Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Growth stocks have outperformed value stocks since the global financial crisis, resulting in the widest valuation gap between the two styles in decades. What could cause this phenomenon to reverse course in favor of value stocks? In Part II of our Rationalizing the Irrational series, we highlight two industry groups, banks and telecommunication services, which we believe present compelling valuations and potential for outperformance. In order to capture high dividend yields and participate in a recovery rally, we recommend owning value now.

These are odd times in global stock and bond markets. In equities, as we explained in our July newsletter, since the market trough of the global financial crisis (“GFC”) in March 31, 2009, valuation multiples for growth style indices have climbed, increasing to a Grand Canyon-sized differential versus multiples for value style indices. This chasm reflects a market preference for growth earnings over value earnings. Surprisingly, during this post-GFC period, stocks in non-US value indices have delivered more earnings growth than stocks in “growth” indices and kept pace with earnings growth rates in the US market. Some of the steepest multiple increases have come from companies expanding their revenues in excess of the competition, but delivering minimal, if any, earnings. As interest rates have fallen and economic growth has slowed, investors have indicated a clear preference for sales growth. Apparently, they will pay whatever it takes to get that exposure – in other words, Growth at Unlimited Prices (or GULP).

Key insights

- No rate rises required: European banks have used this past decade to streamline operations and boost earnings and capital positions, yet still offer cheap valuations and high dividend yields

- An overlooked defensive segment: telecommunication services companies are attractively valued, with high quality assets and favorable competitive dynamics

- In order to capture high dividend yields and participate in a recovery rally, we recommend owning value now

What could cause this phenomenon to reverse course in favor of value stocks? The extreme divergence suggests that deeply undervalued stocks could rebound robustly. In Part II of our Rationalizing the Irrational series, we explore two industry groups, banks and telecommunication services, which we believe present compelling valuations and potential for outperformance.

Although ultra loose monetary policy may hinder bank revenues, their earnings outlook is generally more sanguine.

