Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

March 18, 2020

Ryan Myers, Senior Quantitative Research Analyst

Fusheng Li, Senior Fundamental Research Analyst and Head of China Research

Amid the market panic over coronavirus, China, which accounts for more than 35% of the MSCI Emerging Markets Index, has notably outperformed other emerging and developed markets in 2020 (through March 18). We currently believe China is ahead of other countries in COVID-19 virus containment, and the government is deploying significant monetary and fiscal stimulus to cushion the economic impact.

China may also provide a useful guide in the search for a market bottom in developed equity markets.

Key insights

- It is encouraging that many developed market countries have now realized that China-style “lockdown” initiatives have worked well at slowing the spread of the virus.

- We currently expect new European cases to peak in approximately three weeks, and new US cases to peak in three to four weeks (by mid-April) assuming their lockdown procedures are effective.

- Stock markets have typically anticipated economic recovery well before the upturn in gross domestic product growth, and should, based on our experience, improve coincident with the peak of the virus outbreak.

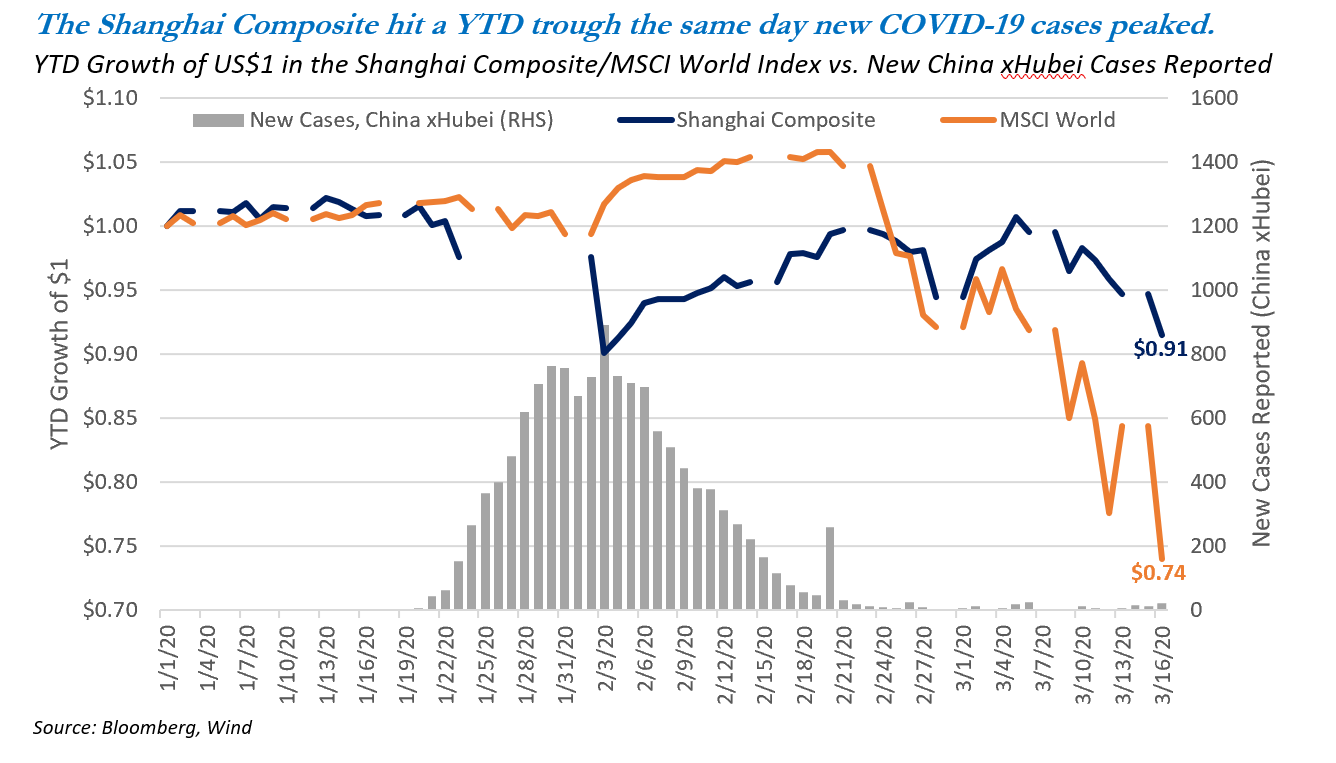

As the chart below demonstrates, the Shanghai Composite reached a year-to-date (YTD) trough on February 3, the same day it reported the highest number of new cases outside of Hubei province. The Chinese market behaved very similarly during the SARS outbreak in 2003, with stocks rallying once new cases peaked.

Isolation measures have shown the ability to slow the rate of new cases below exponential growth, at which point a peak in new cases is close at hand.

It is encouraging that many developed market countries have now realized that China-style “lockdown” initiatives have worked well at slowing the spread of the virus. Based on our analysis of virus growth rates by country, we observe that early on, new COVID-19 cases (a leading indicator for total cases) initially grew faster than exponential growth rates. Isolation measures have shown the ability to slow the rate of new cases below exponential growth, at which point a peak in new cases is close at hand, and the total number of confirmed cases can be fairly accurately modeled.

Cases in China (outside of Hubei province) peaked 10 days after China’s lockdown began. In Europe, Italy began an initial lockdown on March 10 and is likely to adjust measures to further increase social distancing; France and Spain started lockdowns on March 14; Germany adopted lockdown measures March 18; and the UK is likely to adopt similar requirements within the next few days. In the US, seven San Francisco Bay-area counties have already initiated lockdown procedures (“shelter-in-place”), and other metropolitan areas are likely to follow shortly. Based on these timelines, we currently expect new European cases to peak in approximately three weeks, and new US cases to peak in three to four weeks (by mid-April) assuming their lockdown procedures are effective. On the date of writing (3/18/2020), it is instructive to note that equity markets in China, Italy, and Spain outperformed most other global equity markets. This is likely partially attributable to those countries’ positions further along the virus growth curve, where new cases have either peaked or appear likely to peak in the near future.

