Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Artificial intelligence innovators and investors, like Sam Altman and Vinod Khosla, argue that drugs of the future will be built by small, nimble teams—sometimes fewer than 20 people—wielding AI. Capital is already flowing to this vision, raising the question: could today’s pharmaceutical giants be reduced to little more than marketing and distribution engines?

Our view: AI will compress discovery timelines and reduce the cost of identifying new molecules, but it will not eliminate the most complex, value-dense stages of the drug business. Rather than becoming obsolete, Big Pharma is positioned to benefit from the AI revolution, both through internal deployment and by bringing in AI-discovered drugs via licensing deals, asset purchases and company acquisitions.

Key insights

- We expect AI will accelerate drug discovery but reinforce Big Pharma’s scale advantages in trials, regulation, and commercialization.

- Pharma valuations are at multi-year lows, with pricing and tariff risks largely cyclical.

- Investors can gain solid fundamentals today, with AI adoption offering long-term upside as a "free" option.

Why Big Pharma Still Matters

Large pharmaceutical companies generally possess durable moats that extend far beyond the early stages of discovery. Consider manufacturing and the CMC (Chemistry, Manufacturing, and Controls) framework: turning a promising molecule into a globally approvable medicine requires processes that are validated, transferable and supply-secure. These are not capabilities that small teams can easily replicate. Equally important is the ability to execute late-stage clinical trials, which involves enrolling thousands of patients across multiple countries, coordinating patient site networks, and maintaining consistent quality.

On the regulatory front, the infrastructure needed to manage safety, pharmacovigilance for adverse effects, and quality systems across dozens of jurisdictions is both expensive and slow to build. Finally, when it comes to market access, large incumbents typically have greater credibility and reach to negotiate with payers, demonstrate real-world value, and orchestrate global launches. History indicates that while breakthrough drugs often originate in biotech, commercial success typically accrues to the integrators that can manufacture reliably, file globally for approval, and bring treatments to patients at scale.

AI as an Asset Multiplier

We believe AI’s greatest potential lies in transforming the discovery phase, but the ripple effects should strengthen Big Pharma’s existing model rather than dismantle it. As AI-enabled biotech companies generate more early-stage candidates, the supply of assets available for licensing or acquisition increases. Large pharmaceutical firms, which have historically devoted a portion of their research & development (R&D) budgets to sourcing external programs, stand to benefit from this abundance. With more assets to choose from and only a handful of buyers with the resources to advance them, incumbents may be able to negotiate more favorable prices.

Moreover, if AI truly delivers higher-quality drug candidates, the probability of success for early-stage assets rises. This means large companies could see greater returns from the same level of investment, particularly when bringing in programs prior to large-scale proof-of-concept trials. The result is a scenario in which the cost of early-stage R&D declines even as its value increases, reinforcing the central role of Big Pharma as the consolidator and scale operator.

Investment Perspective: Absorb the Disruption

From an investment standpoint, we aim to identify the pharmaceutical companies that are effectively integrating AI into their operating models. The most compelling incumbents are already weaving AI into their workflows, using advanced models to design protocols, optimize site selection, detect safety signals, and manage supply chains. Many are also investing in manufacturing and device capabilities to ensure that the eventual pipeline of AI-discovered drugs can be commercialized at scale.

We evaluate progress by tracking tangible leading indicators such as reductions in development timelines, improvements in enrollment speed, inspection outcomes, and the efficiency with which companies identify and acquire external assets. In our research of the global pharmaceutical industry, we follow the AI-first drug creators that demonstrate strong mechanisms early and then partner with larger firms for the complex later stages of development. We seek to understand both the disruptive energy at the edge of the industry and the scale advantages at its center.

