Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Value investing’s a game of patience, and I’ve played my part

Now it’s your turn, my manager, to show me some heart.

I’ll hold for a while more, but let’s make it clear,

I need returns, or I’ll disappear.

Chatbot GPT-4’s Janet Jackson-inspired lyrics likely capture what many of our clients were thinking in 2020-2021 as massive fiscal and monetary expansion powered growth and speculative stocks, leaving value stocks in the dust. Buying undervalued stocks rarely offers instant gratification. But eventually, markets recognize earnings improvement—and share prices react. We have seen quite a reaction. After facing performance headwinds, as of June 30 Causeway international and global value equity strategies have generated twelve month returns far above their benchmark indices [1]. Some stocks we purchased during the pandemic period have performed well—but what’s next?

Key insights

- Rolls Royce and Samsung Electronics contributed to the recent surge in performance, yet we believe further improvements are not yet priced into their valuations.

- Successful restructuring candidates can, given enough time, experience substantial multiple re-ratings. We think Rolls Royce has this potential.

- Samsung Electronics, in our view, is an attractively valued way for investors to participate in the memory chip industry’s structural growth.

For equity markets to avoid losses, profit margins and valuation multiples must remain intact. That is a tall order given rising interest rates, inverted yield curves, and shrinking monetary liquidity in most global regions. Our investment team is focused on maximizing future returns, even as economic growth slows.

Consistent with our investment process, the top-weighted stocks in Causeway’s fundamentally managed client portfolios are our highest conviction holdings, equities we believe have some of the greatest risk-adjusted expected returns in our investable universe. Perhaps less intuitive is that some of these holdings already have rebounded from earlier lows, contributing to the recent surge in performance and leading some clients to ask what potential upside remains. We believe these companies have operational restructuring and cyclical upturns ahead, further improvements not yet priced into their valuations.

Causeway fundamental portfolio managers Jonathan Eng and Brian Cho discuss what may be next for the two largest-weighted portfolio holdings, as of June 30, 2023, in Causeway unconstrained international and global value equity strategies, Rolls Royce and Samsung Electronics.

Jonathan Eng: More runway for Rolls Royce

Jonathan Eng: More runway for Rolls Royce

Many of our clients will know jet engine manufacturer Rolls Royce. We have held it in many Causeway portfolios for over five years and it has been one of our top-weighted holdings since the end of 2020. The investment thesis stands on two legs, one cyclical, one structural. The cyclical recovery has driven recent share price performance. But I am most excited about the company’s restructuring improvement, which I think the market has yet to recognize.

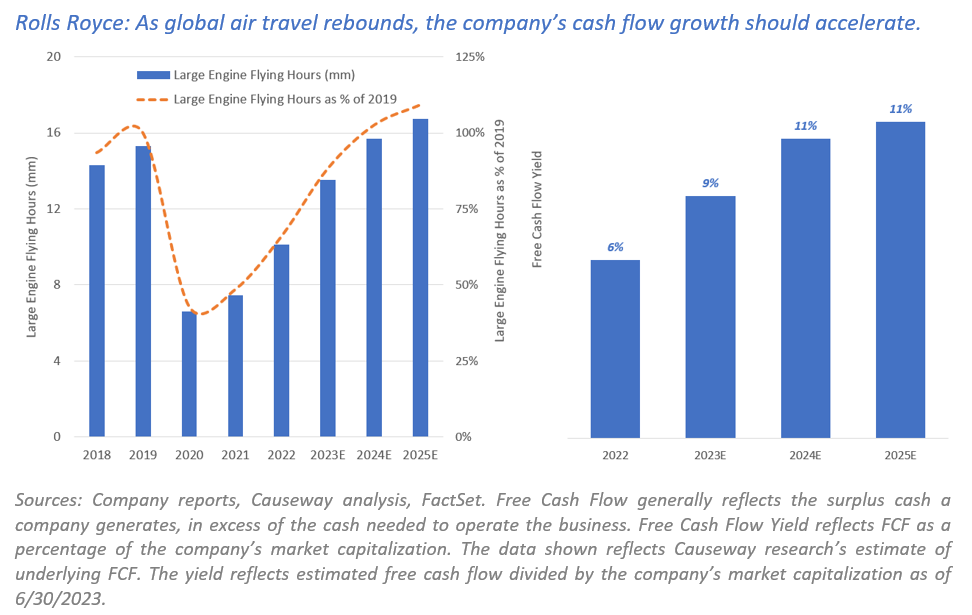

Let’s address the cyclical upturn first; it is happening now. After bleeding cash in the pandemic period, the global recovery in widebody aircraft engine flying hours (“EFH”) could lead Rolls Royce to generate up to £800 million of free cash flow this year. The market thought widebody aircraft was dead but it’s not. Flying hours are rising—widebody EFH surpassed 80% of 2019 levels and I expect they will reach at least 100% over the next couple years. People are traveling and there is growing demand, even with slowing economic activity in China. Air travel typically grows at a higher rate than gross domestic product, so even if economic growth sags, air travel may remain buoyant.

