Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Oil and water, Coke and Mentos, and drinking and driving might seem like ideal pairings in comparison with rising interest rates and emerging markets equities. We don’t need to look very far to see investor concern. Although the market interpreted the US Federal Reserve Bank’s (Fed) comments on March 18 as relatively dovish, the long-term expectation for a rise in US interest rates remains unchanged. In the “taper tantrum” period (late May through June 2013) after the Fed announced it would gradually unwind its asset purchasing program, the MSCI Emerging Markets Index (“EM Index”) declined over 9% while the S&P500 fell over 3%. Why did investors react so negatively to the announced end of quantitative easing in the United States? How has Causeway positioned its emerging markets portfolios to weather an inevitable change in the US monetary regime? To answer these questions, we spoke to Causeway’s co-portfolio manager and quantitative research head, Arjun Jayaraman, as well as our portfolio strategist, Ryan Myers.

Arjun, with the Fed signaling a 2015 increase in interest rates, what type of reaction do you expect from emerging markets?

AJ: Across emerging markets asset classes—equity, debt, and currency—we expect a pullback in response to a US interest rate increase, although markets may have already discounted some expectations of reduced monetary liquidity. Emerging markets currencies will likely suffer due to the current monetary policy divergence. While US monetary policy is expected to tighten, several emerging markets central banks have already been loosening their monetary policy, including India, China, and Russia. Under this scenario, we expect emerging markets equities to fare relatively better than emerging markets debt. As a US-dollar based investor, the strengthening dollar versus local emerging markets currencies detracts from returns on both equity and fixed income. However, equities have an advantage over debt. Specifically, domestic currency weakness typically leads to incremental earnings growth of exporting companies, and all companies generally benefit from the stimulative effect on their regional economy.

Emerging markets are no longer “whipsawing” on the day-to-day Fed chatter, as they were in earlier periods. Meanwhile, the Eurozone and Japan have embarked on massive money creation programs, which may offset some of the monetary liquidity reduction coming from the United States.

In anticipation of relative underperformance of emerging markets versus developed markets, have you made a sizable reduction to your emerging markets allocation?

AJ: In our International Opportunities portfolios that invest in both developed and emerging markets, we have moved to a modest underweight position in emerging markets versus the MSCI All Country World ex-US benchmark. But it isn’t all gloom and doom. Yes, the specter of monetary tightening in May-June of 2013 sent emerging markets reeling. However, here we are, almost two years later, and it appears as if emerging markets are becoming increasingly acclimated to the likelihood of higher US interest rates. Emerging markets are no longer “whipsawing” on the day-to-day Fed chatter, as they were in earlier periods. Meanwhile, the Eurozone and Japan have embarked on massive money creation programs, which may offset some of the monetary liquidity reduction coming from the United States.

RM: Additionally, a number of key catalysts of previous emerging markets crises are no longer present. The 1994-95 “Tequila Crisis” in Mexico, and the 1997-98 “Asian Financial Crisis,” which began in Thailand, were triggered by unsustainable fixed exchange rates versus the US dollar. Today, most emerging markets currencies are floating versus the US dollar, and that acts as a natural adjustment mechanism. Furthermore, most emerging countries have less US dollar-denominated public sector debt and higher foreign exchange reserves than they carried in prior crisis periods.

Political and economic characteristics, and ultimately equity market returns, differ to a much greater extent in the developing countries.

