Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

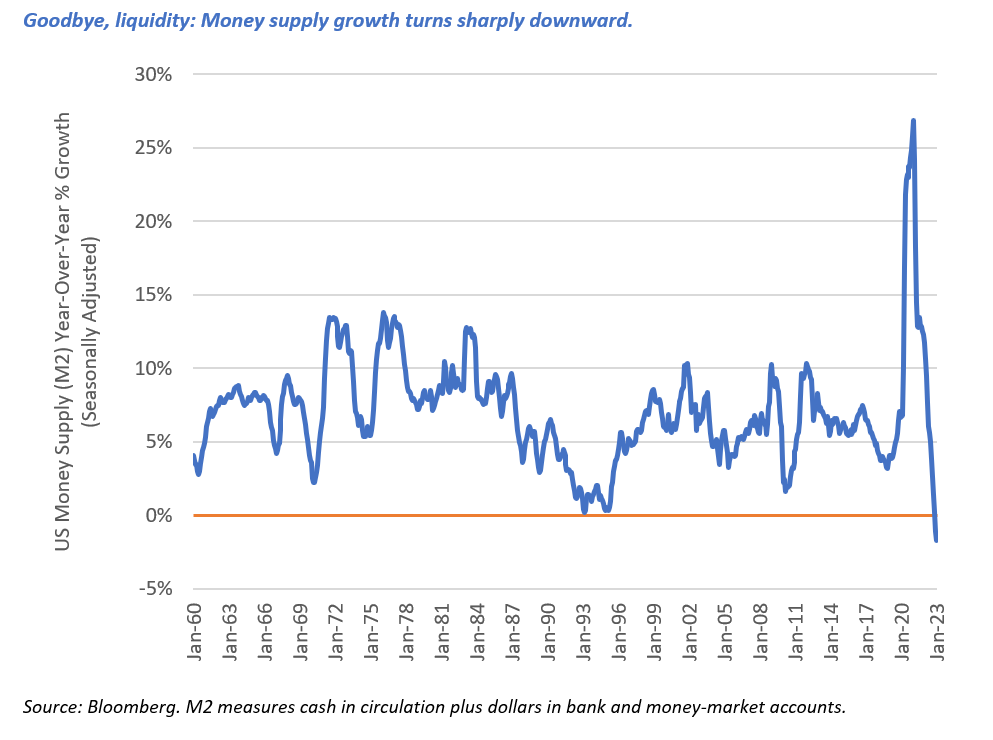

Liquidity generally has a buoyant effect on assets, including equities. We witnessed this uplift most recently in early 2021, when historic highs in the global money supply drove up prices across asset classes: stocks, bonds, and real estate, to name a few. But the liquidity trajectory has turned sharply downward. Central banks have entered a post-pandemic tightening cycle. In the US, year-over-year growth in the money supply has turned negative for the first time in over sixty years. Many banks face higher costs of funding and may incur bad debts from loans to leveraged industries such as commercial real estate. If history is any indication, a credit contraction typically follows central bank tightening and reduced bank lending. Should lenders remain cautious, liquidity will continue to drain from the global financial system, leaving earnings growth to drive share price returns at this stage of the market cycle.

