Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

In the liminal space between “value” and “growth” hide underearning companies we believe have some of the greatest return potential in today’s challenging global equity markets.

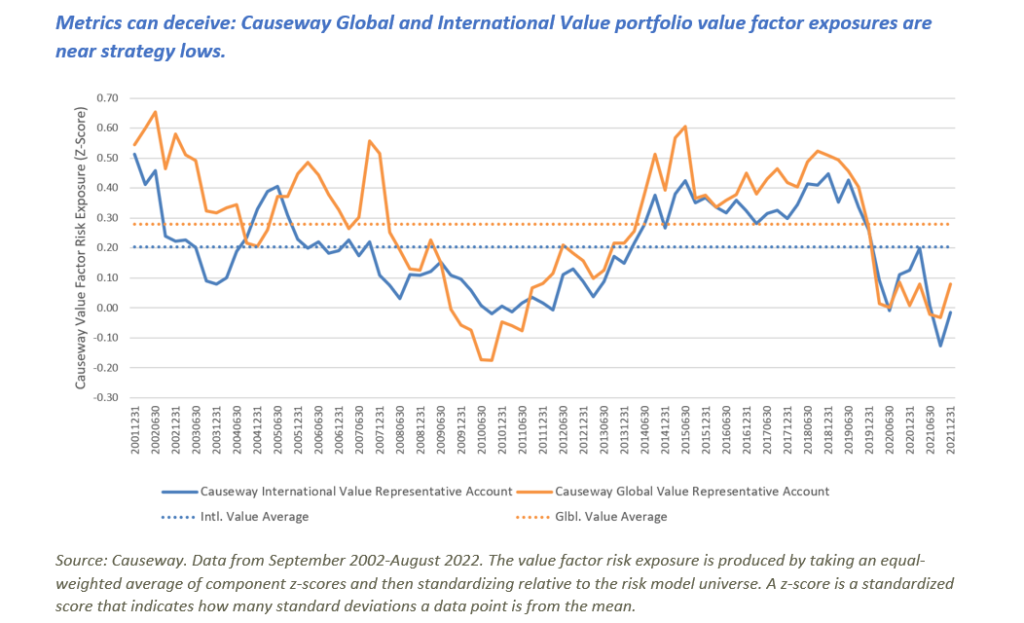

Causeway focuses on valuation. Clients invested in our global and international equity strategies expect us to apply our disciplined value approach to equity markets across cycles, regardless of trends. Why then, just as sobriety has gripped the priciest of stocks, are Causeway’s value risk factor exposures of these portfolios at such low levels?

We have not abandoned our value philosophy. Now would be a strange time to “style drift,” having adhered to our process for the past decade-plus in growth-obsessed markets. Rather, we appear underexposed to value because some of the most compelling global equity investments are underearning companies that confound metric-based value analysis. We believe these beleaguered companies have some of the largest recovery-inspired risk-adjusted returns of any value stocks—much more than companies at peak profitability in this economic cycle.

“Too expensive for mechanical value strategies and too established to attract go-go growth investors, style investors of each ilk can neglect these underearners.”

Companies in recovery mode generally appear expensive on valuation ratios using earnings or cash flows in their denominators. Many businesses managing through more severe earnings setbacks have reduced or paused capital return to shareholders, their paltry dividend yields falling short on yet another mainstay value metric.

