Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Following today’s major COVID-19 vaccine announcement from Pfizer and BioNTech, we have summarized the key insights from our research team. Resolving the current healthcare crisis will be critical in sustaining a value recovery and today’s news was a significant milestone. As we ultimately exit the COVID-19 crisis, we believe our positioning in well-managed cyclical stocks should benefit our clients’ portfolios.

Update On COVID-19 Vaccines: A Major Breakthrough For mRNA Technology

November 9, 2020

- As we communicated to our clients from late summer this year, we expected at least one vaccine to receive Emergency Use Authorization (EUA) approval in the fourth quarter of 2020.

- Rising infection rates in the US and Europe have accelerated the vaccine trial data needed to prove efficacy.

- The 90% efficacy rate announced in the Pfizer/BioNTech (PFE/BNTX) vaccine trial – with media reports indicating no apparent safety concerns in the 40,000-person trial – has exceeded our more optimistic expectations. Given this data, we believe the FDA will likely grant EUA approval by early December.

- Reports also indicate potential production of up to 50 million doses by year end, and up to a further 1.3 billion doses in 2021. Each patient would receive two doses.

- Timing for full approval will likely need to wait for the full six-month safety data, targeted for March 2021, implying full approval in first quarter of 2021 or early in the second quarter at the earliest. However, we see no theoretical limit to the number of patients who can receive a vaccine under an EUA; we believe the initial constraining factor may end up being early manufacturing supply and distribution logistics.

- We view these positive results as a validation of the mRNA technology, implying Moderna’s (MRNA) Phase 3 COVID-19 vaccine may also deliver positive results, with data expected in November. Moderna has publicly stated it intends to file for EUA in late-November and provide supply/distribution details shortly after the filing.

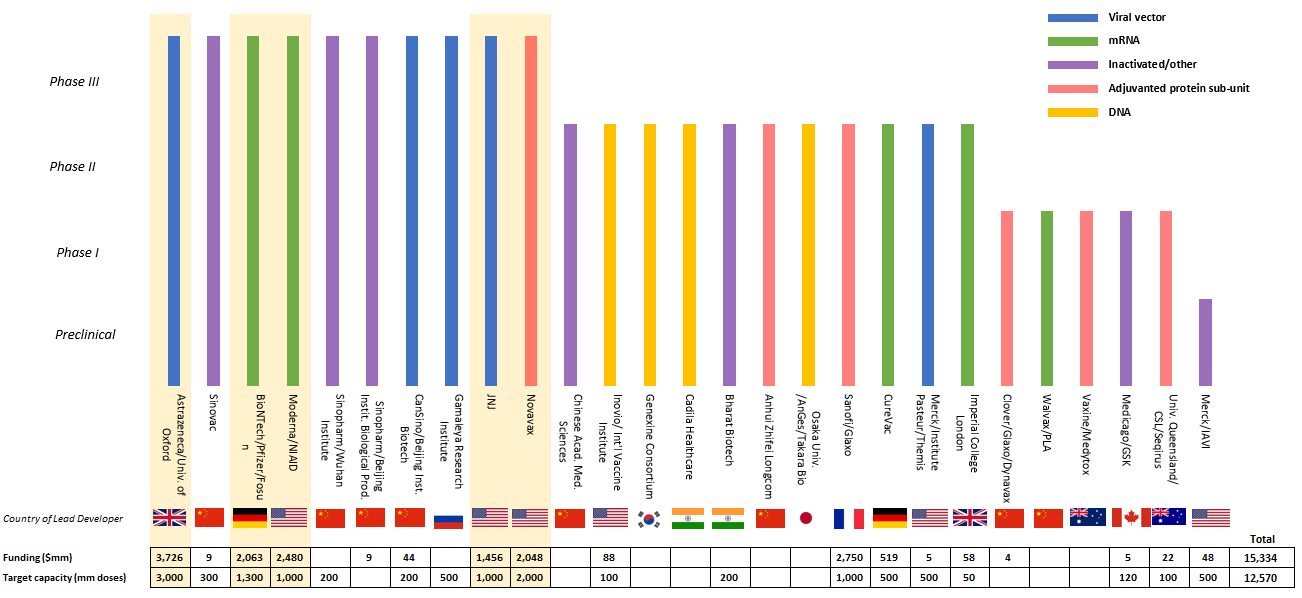

- Although mRNA vaccines currently appear the frontrunners, other vaccine technologies are working their way through trials including adenoviral vector, adjuvanted protein subunit, DNA and inactivated vaccines. Note that at least seven of the major US and European COVID-19 vaccines have received funding from the Biomedical Advanced Research and Development Authority (BARDA) as part of the US Operation Warp Speed program.

- Other major vaccine platforms have observed similar levels of antibodies and T cell responses, boding well for vaccines from others.

- We expect the combined production of the five major vaccine candidates in phase 3 (highlighted below) to total over eight billion doses in 2021, which would cover nearly five billion people (some vaccines require two per person; others are only one dose per person).

The figure shows all vaccine candidates that are currently in human clinical trials or those whose sponsors have received US government funding via the Biomedical Advanced Research and Development Authority (BARDA) as of September 30, 2020. Sources: Exane BNP Paribas, World Health Organization, and public filings.

- As we move into 2021, treatments including targeted antibody therapies should also become more widely available, we believe, mitigating the severity of the virus until vaccines are available.

- We believe the optimal portfolio positioning for these medical breakthroughs is extremely undervalued cyclical stocks, as their share prices exhibit the most sensitivity relative to overall markets to an economic recovery.

Our investment portfolios may or may not hold the securities mentioned, and the securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. This market commentary expresses Causeway’s views as of November 9, 2020 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy or completeness of such information.