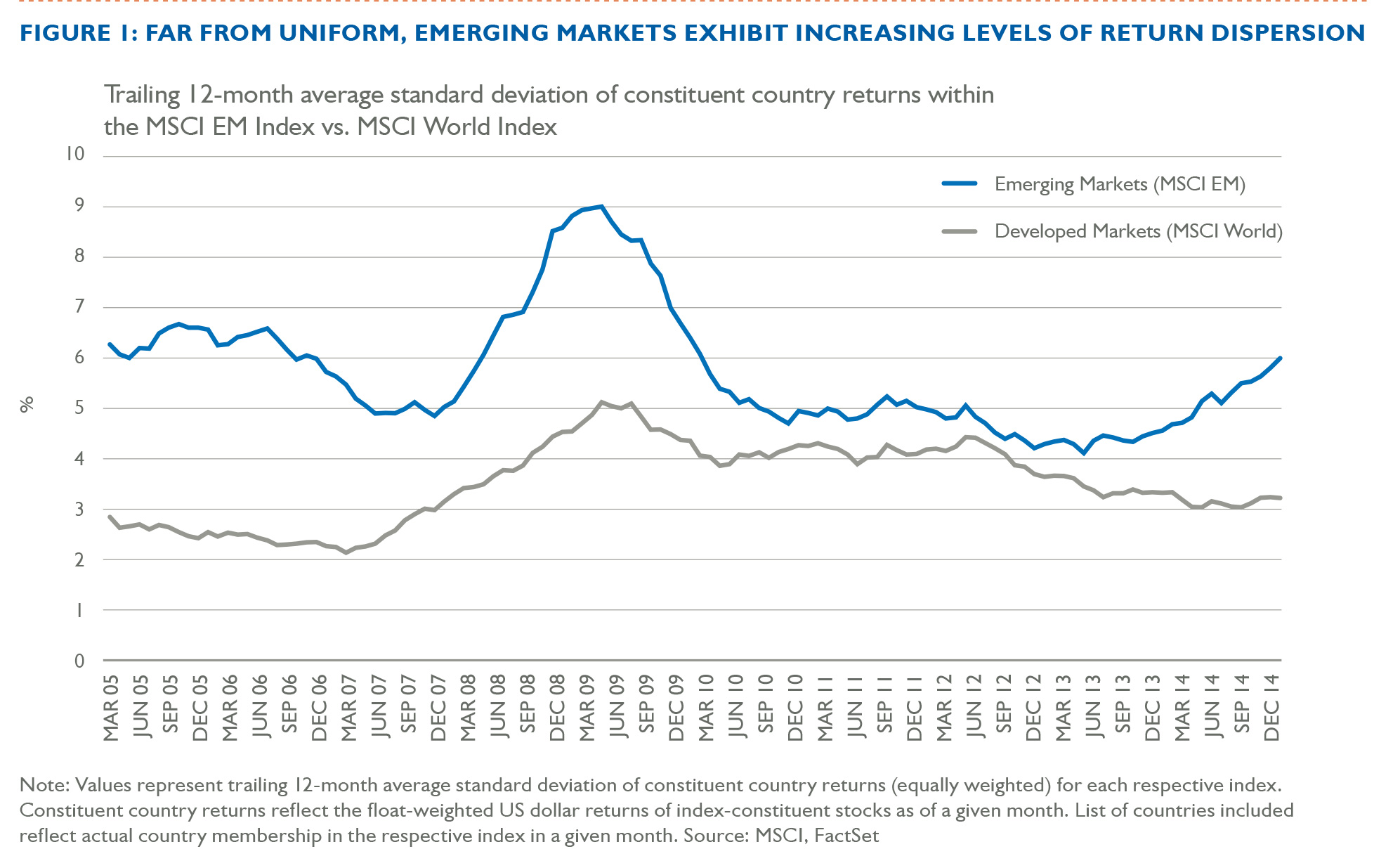

AJ: It is also important to recognize the significant variation in macroeconomic conditions across emerging markets. Political and economic characteristics, and ultimately equity market returns, differ to a much greater extent in the developing countries. In fact, over the last ten years, as illustrated below in figure 1, the standard deviation in country returns within emerging markets has averaged over 60% more than that of country returns within developed markets. And in the last two years, dispersion within emerging markets has increased to nearly twice the dispersion levels in the developed world. In general, we do not expect the entire emerging markets asset class to move in tandem.

Which markets are most vulnerable to a tightening of US monetary policy?

RM: Even a modest rise in US interest rates will likely pressure those emerging countries with high current account deficits relative to their foreign exchange reserves. This is because US dollar-denominated trade liabilities will grow in local currency terms as the US dollar appreciates. In the “taper tantrum” of 2013, the markets and currencies of these deficit countries suffered the most from the prospect of tightening liquidity. We built Causeway’s currency factors to take these considerations into account. Within our factor model, we examine current account deficits, budget deficits, foreign exchange reserves, and inflation forecasts, among other variables. Countries like Brazil, Russia, and South Africa consequently rank low in our currency factor, while countries like Taiwan, Korea, and Thailand rank much more favorably.

