Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Prolonged punitive and widespread tariffs—especially with retaliation—threaten global economic growth. As economies weaken, cyclical sectors tend to underperform, presenting stock-specific opportunities for the patient value investor. In our view, US government stimulus has reached its limits and cannot offset tariff-related headwinds. We believe an American manufacturing renaissance in low value goods (textiles, electronics, toys, etc.) would take many years to materialize, if it occurs at all. Fifty years of complex, efficient global supply chains cannot change overnight.

While the US experiments with reordering the world’s trading system, uncertainty rises and volatility ensues. We are reminded of the delicate balance between safeguarding domestic interests and promoting a cooperative global trading system.

For Causeway International and Global Value equity portfolios, this trade war brings both opportunities and risks. We are spending more time than usual scenario planning, seeking to better understand first and second order effects of tariffs, their implications for various industries, and the portfolios’ exposure to company- and industry-specific risks.

Key insights

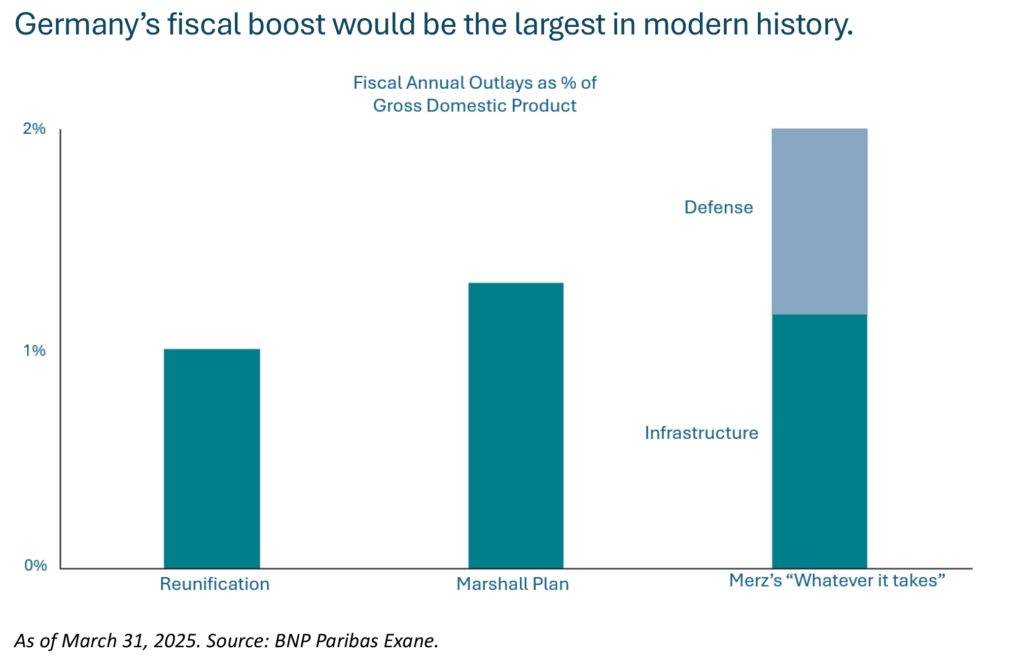

- Europe, led by an unshackled Germany, can stimulate economic growth with fiscal spending.