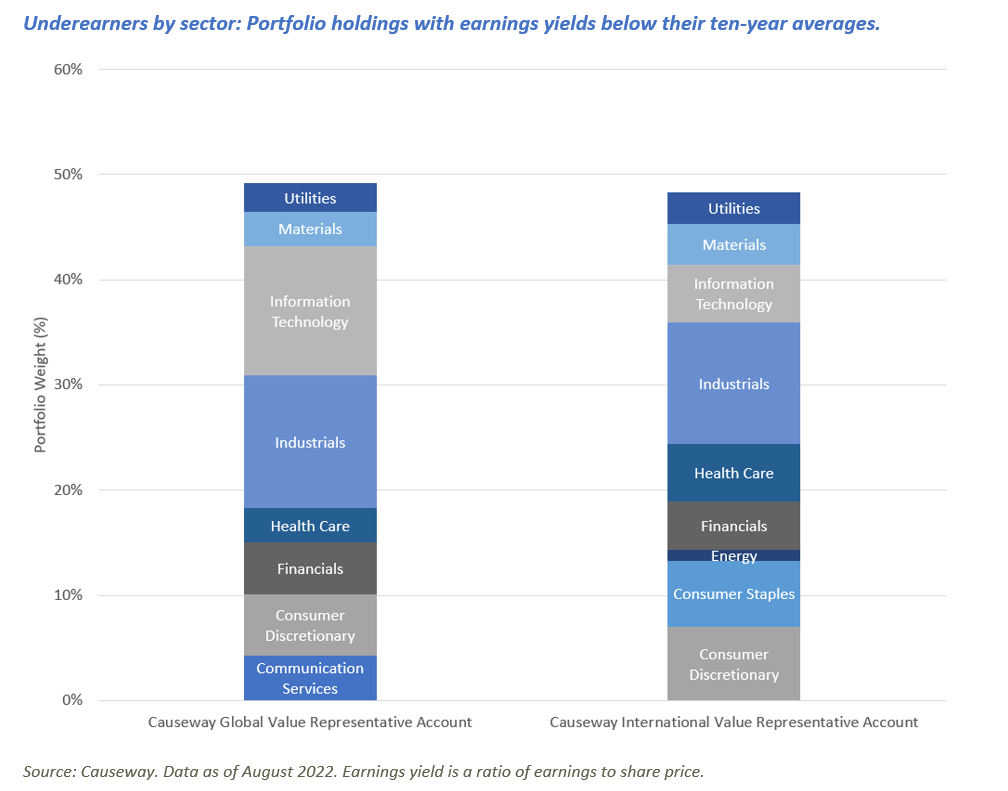

As of end-August 2022, seven of the ten largest-weighted (i.e., highest conviction) holdings in Causeway international value portfolios, and six of the top ten in Causeway global value portfolios have negative value scores in our risk model. Portfolio-wide, the earnings yields of nearly 50% of Causeway global and international value holdings are currently below normalized levels. Too expensive for mechanical value strategies and too established to attract go-go growth investors, style investors of each ilk can neglect these underearners, despite, in our view, their promising upside.

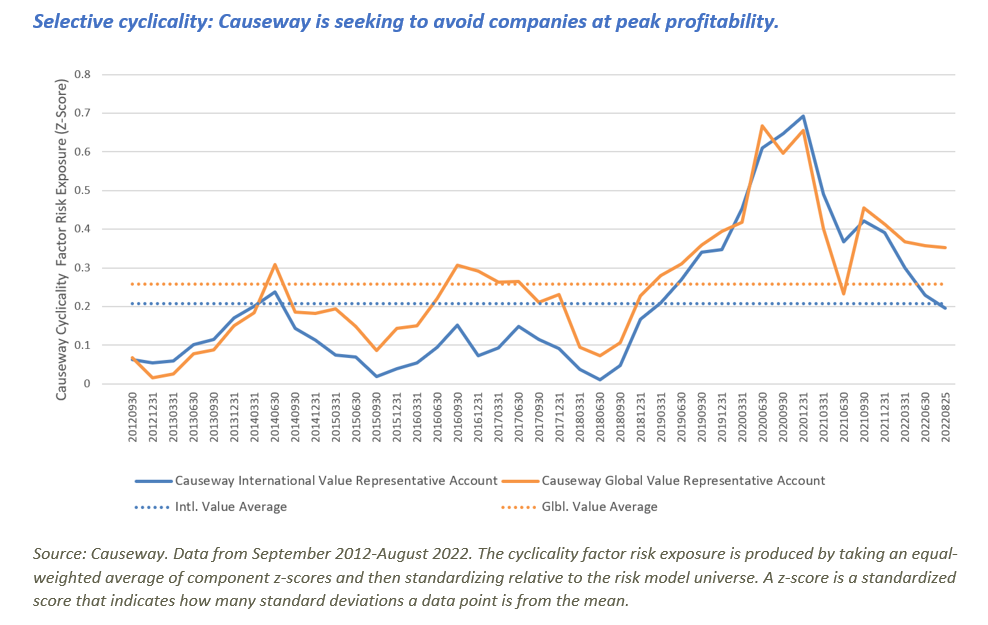

Underearning generally occurs most frequently in cyclical industries. As gross domestic product growth decelerates or even reverses, profits shrink for the most economically sensitive companies. At the bottom of the economic cycle, valuation multiples often appear high relative to history and broad markets. Portfolio manager Jonathan Eng, who leads Causeway’s fundamental research in the industrials and energy sectors, is accustomed to this phenomenon. “A cyclical stock can appear most expensive at its best entry point. As a value investor, you must understand the timing of a company’s earnings cycle.” As the economic cycle crests and earnings peak, many overearning companies exhibit low valuation multiples (absolute and relative to their history).

“With cyclicals, it really is about taking a contrarian approach.”

A cyclical stock in a booming economy can appear to be a lagoon in a broiling desert. But it is a mirage. For example, some of the largest constituents in value indices today are oil & gas majors. Unsurprisingly, earnings for these companies are inextricably linked to oil & gas prices. Peak commodity prices will make these stocks appear especially undervalued. Passive investors seeking to replicate the value indices may own large exposures to these stocks precisely as earnings peak and valuation multiples rise, finding themselves left holding hot sand. Portfolio manager Conor Muldoon, responsible for Causeway’s fundamental commodities research, says, “Value benchmarks generally are not using normalized earnings. Using these longer-term earnings averages, a company can appear much more expensive. With cyclicals, it really is about taking a contrarian approach.”

