Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

We asked Causeway president and portfolio manager Harry Hartford the six key points he is sharing currently with Causeway global and international value clients.

1. The era of cheap money is behind us, and at a minimum, we are entering uncharted territory. It’s a fool’s errand to call the timing and magnitude of a recession (let alone whether there will be one), though anyone formulating their investment decisions based on the interest rate regime of the past 15-20 years will likely be caught flat-footed.

1. The era of cheap money is behind us, and at a minimum, we are entering uncharted territory. It’s a fool’s errand to call the timing and magnitude of a recession (let alone whether there will be one), though anyone formulating their investment decisions based on the interest rate regime of the past 15-20 years will likely be caught flat-footed.

2. An era of higher long-term interest rates should be expected even if global economic activity falters. Large budget deficits, the capital demands required to transition to a low-carbon global economy, and the costs of ongoing armed conflict and aging demographics across developed economies and China suggest structurally higher long-term interest rates will be required to attract capital.

3. An environment of greater volatility, brought about by efforts to bring inflation under control, should benefit active managers. And a greater focus on valuation now that money isn’t free should favor managers employing a disciplined, value-oriented, long-term investment approach.

4. Though US stocks, with their overall higher returns on capital, generally deserve to trade at a premium to their non-US peers, the current premium seems excessive. Also, the major US indices have become relatively concentrated in a small number of expensive mega-cap stocks. For a passive investor mimicking a market-capitalization-weighted index that includes the US, this concentration risk should be of concern.

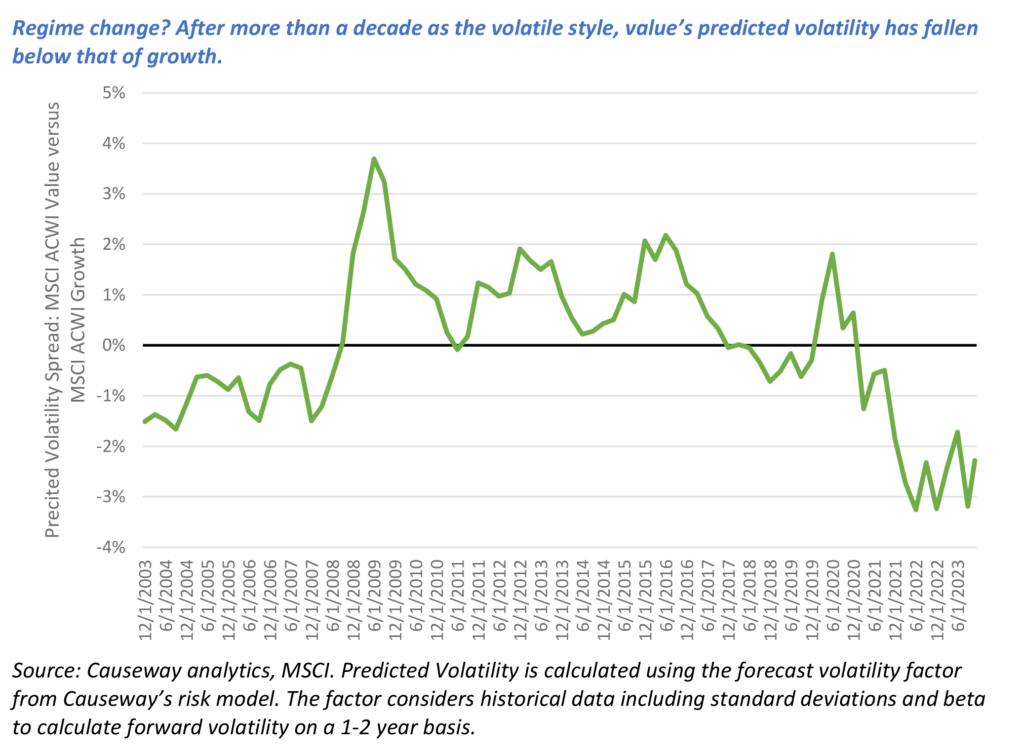

5. Using our measure of predicted volatility, the MSCI ACWI Value Index has become less volatile than the MSCI ACWI Growth Index (realized volatility since December 31, 2021 also has been lower for value versus growth). At a minimum, investors should demand a higher return for owning riskier growth stocks and this is occurring right at the point when long-duration (growth) equities are under strain from higher long-term interest rates.

6. The valuation characteristics of Causeway fundamental portfolios are undemanding, and we anticipate the below-benchmark return-on-equity will continue to rise as the earnings of some of the bigger holdings improve through the end of 2024. In the US market, equity valuations down the market capitalization spectrum appear compelling and the weighted market capitalization of a representative Causeway Global Value portfolio is now below that of the MSCI ACWI Value Index.

This market commentary expresses Causeway’s views as of November 2023 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

The MSCI ACWI Value Index captures large and mid cap securities exhibiting overall value style characteristics across 23 developed markets countries and 24 emerging markets countries. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. The MSCI ACWI Growth Index captures large and mid cap securities exhibiting overall growth style characteristics across 23 developed markets countries and 24 emerging markets countries. The growth investment style characteristics for index construction are defined using five variables: long-term forward EPS growth rate, short-term forward EPS growth rate, current internal growth rate and long-term historical EPS growth trend and long-term historical sales per share growth trend.

MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.