Valuation and Market Sentiment

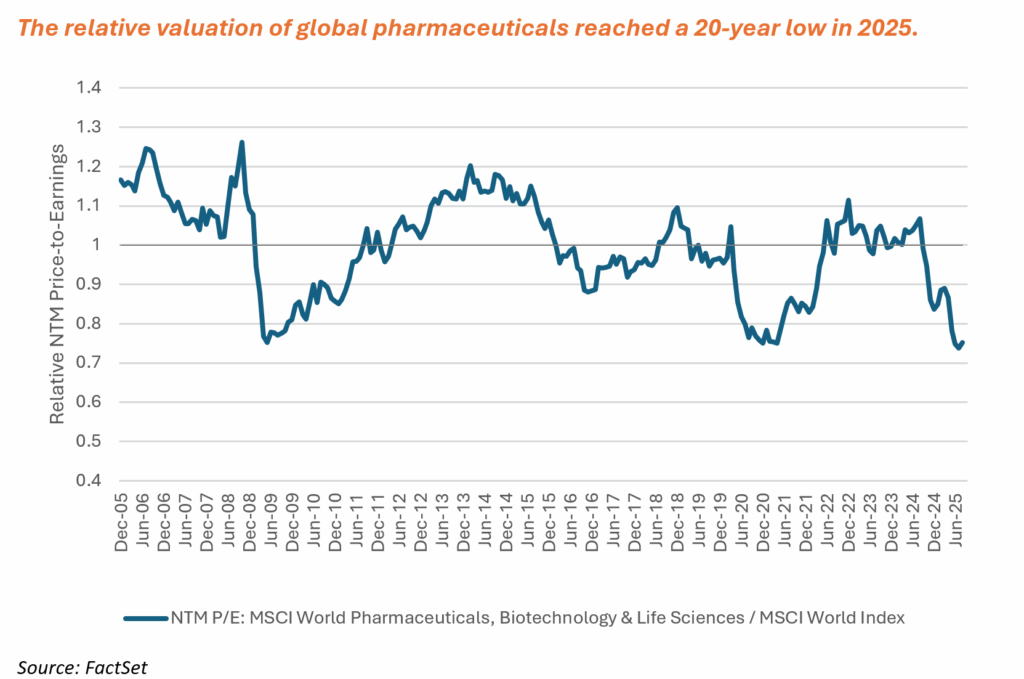

Despite these growth opportunities, pharmaceutical valuations remain depressed. This year, the average forward price-to-earnings multiple of the MSCI World Index’s Pharmaceuticals, Biotechnology & Life Sciences segment fell to its lowest level relative to the overall index in twenty years. Investors continue to focus on tariff risks—which are now fading—and recurring concerns about drug pricing, which historically flare at the beginning of new political cycles before receding into the background. R&D productivity, once a major driver of valuation, is currently a secondary concern, and AI-related improvements have not yet been incorporated into market expectations.

The result is that today’s valuations do not appear to adequately capture the potential upside from AI and may discount obsolescence risks that we consider unlikely. At these depressed levels, we see compelling upside potential, with AI offering investors an effectively “free” option layered on top of already attractive fundamentals.

Causeway Portfolio Holdings: Early AI Moves, Future Payoffs

Within Causeway’s global and international value portfolios, all the pharmaceutical holdings are making visible moves to integrate AI, though we haven’t yet seen significant tangible results. Their initiatives fall into several broad areas—drug discovery, clinical trial recruitment, and documentation efficiency—with most companies pursuing opportunities across multiple categories.

On the scientific frontiers of drug discovery and development, AstraZeneca has turned to generative AI to support its oncology research, while Roche and Genentech are investing in a next-generation AI platform that is intended to reimagine the entire drug discovery process. Novo Nordisk is also building scale in this domain, expanding its AI-driven research programs and tying them to performance-based milestones that span regulatory and commercial progress.

Another group of companies is leveraging AI to sharpen precision medicine and boost research productivity. GSK has expanded its use of AI to improve both precision medicine and broader R&D outcomes, while Biogen has centered its efforts on neuroscience and digital health. In Biogen’s case, this includes applying AI to RNA splicing, predictive modeling, and digital biomarkers in order to enhance neurological research and improve patient monitoring.

Sanofi has taken one of the most public steps by declaring an “AI-first” stance, beginning with the deployment of tools designed to improve patient trial recruitment. This focus reflects an area of immediate operational need, where AI can help accelerate enrollment and streamline the early stages of clinical development.

Several firms are also targeting efficiency gains in clinical development and documentation. Pfizer describes its approach as end-to-end, applying AI across the clinical development cycle, while Merck is deploying generative AI to streamline clinical records and support AI-driven authoring initiatives.

These are real and concrete steps, in our view, but investors must be patient: cost savings are beginning to appear, particularly in SG&A (Sales, General & Administrative) expenses, while revenue impacts will take longer to emerge given the multi-year timelines of drug development. This tension between significant near-term activity and delayed visible payoff is likely to be a common theme in AI adoption across industries. As with the broader AI narrative, much of the promise still sits in the future.

Conclusion: Evolution, Not Extinction

AI is not a death sentence for Big Pharma. Instead, it should be a catalyst for reshaping the economics of the industry, likely to the benefit of shareholders. Small biotech teams may generate more discoveries, but they should continue to rely on large incumbents to manufacture at scale, run global trials, navigate complex regulatory environments, and bring medicines to patients worldwide.

Our base case is that Big Pharma companies will evolve into AI-enabled network operators that integrate promising molecules into global medicines. Current valuations do not reflect this potential, making the sector attractive for long-term investors willing to wait for tangible outcomes. The timing mismatch—cost savings emerging first, revenue later—requires patience, but history suggests that the advantages of scale ultimately prevail.

Far from being made obsolete, we believe Big Pharma will remain the indispensable engine that turns AI-driven innovation into global healthcare reality.

This market commentary expresses Causeway’s views as of September 2025 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information. Our investment portfolios may or may not hold the securities mentioned, and the securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

The MSCI World Index captures large and mid cap representation across Developed Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. It is not possible to invest directly in an index. The MSCI World Pharmaceuticals, Biotechnology and Life Sciences Index is composed of large and mid cap stocks across 23 developed markets countries. All securities in the index are classified in the Pharmaceuticals, Biotechnology and Life Sciences industry group (within the Health Care sector) according to the Global Industry Classification Standard (GICS)

MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.