I think the most meaningful upside—and the reason why Rolls Royce is our largest holding—resides with the current management team’s multi-year operational restructuring program. Rolls finally has, in our view, both an excellent CEO, Tufan Erginbilgic, and board chair, Anita Frew. Erginbilgic, experienced in corporate turnarounds, is refocusing the company on profitability. He has committed to make Rolls more competitive, dramatically cut costs, and raise prices.

Incremental changes can transform a company’s earnings power.

I’ll give you examples: Previously, contracts were often lossmaking, to gain market share. Now, contracts and renewals are subject to return and margin requirements. For certain existing civil aerospace contracts, the company is renegotiating higher prices. Pricing also is improving in the power systems business, to become more responsive to rising raw materials costs. Management is reallocating engineers to improve “time on wing,” the hours an engine can fly before it requires servicing. Aerospace uses a lot of working capital. Over the next few years, I expect the company to release large sums of working capital and improve cash flow. By 2025, we expect the company to reinstate its dividend, adding to total return. We capitalize our estimate of 2025 free cash flow to arrive at a two-year price target that is higher than the current price.

Incremental changes can transform a company’s earnings power. For each portfolio candidate, we try to understand the earnings potential of the company and the appropriate valuation multiple. Corporate restructuring requires more patience, and the analysis gets trickier. I think the market is often too quick to sell after a cyclical upturn and misses out on the structural improvements. Successful restructuring candidates can, given enough time, be portfolio winners with substantial multiple re-ratings. I have seen it before.

Brian Cho: Samsung Electronics is supplying the “picks and shovels” for AI’s gold rush