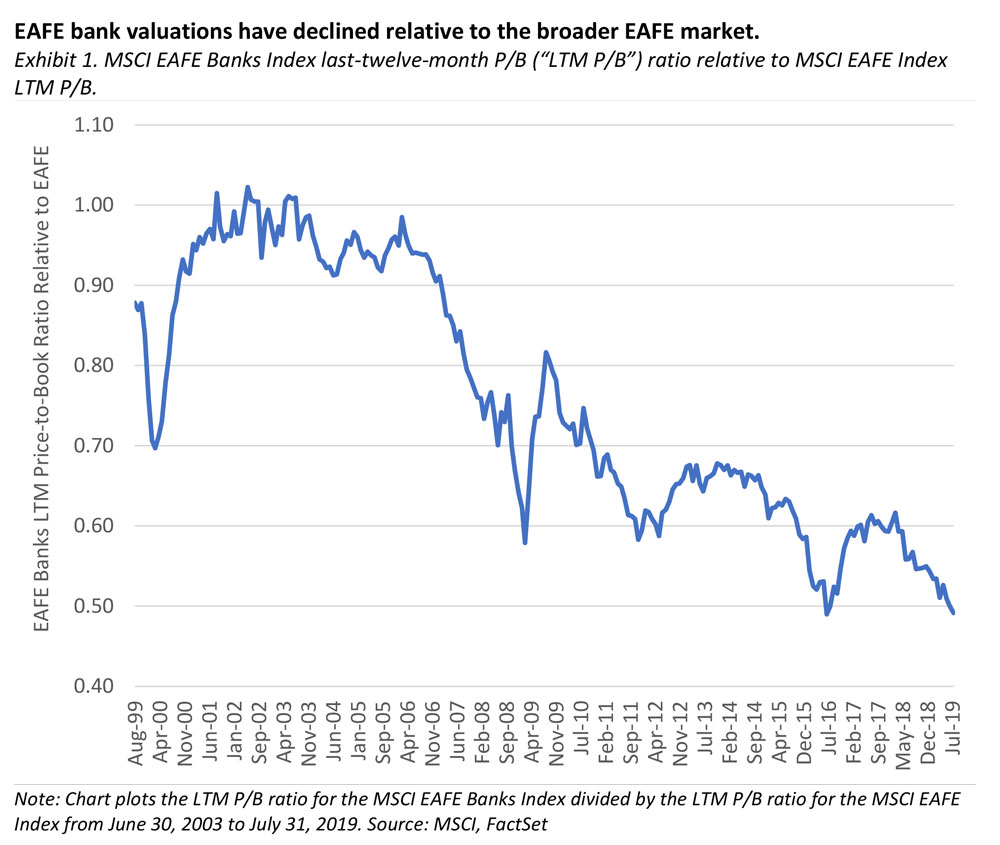

Financials have been one of the largest detractors from performance for the value style indices in recent years. Investors seem to be asking – why invest in banks when they struggle to expand revenues in a climate of falling interest rates and declining net interest margins? Although ultra loose monetary policy may hinder bank revenues, their earnings outlook is generally more sanguine. Most banks have used this past decade to streamline operations and boost their earnings and capital ratios. Controlling what they can, competent bank management teams have cut costs feverishly and repaired balance sheets. However, valuation multiples have stagnated. Many bank stocks’ price-to-book (“P/B”) multiples have de-rated from the GFC trough to present, with Japan and Europe leading the pack downward.

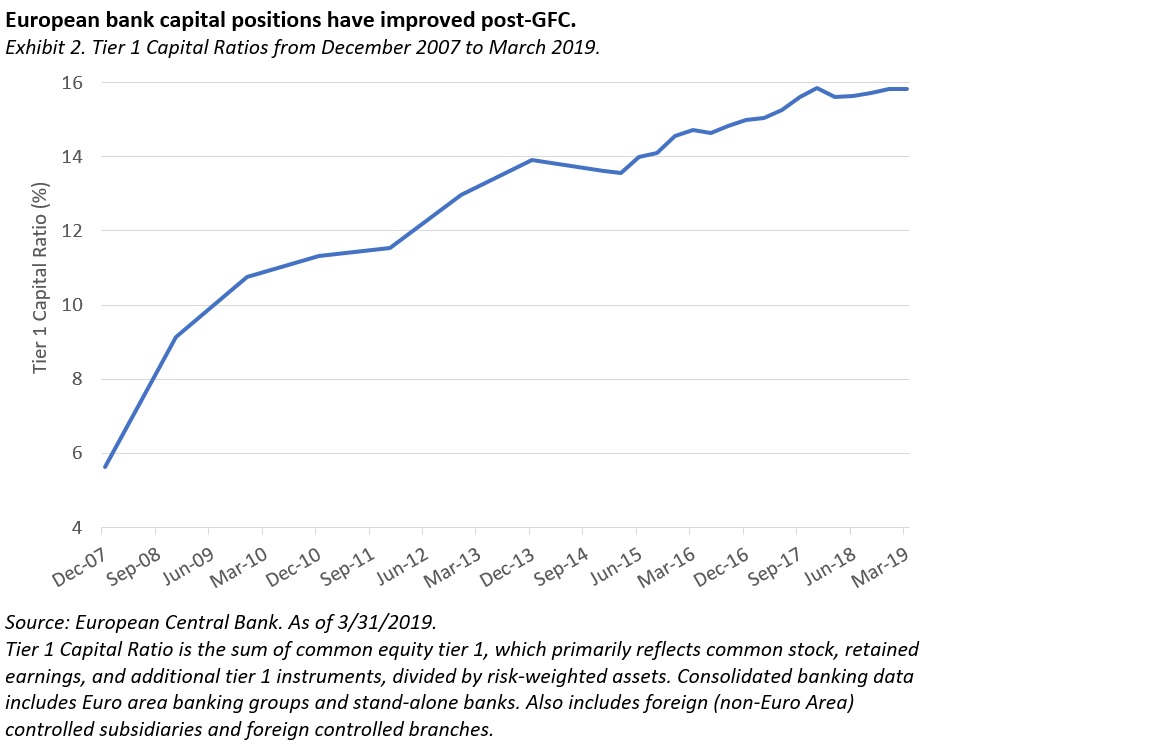

Ironically, in 2008, banks typically had inadequate capital ratios and demonstrably riskier loan books than they do today. European banks have significantly improved their tier 1 capital ratios post-GFC, which increased from 5.6% in December 2007 to 15.8% in March 2019.