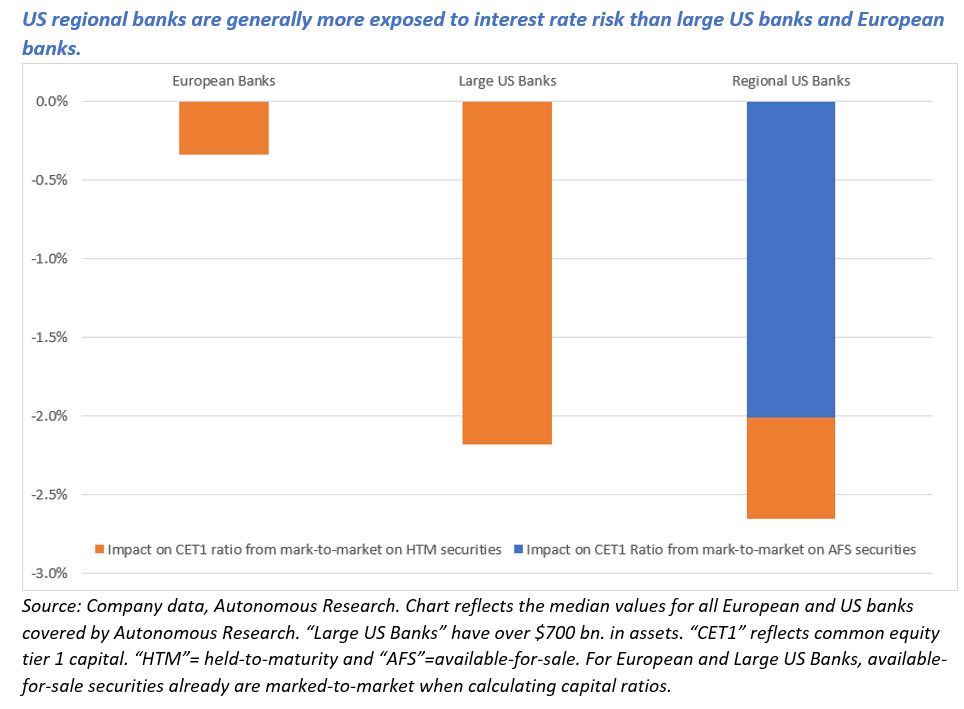

Rising interest rates are generally good for banks because they benefit from higher net interest margins (the income banks generate from loans less the interest they pay for deposits). But for banks with weaker capital positions, a series of steep rate hikes after a prolonged period of exceptionally plentiful money supply is creating liquidity challenges as depositors withdraw funds—to switch to higher interest-bearing products, among other reasons. US regional banks appear particularly vulnerable, as mostly lighter-touch regulation has led to lower levels of liquidity and more interest rate risk than large US banks and European banks, generally. Silicon Valley Bank and two other US lenders collapsed after mass deposit withdrawals. To backstop depositors and prevent systemic financial failures, US monetary authorities established an emergency bank funding facility. Major central banks coordinated to improve global access to US dollar liquidity. But liquidity is not a panacea. Relatively high capital and liquidity levels could not save Credit Suisse, whose business model had led to money losses for the past two years. The Swiss financial firm managed through a deposit flight in the fourth quarter of 2022, but the collapse of Silicon Valley Bank triggered a greater crisis of confidence, spurring customer and investor outflows from which Credit Suisse could not recover.

Banks and diversified financials holdings comprise about 8% of Causeway global value portfolios and 11% of Causeway international value portfolios as of March 23, 2023. These are underweight positions versus their benchmark indices (MSCI ACWI Index for global value and MSCI EAFE Index for international value). For both strategies, the largest individual positions in these industry groups are banks with current market capitalizations above $25 billion, domiciled in Europe or the US. As some of the world’s largest banks they are heavily regulated and typically subject to more stringent capital and liquidity requirements than smaller regional US banks.

After strong share price performance in the second half of 2022, we had been trimming global and international value portfolio positions in banks. However, the recent turmoil sent several of these stocks into more competitive positions, in our view, even with more stringent valuation inputs including compressing net interest margins, credit deterioration, and higher costs of equity. We look for bank stocks with attractive valuations and longevity of the banking franchise.

European banks, in general, may have more capacity to return capital (via dividends and share buybacks) than their US banking peers. This is quite a turn of the tables from the difficult post-global-financial-crisis years when European banks restructured assets far too slowly to pay for past sins. European banks’ asset portfolios generally have less risk exposure to rising interest rates than US banks. And their deposit bases may be more stable, as European yield-seeking depositors typically have fewer money market fund alternatives. Should market sentiment push down prices of banks to attractive levels, we may look to add to or initiate portfolio positions to banks we believe have strong fundamentals and ample capital positions.

As of March 23, 2023, the Causeway emerging markets strategy is underweight banks in aggregate but has overweight positions to banks in countries including South Korea, India, and Brazil, due to an attractive combination of quantitative valuation, growth, and momentum alpha scores. The strategy is underweight banks in the Middle East region, where the currencies of constituent countries (Saudi Arabia, UAE, Qatar, Kuwait) are pegged to the US dollar and interest rates tend to move with US rates.