AJ: In 2015, currencies of high inflation and high current account deficit countries such as Brazil and Turkey (two of the worst performing countries year-to-date in the EM Index) have underperformed currencies of countries with more supportive macroeconomic fundamentals, including many in emerging Asia. Countries that suffered from weak fundamentals several years ago have made significant strides to improve their positions. For example, in India, inflation has halved since the end of 2013, and its current account deficit narrowed to 1.6% of GDP in the fourth quarter of 2014, having reached a record deficit – two years prior – of 6.7%. Both India and Indonesia have benefitted from the recent decline in crude oil prices. Indonesian President Joko Widodo’s administration has cut fuel subsidies, and aims to cut the budget deficit to 1.9% of gross domestic product.

Ryan, how do falling oil and gas prices affect Causeway’s expectations for emerging markets?

RM: Not all emerging markets have their national incomes tied to commodity exports, and low oil prices may continue to differentiate the economic performance of energy exporter and importer nations. In emerging Asia, most countries, including China and India, are net oil importers, and falling energy prices should benefit economic development. Depressed oil prices also should soften the impact of government reductions of fuel subsidies in India, Malaysia, and Indonesia, for example. We believe that energy and materials exporters such as Russia, Mexico, and the Gulf nations will continue to face challenges. Falling crude oil prices have also significantly reduced inflationary pressures, so central banks in emerging countries should have more leeway to pursue expansionary monetary policy through lower interest rates. We have already seen cuts this year in the benchmark rates of India, Russia, and China.

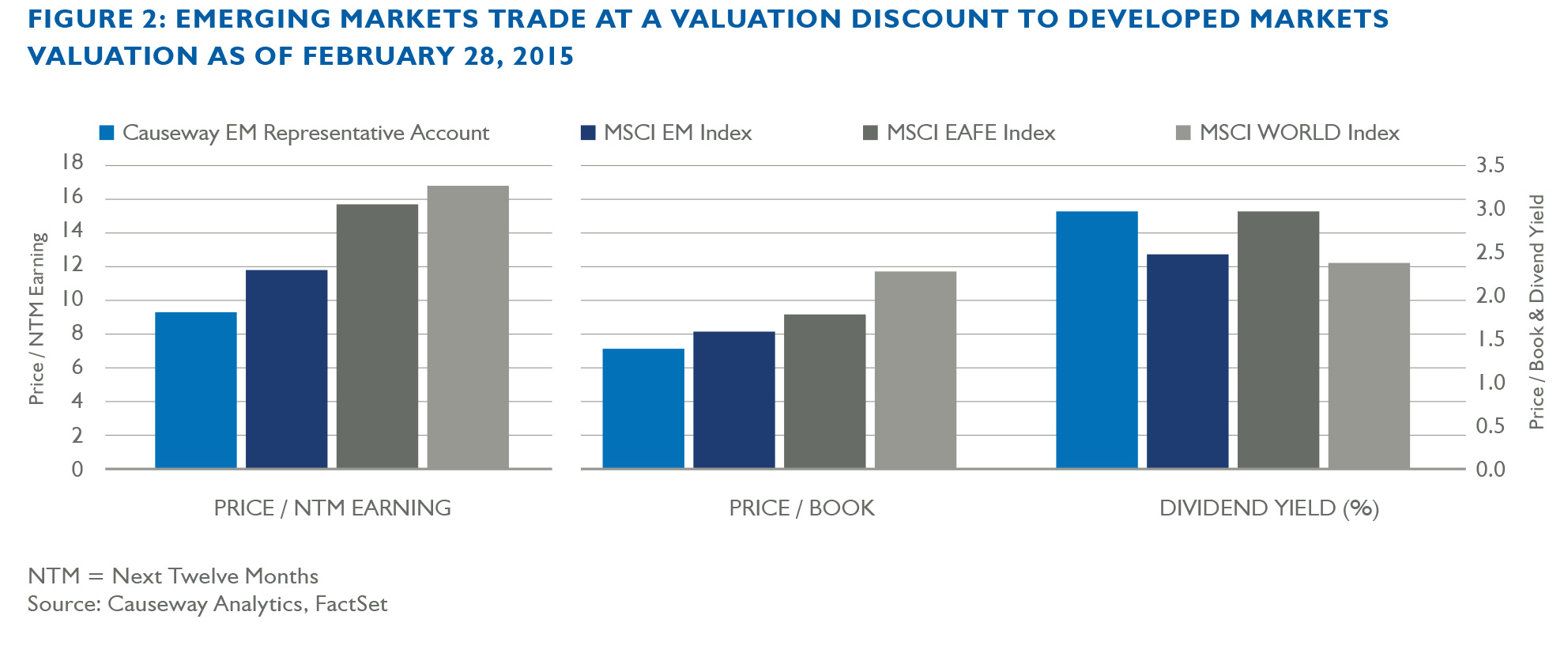

Emerging markets equities tend to trade at a discount to developed markets. Do you think they carry a sufficient valuation “buffer” to shield the markets from a Fed-related selloff?

