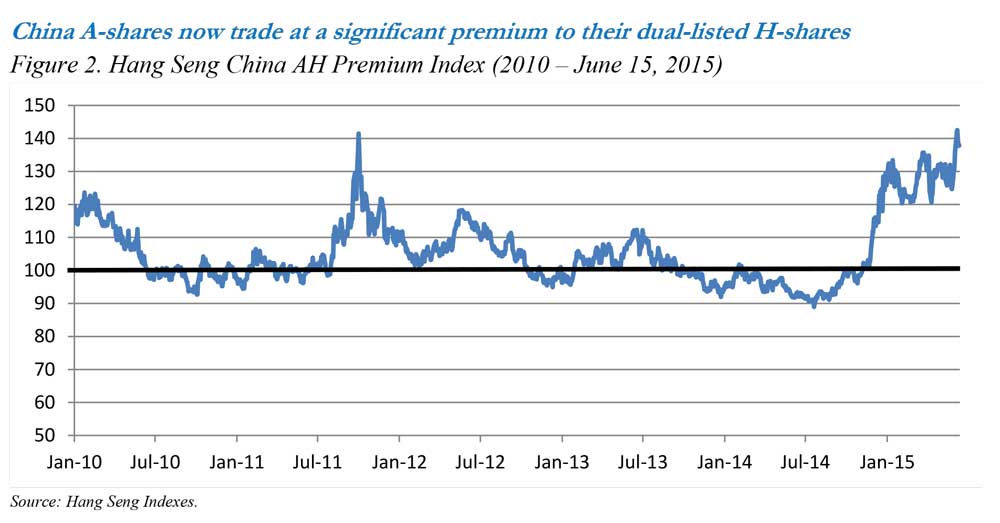

As value investors, Causeway places the most emphasis on value factors. By this measure, the China A-share market looks very expensive. Having risen nearly 136% in the past year, as of May 31, 2015, the MSCI China A Index trades at 18.9x next-twelve-month earnings versus the MSCI EM Index at 11.7x. Perhaps more surprising is that dual-listed stocks (those that trade both as A-shares and H-shares) trade at a large premium on the mainland. One potential explanation for this premium is the tremendous (and growing) amount of mainland capital seeking investments – and buying equities. The Hang Seng China AH Premium Index tracks the relative premium or discount of A-shares for roughly 60 dual-listed stocks. As evident in Figure 2, although past index values waver around 100, signifying parity, the A-share premium has recently increased to over 40%. There is no direct arbitrage mechanism to correct this differential (one cannot buy an H-share and sell it in the A-share market), but we believe this phenomenon will not persist indefinitely, assuming market access continues to expand.

Given relative and absolute valuations, even if A-shares were presently included in the MSCI EM Index or market access was not limited, we would likely prefer the H-shares of dual-listed companies. We would buy few mainland-exclusive A-shares due to more attractive valuations in other geographies. The imminent addition of a group of US-listed ADRs that have no local listing in China should have a greater impact on the MSCI EM Index than A-share inclusion. These additions include technology companies Alibaba, Baidu, Ctrip.com, Netease, and JD.com, all of which trade only in the United States. The impact on MSCI indices will be relatively small in the near term, as MSCI assigns index weights based on float, not market capitalization. At Causeway, we have always included in our universe the US-listed ADRs of emerging markets companies. In instances of dual listings (a local listing and an ADR), we take into account valuation and liquidity differences when choosing where to trade, as we would do with China A-shares. Thus, while prospective changes to the MSCI EM Index will have ancillary implications for our portfolio (tracking error, and country/position constraints, for example), they will not change our existing investment process.

Perhaps more exciting for Causeway’s Emerging Markets strategy is the opening of the Saudi Arabian equity market to qualified foreign investors beginning June 15, 2015.

Perhaps more exciting for Causeway’s Emerging Markets strategy is the opening of the Saudi Arabian equity market to qualified foreign investors beginning June 15, 2015. Historically, foreigners generally had no means of directly accessing Saudi stocks. The opening marks a move by the Kingdom to diversify the economy beyond oil, expose local companies to market discipline, and create jobs. With a total market capitalization of over US$500 billion (worth more than all other Gulf Arab markets combined), we expect to see a variety of Saudi stocks entering our universe that meet our liquidity threshold, and the pegged Saudi riyal removes much of the translational foreign exchange risk for US dollar investors. MSCI may add Saudi Arabia to its Emerging Markets Index as early as 2017, and its size would put it on par with Russia or Brazil (though an inclusion factor would likely limit its initial weight to around 1.5-2%, similar to Turkey or Poland).

Causeway has owned multiple markets in advance of their “graduation” to the EM Index, most recently the United Arab Emirates and Qatar. With Saudi Arabia and other future markets, we would continue to apply our standard exposure constraints: a +/- 2 percentage points active constraint at the individual stock level and a +/- 5 percentage points active constraint on total country exposure relative to the EM Index. Regardless of a country’s “official” designation by MSCI, Causeway’s Emerging Markets strategy will continue to search for any and all investment opportunities in accessible developing markets where expected alpha generation exceeds risks and transaction costs.

The market commentary expresses the portfolio managers’ views as of June 2015 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors, as well as increased volatility and lower trading volume.

The MSCI Emerging Markets Index is a free float adjusted market capitalization index, designed to measure equity market performance of emerging markets, consisting of 23 emerging country indices.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.