We have observed a de-rating of P/B multiples for banks in our international and global value portfolios, with what looks like financial Armageddon priced into their valuation multiples, despite materially improved capital positions. Many of these enduring institutions currently trade as if they won’t earn a return even half of their cost of capital.

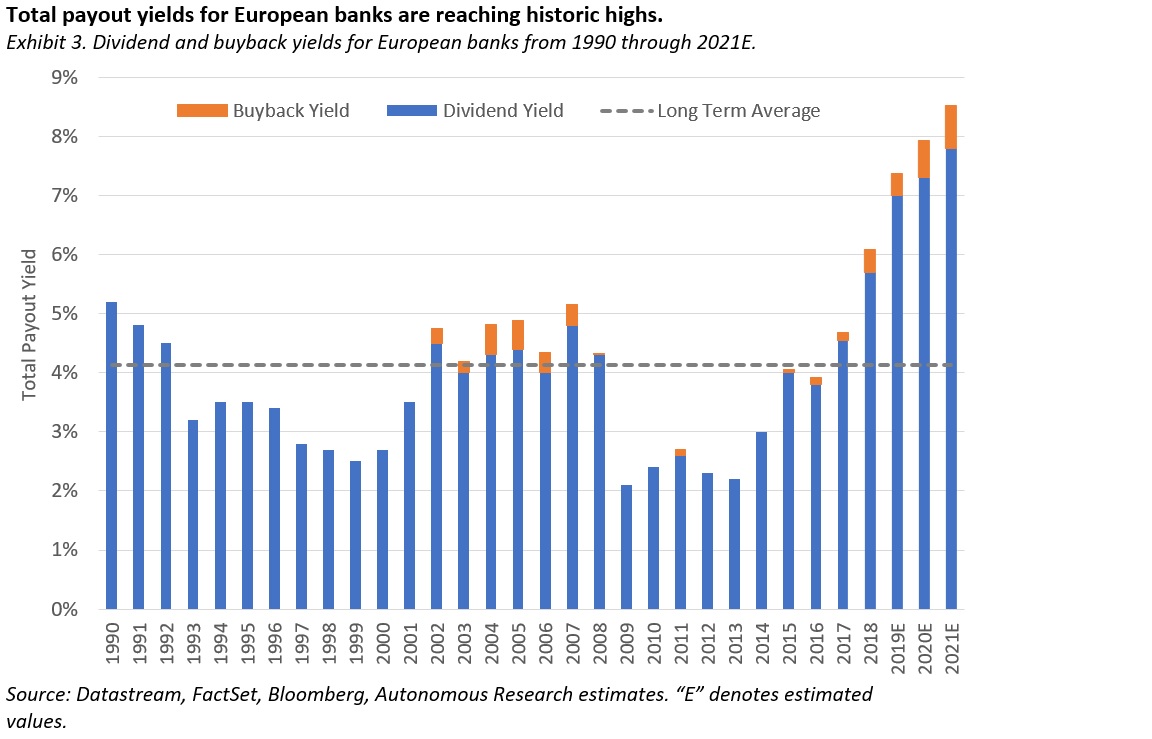

In addition to improving capital positions, bank management teams are returning capital to shareholders via dividends and buybacks.

We believe the most undervalued of the banks are listed in Europe. In addition to improving capital positions, bank management teams are returning capital to shareholders via dividends and buybacks. As a result, total payout yields for European banks are reaching historic highs (Exhibit 3). In recent quarters, we have added significantly to portfolio weight in several of what we believe to be the better managed of these banks.

