Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

By Ryan Myers, Causeway Quantitative Portfolio Manager

Based on the Federal Open Market Committee’s September policy statement, it seems increasingly likely that the U.S. Federal Reserve (“Fed”) will begin tapering its bond purchases later this year. Emerging Markets (EM) equities have underperformed Developed Markets this year largely due to the regulatory and market turmoil in China, but now there are questions around additional pressure from tighter U.S. monetary policy. Might the burden of lower global liquidity fall harder on developing economies, which may be more sensitive to capital flows? While EM equities have generally fared relatively well in past tightening cycles, coincident currency declines weakened returns for USD-based investors. We argue that EM currencies are generally in a more favorable position now than in previous cycles. We believe currency crises are less likely to be repeated, and EM central banks are (atypically) leading the Fed in this tightening cycle, which should relieve pressure on exchange rates.

Key insights

- Despite the perceived vulnerability of emerging markets equities to global tightening, EM equities have generally fared relatively well in past tightening cycles.

- Emerging markets currencies have posed a major risk to EM equity returns in past monetary tightening cycles. But we think their valuation levels combined with the direction of EM interest rate policy should offset at least some of the FX pressure.

- We believe the current tightening cycle should not be grounds for avoiding EM equities.

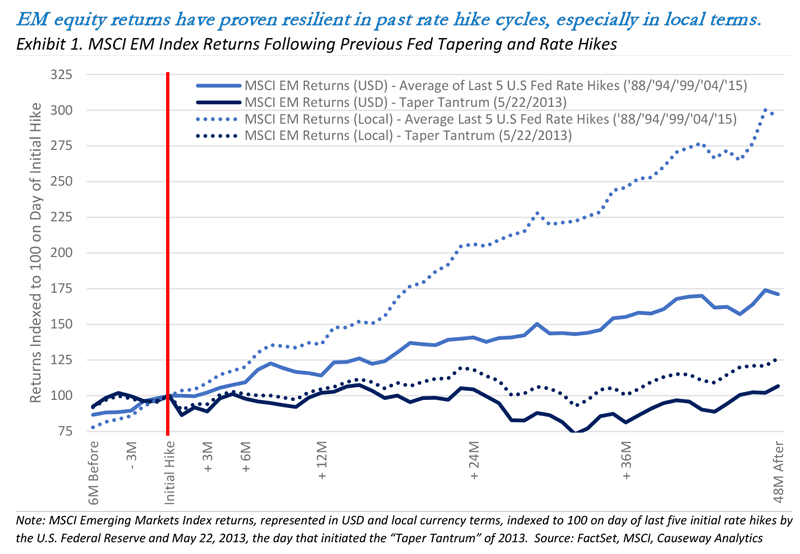

Exhibit 1 charts the average returns of the MSCI Emerging Markets Index (“EM Index”) in the early years of the last five Fed tightening cycles and from the first day of the so-called “Taper Tantrum” in 2013. Despite the perceived vulnerability of EM equities to global tightening, USD returns (solid lines) are positive. Local returns (dotted lines) are even higher. The EM Index in local terms nearly tripled, on average, in the four years following the previous five Fed hikes. In both USD and local currency returns, the EM Index outperformed the MSCI World Index (not pictured) in these periods. While it is true that the EM Index underperformed the MSCI World Index following the “Taper Tantrum,” Fed tapering in 2021 – unlike in 2013 – has also been much better telegraphed.

Even though weakness in EM currencies has detracted from USD-denominated returns in previous cycles, there are reasons to anticipate less volatility in the current tightening cycle. When we analyze the last five Fed hikes, we are reaching back into the late 1980s and 90s. Many EM currencies were pegged to the U.S. dollar in the 1990s and faced untenable fixed rates that resulted in violent currency crises including Mexico (1994-95), Russia (1998), and the Asian Financial Crisis (1998-99) felt across Indonesia, Malaysia, the Philippines, and Thailand, among others. In the wake of these crises, many countries were forced to adopt floating exchange rates, allowing their currencies to freely adjust for changes in monetary policy and/or capital account imbalances in real time.