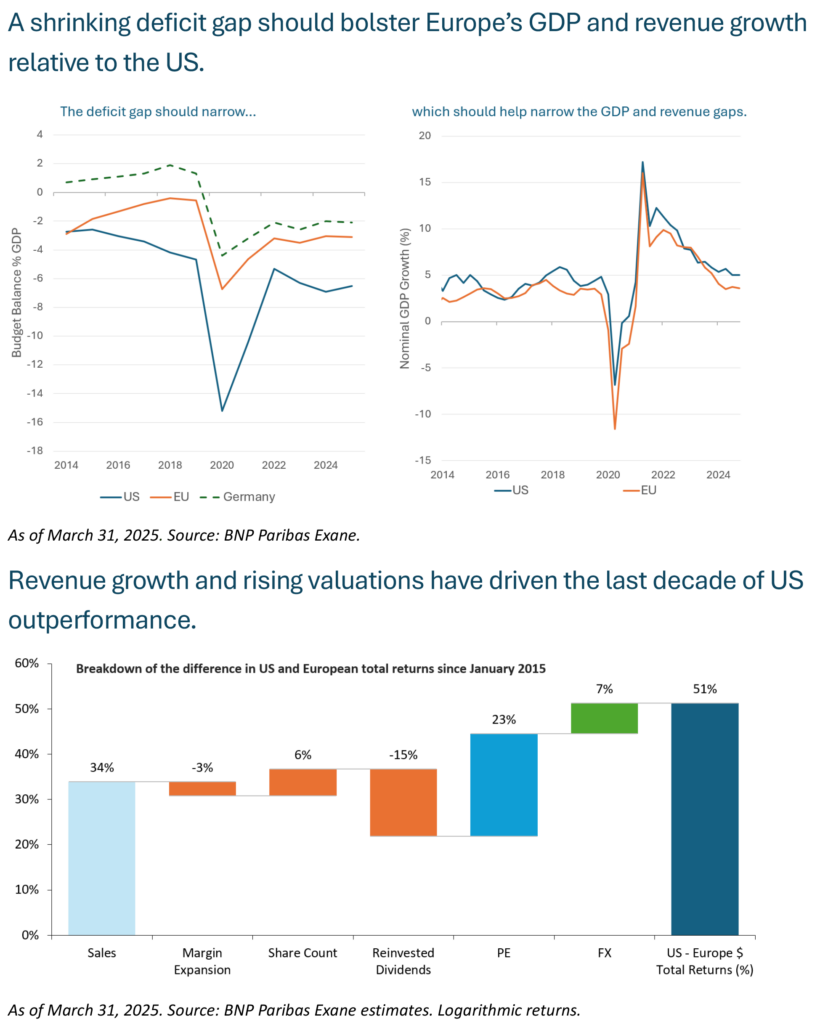

- Policies that impede US revenue growth should pressure the valuation premium of US versus non-US stocks.

- While tariff pressure looms, we believe cyclical sectors offer some of the most attractive investment opportunities.

In the next ninety days, the Trump administration may negotiate the removal of the most problematic non-tariff barriers to trade, then reward compliant trading partners with favorable deals. At the same time, we believe if US policymakers fail to lower deficits and rein in government spending stocks may suffer further. An unruly US Treasury market and rising bond yields could damage US growth and spark a credit crisis. We suggest that higher deficit spending has contributed significantly to US gross domestic product growth and stock market multiple expansion; unwinding that support may have the opposite effect.

We expect US stocks should relinquish some of the valuation premium gained over the past decade, reinforcing our caution on valuations. Meanwhile, we believe the EU must spend more on defense and infrastructure. Led by Germany, this stimulus should be deployed just as the US withdraws its own.

Stocks at the top of our risk-adjusted return ranking include select cyclicals, as their valuations already reflect expectations for a weaker economy. In early April, well-capitalized financial institutions, tariff-threatened pharmaceuticals, information technology hardware, and consumer discretionary stocks dragged on Causeway Global and International Value portfolio returns. These companies may, in our view, offer the largest upside potential in our two-year forecast period.

Looking past near-term uncertainty, we continue to favor globally competitive and innovative companies. Examples include industrial firms in duopoly or oligopoly markets and healthcare companies with pipelines of high-potential products. When we can purchase shares of these companies at recession-level valuations, our confidence in their subsequent outperformance increases.

This market commentary expresses Causeway’s views as of April 11, 2025 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

The views herein represent an assessment of companies at a specific time and are subject to change. There is no guarantee that any forecast made will come to pass. This information should not be relied on as investment advice and is not a recommendation to buy or sell any security. For full performance information regarding Causeway’s strategies, please see www.causewaycap.com.