Indiscriminate selling this year has shrunk stock markets to levels that we believe offer some of the greatest upside potential since the Global Financial Crisis.

We believe the current market weakness, accentuated in industries considered most virus-prone, provides us with a rare opportunity to upgrade fundamental client portfolios into companies with, in our view, excellent management teams, defensible franchises, and potentially higher terminal growth rates than some of our recent sells. Indiscriminate selling this year has shrunk stock markets to levels that we believe offer some of the greatest upside potential since the Global Financial Crisis. Cyclical stocks have incurred the greatest selling pressure in this global stock market meltdown. Market fear of financials, industrials, certain media and other stocks presents us with a chance to—if history is any guide—give our clients access to an eventual recovery in industrial activity, consumer confidence, and consumer discretionary spending. In Causeway emerging markets portfolios, we currently maintain an overweight to Chinese stocks, and our China holdings include new economy stocks that we believe should fare better in an environment where there is limited face-to-face interaction.

With China currently experiencing dwindling new cases, life appears to be beginning to return to normal in much of that country. If new cases in the US and the EU peak (according to our estimates) in approximately mid-April, we are currently assuming a similar pace of return to normal operations and an eventual return to daily life. Stock markets have typically anticipated economic recovery well before the upturn in gross domestic product growth, and should, based on our experience, improve coincident with the peak of the virus outbreak.

This market commentary expresses Causeway’s views as of March 18, 2020 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented have been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

The Shanghai Stock Exchange Composite Index (“Shanghai Composite”) is a capitalization-weighted index that tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange.

The MSCI World Index is a free float-adjusted market capitalization index, designed to capture large and mid-cap segments across 23 developed markets countries. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index, designed to measure the performance of the large and mid-cap segments of 26 emerging markets countries. These MSCI indices are gross of withholding taxes, assume reinvestment of dividends and capital gains, and assume no management, custody, transaction, or other expenses. It is not possible to invest directly in an Index. MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations, and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.