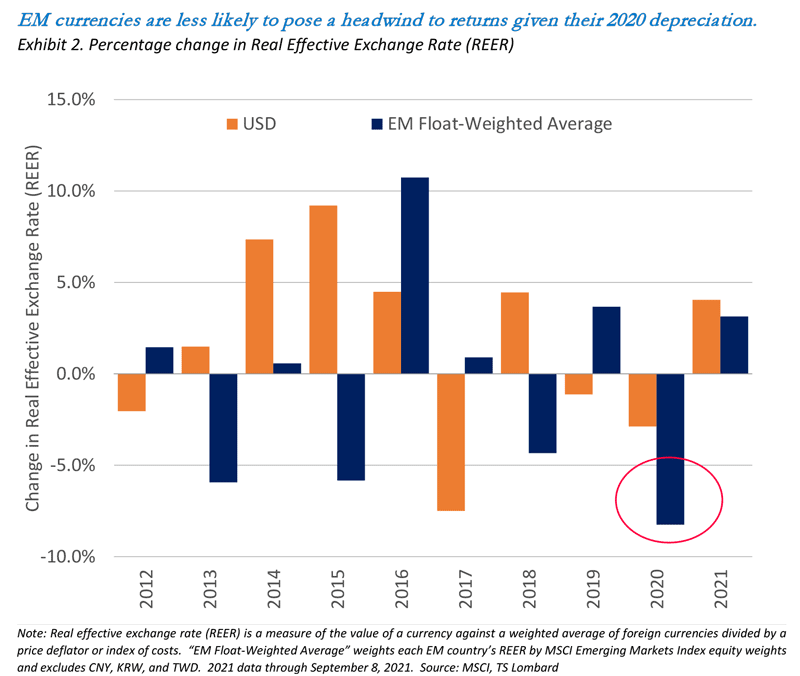

Though the higher prevalence of floating rates decreases the likelihood of EM currency crises, even gradual FX movements can erode USD returns. Recent history, however, suggests that exchange rates have already incorporated dollar strength. In 2020, on a real effective exchange rate basis, EM currencies depreciated the most in ten years and even more than in the “taper tantrum” year of 2013 (see Exhibit 2). Even though they have partly recovered in 2021, many EM currencies are still undervalued compared with their pre-pandemic average levels. At these discounted levels, we believe many EM currencies may not have much farther to fall. Additionally, many EM central banks have bolstered their foreign exchange reserves during the recovery from the pandemic, providing additional cushion against future exchange rate volatility.

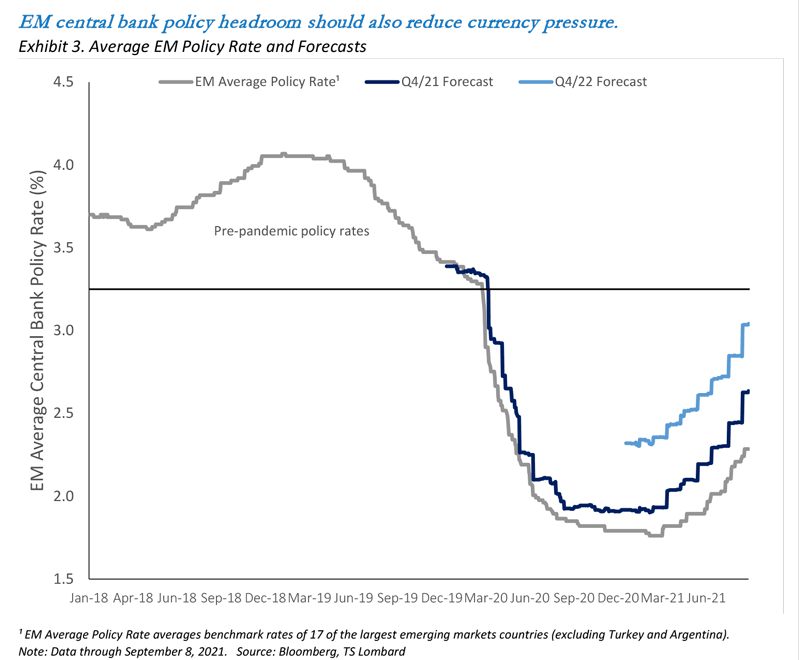

Another key to stable and appreciating EM currencies in 2021 has been the general trend of increasing EM central bank policy rates. In 2021, we have seen rising rates in Brazil, South Korea, Mexico, Russia, Chile, Hungary, Czech Republic, and Peru. Some of these hikes have been in response to rising inflation (such as in Latin America) or currency pressure, while others are hiking in response to the progress of economic recoveries. Exhibit 3 plots average EM central bank policy rates in gray, and consensus analysts’ expectations for rates at the end of 2021 (in dark blue) and the end of 2022 (in light blue). If consensus forecasts prove correct, by the end of 2021 this broad-based policy tightening will have reversed only about half of the monetary accommodation provided by EM central banks since the start of the pandemic. With plenty of policy headroom, EM central banks should have an extended runway to further hike local rates. High interest rates should, all else equal, attract capital to those currencies and lead them to appreciate, or at least remain stable, versus the U.S. dollar.

No discussion of Emerging Markets currencies would be complete without mention of China, which accounts for 34% of the EM Index as of August 31, 2021. We believe China may be on a different monetary path from much of the rest of the EM Index. Having arguably over-tightened credit in 2020, China’s central bank cut its reserve ratio requirement once in 2021 (with additional cuts likely coming soon) and recently has been injecting additional liquidity into markets to combat contagion from the Evergrande debt crisis. But we believe China is unique among EM countries in several important respects related to monetary policy and FX. Both the renminbi (RMB) and the Hong Kong dollar (HKD), where many China equities trade, maintain effective pegs to the USD. The combination of these pegs with a relatively closed capital account and high level of FX reserves translates into stable exchange rates. So even though China stocks account for a larger percentage of the EM Index compared to earlier monetary cycles, we do not currently expect HKD and RMB exchange rates to play a meaningful role in USD returns.

EM currencies have posed a major risk to EM equity returns in past monetary tightening cycles. But we think their valuation levels combined with the direction of EM interest rate policy should offset at least some of the FX pressure exerted by Fed tightening. Overall, we believe the current tightening cycle should not be grounds for avoiding EM equities.

This market commentary expresses Causeway’s views as of September 2021 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy or completeness of such information.

Past performance is no guarantee of future performance. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Investments in smaller companies involve additional risks and typically exhibit higher volatility.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index, designed to measure equity market performance of emerging markets across 26 Emerging Markets countries. The MSCI World Index is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout developed markets and is comprised of stocks from 23 developed countries.

These MSCI indices are gross of withholding taxes, assume reinvestment of dividends and capital gains, and assume no management, custody, transaction or other expenses. It is not possible to invest directly in an Index.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.