Causeway’s international small cap strategy also is underweight banks (though overweight the financials sector overall, due to attractive opportunities in diversified financials and insurance). As of March 23, 2023, the strategy has an aggregate 3% weight in five bank holdings. Two are in South Korea, and three are in Europe, but we believe capital positions remain strong and valuations and momentum are attractive.

This shock to the banking system may intensify the economic repercussions of the end of easy money. We expect many banks—particularly US regional banks—to become subject to stricter liquidity regulation, which would further decrease lending. Even before the recent bank failures, US regional banks had begun raising their credit standards. Regional banks often have meaningful exposure to commercial real estate, where losses are currently expected to rise. Small businesses—in North America, then Europe, and possibly Asia—may find their access to credit diminished. Tightening credit standards historically have taken about two quarters to slow gross domestic product growth. Excesses in various economies globally will become more evident the longer the monetary squeeze continues. In most Western economies, small businesses account for outsized levels of employment. Expensive or unavailable credit should likely lead to layoffs in the US and other developed economy countries. That may suffice to temper core non-housing service inflation. In short, we expect slower regional and local lending to create a headwind for economic growth, especially for small to mid-sized companies. The risk that the Federal Reserve and other central banks do not prevent stagflation would cause problems in equity markets as both drivers of returns—liquidity and growth in earnings—would suffer.

We expect slower regional and local lending to create a headwind for economic growth, especially for small to mid-sized companies.

In a slowing economy, where can investors find earnings growth—that last-standing driver of equity share price appreciation? We look to company managements continuing the arduous work of operational restructuring. We believe some of the greatest share price improvements will come not from splashy, big-bang changes, but from managements extracting one small profit improvement after another for a meaningful cumulative effect. Examples include a consumer goods company growing its core operating margins by wringing out inefficiencies from its supply chain operations and enhancing individual product lines. We continue to hold shares of a large jet engine manufacturer that performed well on China’s Covid-reopening. We believe we have identified a second phase of recovery for the company, in which its CEO can focus intensely on improving returns. Many portfolio companies can reduce expenses—in some cases quite dramatically—which should buffer earnings in a recession. Causeway global value client portfolios hold an American technology businesses services company that should benefit from the flexibility of a nearly all-variable cost base. We are finding other opportunities in key players in oligopolistic markets who have pricing power and entrenched customers, such as a European-domiciled provider of mission-critical enterprise software. As credit becomes scarcer, we believe financial strength is paramount, particularly for those companies undergoing operational restructuring. Across Causeway client fundamental portfolios, we have scrutinized the balance sheets of holdings to understand better the effect of rising interest rates and believe in the portfolios’ overall financial strength. Payout yields—from companies paying dividends and buying back shares—remain an important component of total return.

We believe some of the greatest share price improvements will come not from splashy, big-bang changes, but from managements extracting one small profit improvement after another.

Although the end of easy money may create economic challenges and market tumult, it should also intensify investors’ focus on valuation. We believe every downturn creates opportunities for Causeway equity strategies, and our team seeks to use market volatility to redeploy capital into well-vetted equities with upside potential.

This market commentary expresses Causeway’s views as of March 24, 2023 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Please see https://www.causewaycap.com/wp-content/uploads/Risk-Disclosures-1.pdf for additional information on the risks of investing using Causeway’s strategies.

The MSCI ACWI Index is a free float-adjusted market capitalization index, designed to measure the performance of the large and mid-cap segments across 23 Developed Markets and 24 Emerging Markets countries. The MSCI EAFE Index is a free float-adjusted market capitalization index, designed to measure the performance of the large and mid-cap segments across 21 Developed Markets countries. These MSCI indices are gross of withholding taxes, assume reinvestment of dividends and capital gains, and assume no management, custody, transaction or other expenses. It is not possible to invest directly in an Index. Accounts will not be invested in all the constituent securities of their benchmark indices at all times, and may hold securities not included in their benchmark indices.