In the communication services sector, telecommunication stocks have typically suffered from recent revenue headwinds and valuation multiple compression. In Asia, we note that select telecommunication stocks in three-player markets offer abundant financial strength and sufficient surplus cash to sustain 4% plus dividend yields, but they trade at low single digit multiples on earnings and cash flow. We highlight a major European telecommunications stock –which sunk to a 52-week price low in May of this year – that announced the potential partial sale of its cell phone tower assets last month. The company’s share price soared 19% in local currency terms in one week. Trading at roughly 5x enterprise value to earnings before interest, tax, depreciation and amortization (“EV/EBITDA”) in late July, we consider this stock to be a bargain versus the listed US and European cell phone tower companies trading at 20-25x EV/EBITDA. This telecommunication company’s overlooked tower assets could represent a quarter or more of the company’s entire market capitalization. In a “break up” analysis, one typical form of fundamental analysis, this stock has considerable upside potential. In contrast with fundamental analysis, momentum-driven investing strategies don’t “see” hidden assets, and are not designed to incorporate them into estimates of potential returns.

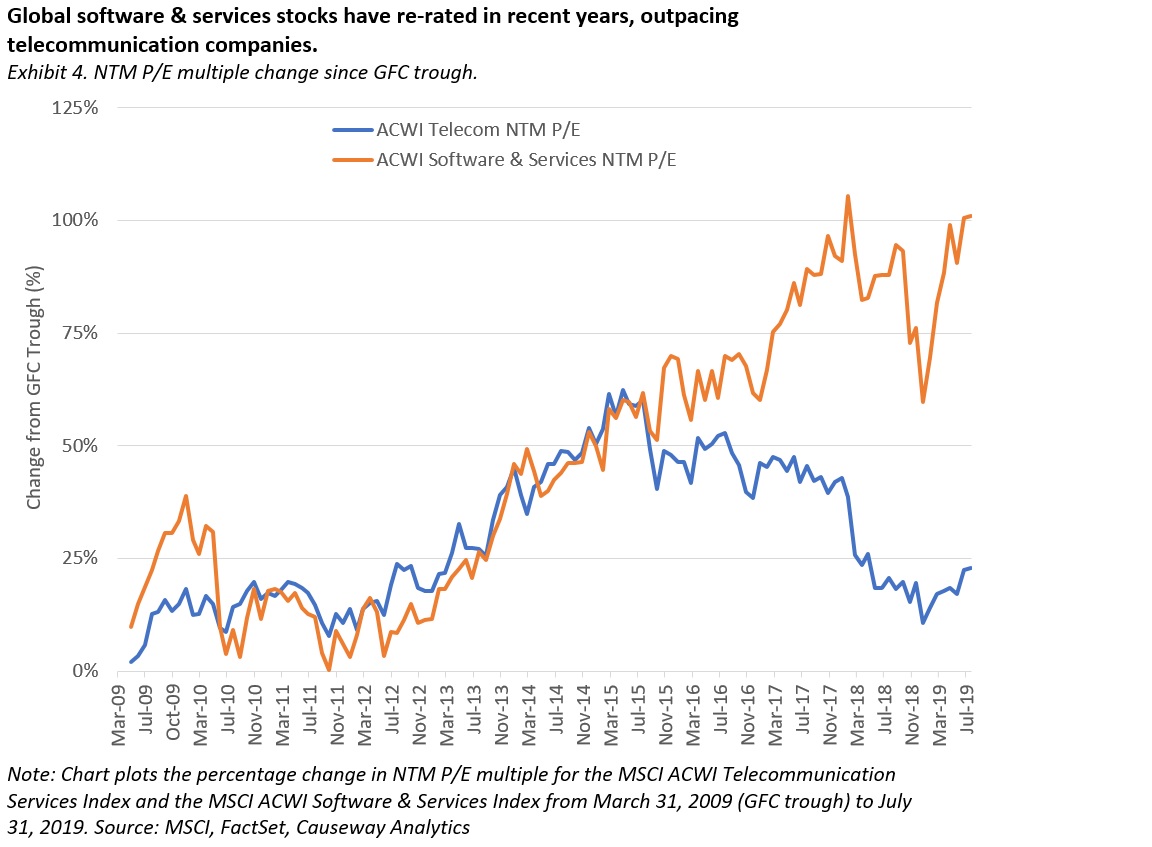

While the telecommunication stocks struggled to get noticed, software and internet stocks have dominated valuation re-rating and price momentum.