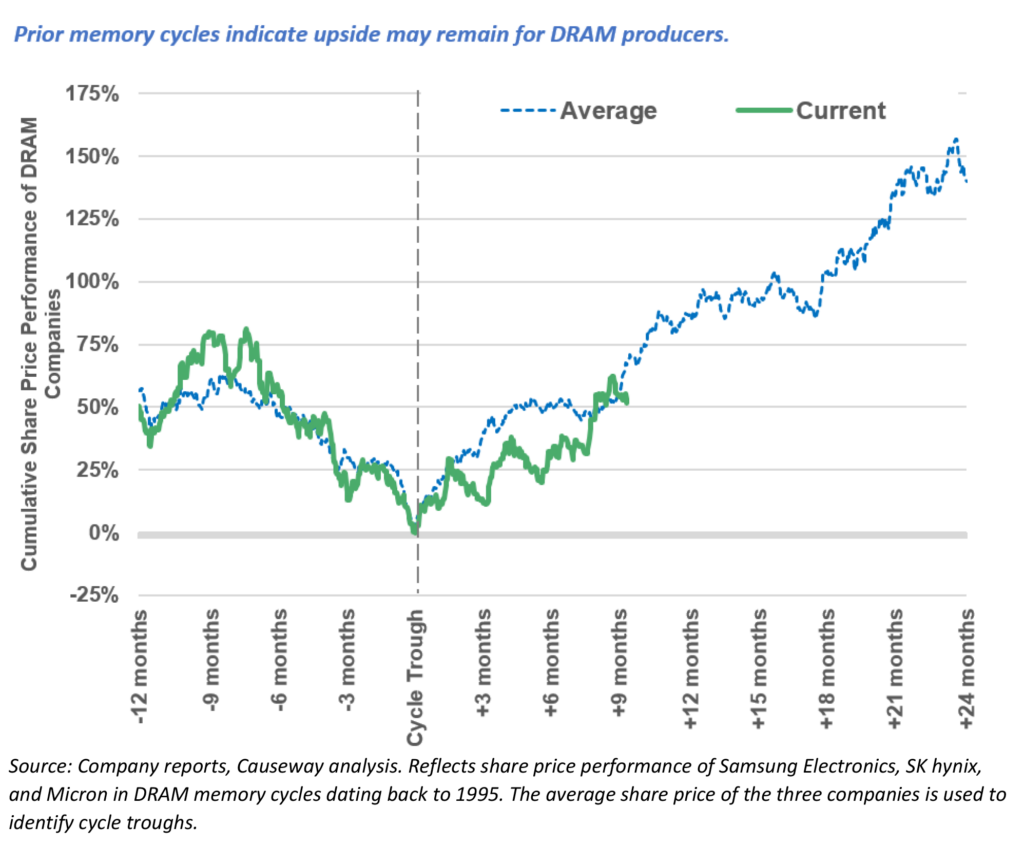

Covering technology, I am no stranger to cycles. I have spent much of my career immersed in global semiconductor cycles, which affect memory chipmaker, Samsung Electronics. Our current holding period in Samsung began in 2015, and we have traded it opportunistically since then, sizing up and down given where we believe we are in the cycle.

The memory semiconductor industry, known for its massive capital costs and boom-and-bust cycles, has generally consolidated into three dominant suppliers: leader Samsung, SK hynix (also a portfolio holding), and US-based Micron. Pandemic disruptions and subsequent inventory overstocking made this past cycle the most volatile we have seen in fifteen years. However, the three industry giants, operating in an oligopoly with high barriers to entry, have recently shown unprecedented supply management discipline. They have cut capacity by 20-30% and indicated willingness to cut further if conditions do not improve.

In addition, as supply and demand for traditional information technology end-markets like PCs, smartphones, and data centers begins to balance, we are seeing a surge in technology investment related to artificial intelligence (“AI”). Most capital is being directed toward AI servers used to train large language models. These servers consist of graphics processing unit (“GPU”) chips from Nvidia and AMD, a central processing unit chip from Intel and AMD, and many high-performance dynamic random-access memory (“DRAM”) chips, known as high bandwidth memory (“HBM”). HBM chips are critical for GPUs to ingest and process vast amounts of data with minimal latency. Samsung and SK hynix hold a dominant market share in HBM, although Micron is expected to catch up in the next few years.

As in past computing cycle transitions, semiconductors and hardware should be early beneficiaries, supplying the “picks and shovels” to build new computing capacity. We believe we are in the initial stages of AI server infrastructure build, which should continue as generative AI applications expand. More importantly, the computing power required for AI model training currently is doubling every three to four months, a substantially faster rate than the historical two-year average. DRAM supports this accelerated compute intensity, and we believe it is a key bottleneck in AI expansion. The near-term AI hype feels frothy to me, but broad adoption of generative AI should accelerate memory usage in data centers, providing a durable driver of memory unit demand for years to come.

We believe we are in the initial stages of AI server infrastructure build, which should continue as generative AI applications expand.

In addition to its memory business, Samsung maintains strong global brands for its smartphone, TV, and consumer appliance businesses, as well as foundry and image sensor segments, which in our view are still underappreciated by investors. The company has been increasing its capital return to shareholders, committing for the past several years to returning 50% of its free cash flow to shareholders (up from 0%), and increasing its dividend payment. Yet it continues to trade at significantly lower valuations compared to technology sector leaders. We are using a conservative base case of 1.4x price-to-book value multiple for 2025 and expect further upside over the next two years. To us, Samsung continues to present an attractively valued opportunity for investors to participate in the industry’s growth potential.

Uncertainty about the trajectory of interest rates and economic activity may engender volatility into global equity markets, providing fertile ground for a team dedicated to unearthing mispriced securities using a disciplined, patient investment approach. The two largest-weighted holdings in fundamental client portfolios demonstrate our belief that our investment process can add value on a stock-by-stock basis, even amid a more cautious outlook for global equities generally. These portfolio holdings have benefitted our clients lately…and we believe there can be more to come.

[1] For current performance information over various periods, please see Causeway Capital Management: Strategies

This market commentary expresses Causeway’s views as of July 2023 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

The views herein represent an assessment of companies at a specific time and are subject to change. There is no guarantee that any forecast made will come to pass. This information should not be relied on as investment advice and is not a recommendation to buy or sell any security. The securities identified and described do not represent all of the securities purchased, sold, or recommended for client accounts. Our investment portfolios may or may not hold the securities mentioned. The reader should not assume that an investment in the securities identified was or will be profitable. For full performance information regarding Causeway’s strategies, please see www.causewaycap.com.

Past performance is no guarantee of future performance. International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Please see https://www.causewaycap.com/wp-content/uploads/Risk-Disclosures.pdf for additional information on the risks of investing using Causeway’s strategies.

Jonathan Eng: More runway for Rolls Royce

Jonathan Eng: More runway for Rolls Royce