AJ: Over the long term, we believe that they do, because their undervaluation is coupled with better economic growth prospects than advanced economies. As of January 2015, the International Monetary Fund estimates that, on average, emerging markets will grow 4.3% in calendar 2015, versus 2.4% for advanced economies.

Falling crude oil prices have also significantly reduced inflationary pressures, so central banks in emerging countries should have more leeway to pursue expansionary monetary policy through lower interest rates.

Arjun, how has Causeway positioned emerging markets portfolios for this anticipated return to “normal” monetary policy in the US?

AJ: Our top-down country, currency, and sector factor components are especially important to our process in this environment. When stock price dispersion is increasing among emerging markets countries, allocating exposure to the “right” countries matters more than usual. At present, relative to the EM Index, our portfolios are overweight the emerging Asia region, especially India, Taiwan, and South Korea. India ranks well on our technical factors, exhibiting positive price momentum. Taiwan and South Korea both exhibit positive earnings growth coupled with attractive valuations. And countries such as Taiwan are actually benefiting from the rising US dollar, as their economies are export-driven, and US dollar appreciation should further grow sales and earnings in local currencies. In contrast, we are not as optimistic for Latin America, due to a negative macroeconomic outlook and high valuations. Brazil trades at 10.5x next-twelve-month price-to-earnings (NTM P/E), which is only a small discount to the EM Index as a whole. We believe that this multiple is unjustified, given major inflation and growth challenges. The country’s high real interest rates and weak gross domestic product growth create a poor macroeconomic climate. Causeway’s underweight position in Brazil (and the Brazilian real) has been a significant contributor to our relative performance against the EM Index this calendar year-to-date. Mexico also appears overvalued, at 18.5x NTM P/E, and the previously optimistic macroeconomic outlook has begun to fade with falling oil prices.

RM: By sector, we are overweight the utilities and health care sectors, which both have strong earnings growth prospects. One of our most significant underweight positions is to the consumer staples sector. Despite weak earnings growth forecasts, valuation premiums for this sector have risen because of investors’ preference for predictable earnings growth and dividend yield. We have found more compelling investment opportunities in stocks with greater exposure to economic cycles, in sectors such as information technology (“IT”). Some of IT’s largest constituents benefit from a stronger US dollar, adding to already above-market average levels of future earnings growth.

Ultimately, we seek to exploit multiple alpha sources across the asset class.

AJ: Ultimately, we seek to exploit multiple alpha sources across the asset class. Although our portfolio has a strong value orientation, if we were to focus solely on undervaluation in today’s markets, our portfolio would hold almost exclusively Chinese banks, Russian energy, and Brazilian utilities. We do not believe that risky troika would serve our clients well. In addition to undervaluation, our investment process seeks stocks that will benefit from growth and price momentum. We evaluate these features in the context of top-down factors to achieve a more well-rounded definition of attractive stocks. Our goal is to identify investment opportunities across cycles, as styles move in and out of favor, global monetary conditions change, and economies evolve.

Important Disclosures

The MSCI EAFE Index is a free float-adjusted market capitalization weighted index, designed to measure developed market equity performance excluding the U.S. and Canada, consisting of 21 stock markets in Europe, Australasia, and the Far East. The MSCI World Index is a free float-adjusted market capitalization weighted index, designed to measure developed market equity performance, consisting of 23 developed country indices, including the U.S. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index, designed to measure equity market performance of emerging markets, consisting of 23 emerging country indices.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

Market Commentary

The market commentary expresses the portfolio managers’ views as of 3/31/2015 and should not be relied on as research or investment advice regarding any stock. These views and portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Any portfolio securities identified and described do not represent all of the securities purchased, sold, or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.