As we explored in our July newsletter, falling interest rates have contributed to growth’s upward re-rating. Will interest rates in the developed world stay low – or negative – for many years ahead? Shall we simply capitulate and assume that the time value of money (aka the discount rate) has shriveled to practically nothing? Or worse, that “negative is the new normal”? In open economies with free trade and immigration, we find it unlikely that wealthy, aging populations have a negative “time preference” with no need for positive interest rates to compensate them to forego current consumption to save the future. We view negative interest rates as a sign of impending economic stress (recession), and the subsequent economic recovery should favor cyclical stocks (those sensitive to economic growth).

In recent years, growth and momentum investing popularity, as well as speculation on exciting revenue growth stocks, have thrived in markets flooded with both liquidity and computing power. But high valuations imply high expectations, and thus are vulnerable to shocks. The narrow leadership in the growth market also suggests that the recent pro-growth trend could reverse quickly. Led by Apple and Amazon, five stocks are responsible for 12% of the MSCI World Growth Index’s cumulative return from the GFC trough in March 2009 through July 31, 2019. If a change in the competitive landscape, increased regulatory scrutiny, or other factors negatively impact the outlook for a few of these stocks, the effect on the growth universe could be material.

Given the extreme divergence in valuation, any swing in momentum to deeply undervalued stocks could become a major rotation.

What could be the other catalysts for a convergence of low volatility/defensives/growth and value/cyclical/unpopular stocks? Given the extreme divergence in valuation, any swing in momentum to deeply undervalued stocks could become a major rotation. We believe that passive and quantitative trend trading strategies have played a significant role in the rise of valuations exceeding underlying fundamentals. Momentum has a record of sharp reversals, which could lead to demand for the cyclical laggards and, more broadly, stocks with low P/E and P/B ratios. While the timing of a value rally cannot be predicted, once this chain reaction occurs, it will be too late to buy value. In order to capture high dividend yields and participate in a recovery rally, we recommend owning value now.

This market commentary expresses Causeway’s views as of August 2019 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

The MSCI EAFE Index is a free float-adjusted market capitalization weighted index, designed to measure developed market equity performance excluding the U.S. and Canada, consisting of 21 stock markets in Europe, Australasia, and the Far East. The MSCI EAFE Banks Index includes all companies within the MSCI EAFE Index that are classified as banks according to MSCI’s Global Industry Classification Standard.

The MSCI ACWI Index is a free float-adjusted market capitalization index, designed to measure the equity market performance of developed and emerging markets, consisting of 23 developed country indices, including the U.S, and 24 emerging

market country indices. The MSCI ACWI Telecommunication Services Index includes all companies within MSCI ACWI Index that are classified as telecommunication services according to MSCI’s Global Industry Classification Standard. The MSCI ACWI Software & Services Index includes all companies within MSCI ACWI Index that are classified as software & services companies according to MSCI’s Global Industry Classification Standard.

The MSCI World Index is a free float-adjusted market capitalization weighted index, designed to measure developed market equity performance, consisting of 23 developed country indices, including the U.S. The MSCI World Growth Index captures large and mid cap securities exhibiting overall growth style characteristics across 23 Developed Markets countries. The growth investment style characteristics for index construction are defined using five variables: long-term forward EPS growth rate, short-term forward EPS growth rate, current internal growth rate and long-term historical EPS growth trend and long-term historical sales per share growth trend.

These MSCI indices are gross of withholding taxes, assume reinvestment of dividends and capital gains, and assume no management, custody, transaction or other expenses. It is not possible to invest directly in an Index.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.