Quantitative portfolio manager Arjun Jayaraman is observing some potentially unreliable metrics in emerging markets equities as well, particularly in cyclical businesses like shipping. “In cases where traditional cross-sectional value measures indicate that a stock looks cheap, we also are reviewing self-relative valuation—how cheap a company appears relative to its history,” he says. Rather than rely on a few simple metrics, Causeway’s quantitative emerging markets and international small cap strategies use a multi-dimensional framework of value, growth, and momentum analysis to better understand a company’s alpha potential.

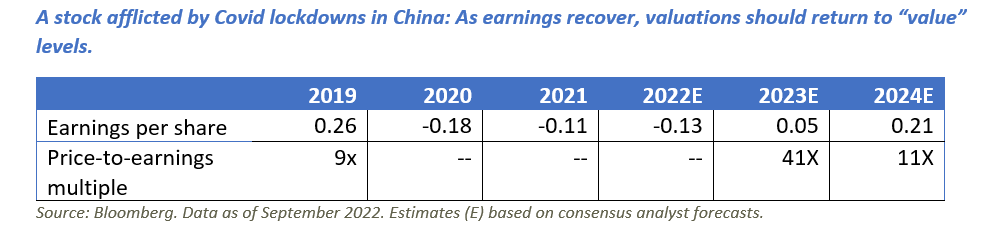

Many of the stocks scoring poorly on Causeway’s value factor are still recovering from pandemic repercussions, including China lockdowns, supply chain constraints, and labor shortages. Portfolio holdings where we have identified better earnings recovery potential have significant exposure to China, where the zero-Covid policy is wreaking havoc on the free movement of goods, not to mention disrupting global travel. These holdings include world class firms in aerospace, rail equipment/signaling, travel-related software, media & entertainment, and financial services/life insurance. Take, for example, a casino operator Causeway portfolio managers purchased for unconstrained international value client portfolios in July 2020. To us, this was—and remains—a value buy. Despite leading a large oligopolistic gaming market, its shares trade at Covid-depressed lows. By traditional value metrics, the stock appears expensive. Its earnings turned negative in 2020 and, that same year, it suspended its annual dividend to conserve capital. A stock like this exposes the caprices of style index construction: the company fundamentals remain largely unchanged, but over a span of less than five years MSCI reclassified the stock from growth to value to growth again, moving it in and out of the relevant style indices. “We believe certain China lockdown-afflicted stocks can return to pre-Covid levels of profitability, and possibly higher,” says fundamental portfolio manager Alessandro Valentini. “To us, a China-reopening is the light at the end of the tunnel for some late-Covid recovery stocks.”

The execution risk of a company regaining prior levels of profitability as constraints ease may be considerably lower than achieving unprecedented levels of growth. Of course, if the business has changed materially for the worse, all bets are off for a rebound in profits. Careful research aims to weed out the permanently impaired from those that can recover, sometimes stronger and more profitable than ever. Although our quantitative risk model cannot discern the reason for a reversal in company fortunes (we rely on our fundamental analysts for that), we remain loyal to its underpinning philosophy of diversification. As monetary conditions continue to tighten in most countries, shrinking liquidity and rising bond yields likely spell trouble ahead for stock markets.

“We rely on our financial strength criteria to give the underearners time to resolve their setbacks and return to more normal levels of profitability and cash flow.”

We rely on our financial strength criteria to give the underearners time to resolve their setbacks and return to more normal levels of profitability and cash flow. For diversification, we supplement the underearners with economically defensive stocks, in sectors including healthcare, consumer staples, and utilities. We believe the combination of underearners plus companies that can deliver consistent earnings and cash flow growth over the next several years, provides portfolio return ballast and meaningful upside potential.

This market commentary expresses Causeway’s views as of September 2022 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

Causeway’s risk model analyzes multiple factors for each holding (excluding certain portfolio ETFs, fixed income, and commodities and other derivatives) to calculate an account’s style exposures, forecast an account’s volatility, forecast an account’s tracking error, and forecast an account’s beta.

The Causeway Emerging Markets strategy uses quantitative factors that can be grouped into eight categories: valuation, growth, technical indicators, competitive strength, macroeconomic, country, sector, and currency. The Causeway international small cap strategy uses quantitative factors that can be grouped into six categories: valuation, earnings growth, technical indicators, competitive strength, macroeconomic, and country. “Alpha” means performance exceeding the benchmark index.

MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.