Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Causeway has used the pessimism from a delayed China reopening to increase exposure to developed markets stocks afflicted by China’s zero-Covid policy. We believe these companies are competitively well-positioned and demonstrate meaningful alpha potential.

Patience, you say. How about patients? Call the doctor. For equity markets, we see the potential for further pain in the absence of any central bank monetary support next year. Relative outperformers in global markets in 2022-to-date include stocks with high dividend yields and low price-to-book values, as they appear more earnings resilient than long-duration growth stocks. But as interest rates continue to push higher in most regions globally, even stocks appearing cheap by traditional value metrics may face earnings headwinds as economies slow. Where can investors find companies to deliver earnings upgrades—not downgrades—at attractive entry prices?

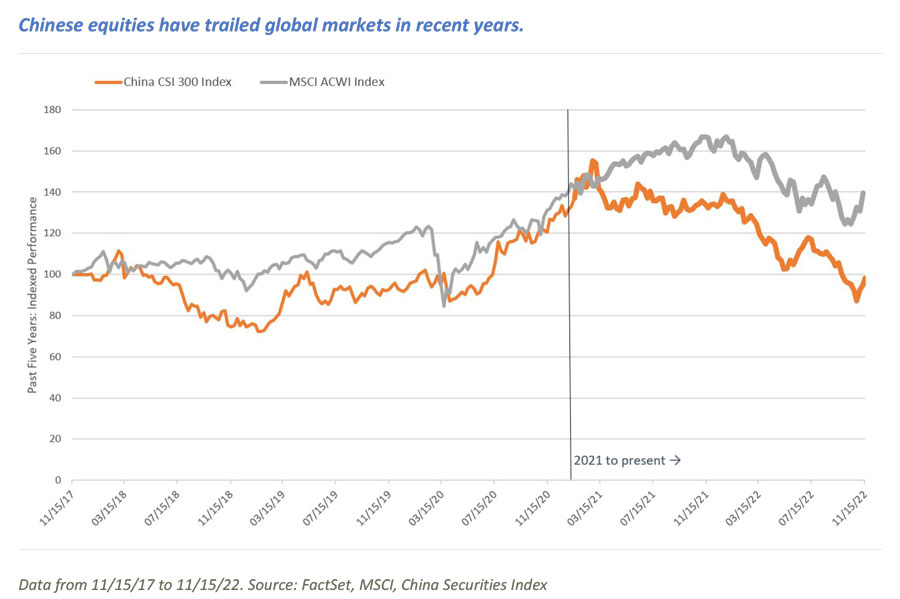

We believe the answer is connected to the worst-performing major equity market in the past two years: China.

“After nearly three years of a strict zero-Covid policy, China’s pent-up economic demand should, upon reopening, reignite the earnings of certain China-exposed companies.”

Soaring Chinese equity risk premia reflect valid concerns, including sagging real estate values, unpredictable and often harsh domestic regulation, concentration of political power, and geopolitical tensions. But after nearly three years of a strict zero-Covid policy, China’s pent-up economic demand should, upon reopening, reignite the earnings of certain China-exposed companies. Reopening is inevitable, in our view, even if we cannot predict when it may occur. As is true of any sovereign, China cannot cripple its economy without severe consequences. Shrinking real gross domestic product growth threatens social stability—and we believe social stability is the linchpin of the Communist Party of China.

As of end-October 2022, we estimate that approximately 10% of revenues from developed markets companies in unrestricted Causeway international value and global value strategies are from Greater China (China, Hong Kong, and Taiwan). These companies should be direct beneficiaries of the end of China’s zero-Covid policy.

Most of these China-afflicted developed markets stocks have delivered disappointing 2022-to-date performance. However, for this group, we are currently forecasting some of the largest two-year expected returns of the approximately 200 portfolio candidates that have progressed through our rigorous fundamental equity research process. As part of our fundamental investment process, we rank stocks based on a risk-adjusted, trading-liquidity-adjusted, two-year expected (Causeway-forecasted) returns. Typical of what Causeway seeks for its holdings, many of these companies have implemented operational restructuring to improve efficiency and lower costs in anticipation of a return to revenue expansion.

Markets appear to be ascribing negligible reopening revenue growth to these stocks. Here are examples of companies held in unrestricted Causeway global and international portfolios that we believe have considerable “reopening upside.”

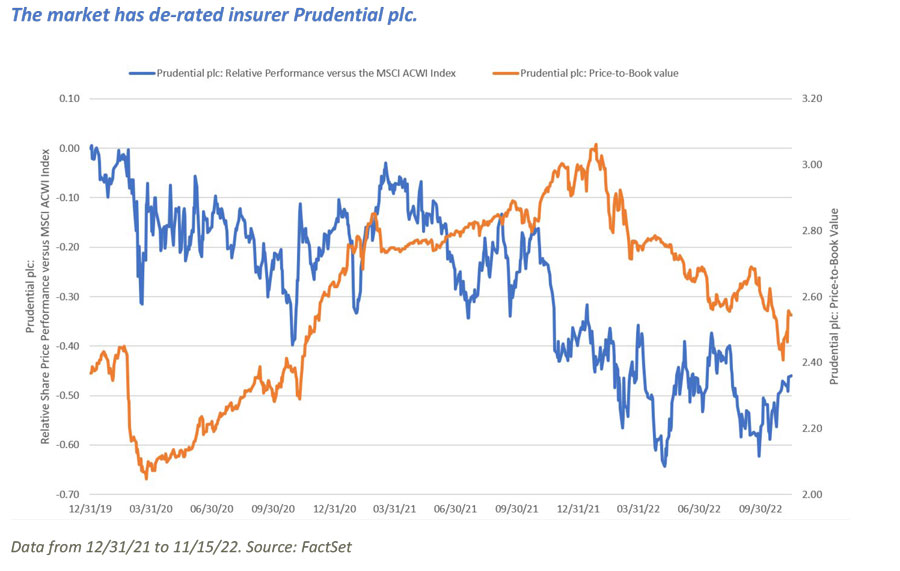

UK-Listed Insurance Company: Prudential plc

Despite its UK domicile, Prudential generates nearly all its revenue in Asia and Africa, serving a growing population in health, savings, and protection coverage. It is a leading pan-Asian franchise, with significant exposure to some of the most underpenetrated life insurance markets in the region. The company reported strong first-half 2022 results (insurance premiums grew 9% year-over-year in local currencies), despite mainland China border closures inhibiting its key Hong Kong market and Omicron-related lockdowns hampering others. We believe the company should sell even more policies when Covid restrictions dissipate.

When borders open, presumably so should insurance customers’ checkbooks.

Our two-year target price is meaningfully above the current share price, using conservative assumptions for how much China’s reopening will increase sales: 0% in 2023, 10% in 2024, and 5% in 2025. Our recovery estimates are restrained: we assume that in 2025, the company’s cross-border sales to mainland Chinese customers will be one-third of 2019 levels. Visitors to Hong Kong from mainland China represented one-quarter of total company revenue in 2019. Management’s surveys of these customers suggest their appetite for Hong Kong insurance products has not waned. When borders open, presumably so should insurance customers’ checkbooks.

UK-listed Aerospace Company: Rolls-Royce Holdings plc

The most cash-generative business segment for aerospace engine manufacturer Rolls Royce is servicing its installed base of engines. The more hours its engines are operating in the air, the more service revenue the company generates. China’s Covid lockdowns have restricted air travel, limiting the flying hours of its widebody aircraft engines. We estimate that, prior to Covid, China accounted for about 20-25% of Rolls Royce’s total engine flying hours.

The most cash-generative business segment for aerospace engine manufacturer Rolls Royce is servicing its installed base of engines. The more hours its engines are operating in the air, the more service revenue the company generates. China’s Covid lockdowns have restricted air travel, limiting the flying hours of its widebody aircraft engines. We estimate that, prior to Covid, China accounted for about 20-25% of Rolls Royce’s total engine flying hours.

Company management has paid down debt and removed costs, which should allow Rolls Royce to reach pre-Covid levels of cash flows with fewer engine flying hours.

Far from lying dormant awaiting a travel recovery, company management has paid down £2 billion in outstanding debt and removed over £1 billion in costs, which should allow Rolls Royce to reach pre-Covid levels of cash flows with fewer engine flying hours—about 75%-85% of 2019 hours flown. The company has reported that, at present, widebody aircraft flying hours are 65% of 2019 levels. Every 1% gain in engine flying hours should, all else being equal, equate to about £30 million of incremental free cash flow. We estimate that a full China reopening by year-end 2025 should boost the company’s free cash by over £1 billion—quite an improvement compared to cash flow losses in 2020 and 2021.

Rolls Royce’s market capitalization is roughly half of what it was in 2019. The company operates in a consolidated industry with high barriers to entry—thus, they have few competitors. This stock has made us all patients…but we do see the potential for a meaningful recovery.

Other China-exposed portfolio holdings include Japanese industrial automation company Fanuc Corporation and, for Causeway global value clients, US-listed Walt Disney Company. China is the largest regional source of Fanuc’s revenue—about one-third of revenue from the last fiscal year. Add China’s end-market demand for Fanuc-generated goods, and it becomes even more important. We estimate Walt Disney Company will incur up to $1 billion in lost annual operating profits from the temporary closure of Shanghai Disney Resort as well as lost global park and merchandise sales from Chinese tourists staying home.

In the multi-decade history of Causeway’s investing team, we have been able to identify companies with cyclically depressed valuations that took advantage of a crisis—whether TMT, global financial, or European debt—to become better businesses. As equity markets brace for continued monetary tightening, we are focused on value, often found outside of traditional low price-to-earnings or low price-to-book-value stocks. Some of the most significant undervaluation may reside in neglected areas of global markets. We are adhering to our fundamental valuation process to identify the greatest risk-adjusted expected return opportunities over our investment horizon. Even if that means taking a contrarian—and patient—approach to China’s reopening.

The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified were or will be profitable. For performance of Causeway’s overall portfolios, please see www.causewaycap.com.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Please see Risk Disclosures for additional information on the risks of investing using Causeway’s strategies.

MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

The MSCI ACWI Index is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets. The MSCI ACWI Value Index captures large and mid-cap securities exhibiting overall value style characteristics across the MSCI ACWI Index markets. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. The MSCI ACWI Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics across the MSCI ACWI Index markets. The growth investment style characteristics for index construction are defined using five variables: long-term forward EPS growth rate, short-term forward EPS growth rate, current internal growth rate and long-term historical EPS growth trend and long-term historical sales per share growth trend. The China CSI 300 Index is a market cap weighted stock market index designed to map the performance of the 300 most liquid A shares traded in the Shanghai and Shenzhen stock exchanges. Accounts will not be invested in all the constituent securities of their benchmark indices at all times, and may hold securities not included in their benchmark indices.