Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Portfolio manager Joe Gubler shares how Causeway's International Small Cap strategy generated 17% alpha net of fees over the last twelve months, and why portfolio characteristics continue to be as attractive as at any time in the last three years.

Key insights:

1. Causeway International Small Cap outperformed the benchmark by over 17% net of fees for the twelve months to March 31, 2024.

2. Our process successfully identified several stocks benefitting from the AI theme and traded them efficiently.

3. Other hidden gems further added to performance and there were no major detractors.

4. Portfolio characteristics continue to be as attractive as at any time in the last three years.

Learn more about Causeway International Small Cap

This market commentary expresses Causeway’s views as of April 2024 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. For further information on the risks regarding investing in Causeway’s strategies, please go to https://www.causewaycap.com/wp-content/uploads/Risk-Disclosures.pdf.

The Causeway international small cap strategy uses quantitative factors that can be grouped into seven categories: valuation, sentiment, technical indicators, quality, corporate events, macroeconomic, and country. The relative return attributed to a factor is the difference between the equally-weighted average return of the highest ranked quintile of companies in the strategy’s universe based on that factor and that of the lowest ranked quintile of companies. “Alpha” means performance exceeding the benchmark index.

The MSCI ACWI ex USA Small Cap Index captures small cap representation across 22 of 23 developed markets (excluding the US) and 24 emerging markets. With 4,334 constituents, the index covers approximately 14% of the global equity opportunity set outside the US. The index assumes reinvestment of dividends and capital gains, and assumes no management, custody, transaction, or other expenses. The index is unmanaged and one cannot invest directly in an index.

MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

Disclosures:

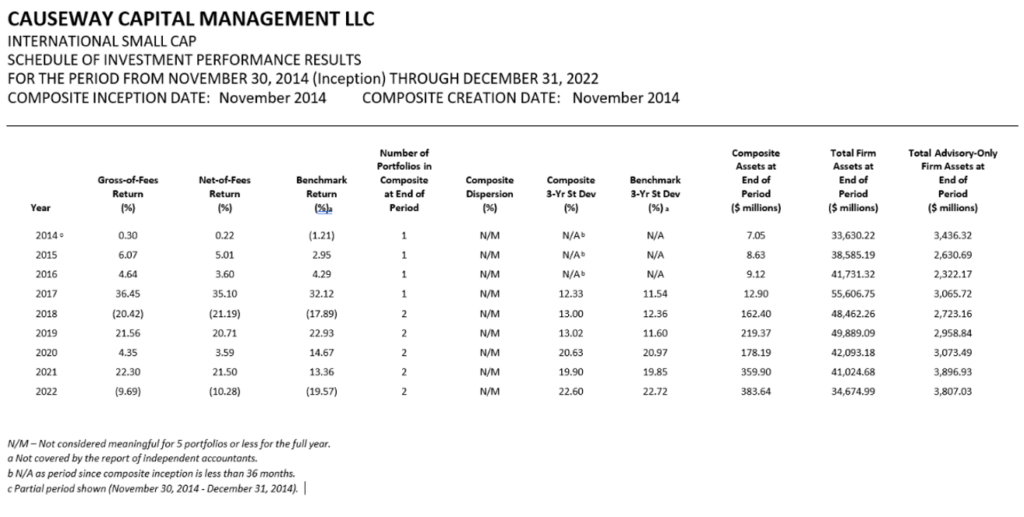

Causeway Capital Management LLC (Causeway) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Causeway has been independently verified for the periods June 11, 2001 through December 31, 2022.

A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. The International Small Cap Composite has had a performance examination for the periods November 30, 2014 through December 31, 2022. The verification and performance examination reports are available upon request.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

The Firm, Causeway, is organized as a Delaware limited liability company and began operations in June 2001. It is registered as an investment adviser with the U.S. Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training. Causeway manages international, global, and emerging markets equity assets primarily for institutional clients including corporations, pension plans, sovereign wealth funds, superannuation funds, public retirement plans, Taft-Hartley pension plans, endowments and foundations, mutual funds and other collective investment vehicles, charities, private trusts and funds, model and SMA programs, and other institutions. The Firm includes all discretionary and non-discretionary accounts managed by Causeway.

The International Small Cap Composite includes all U.S. dollar denominated, discretionary accounts in the international small cap equity strategy. The international small cap equity strategy seeks long-term growth of capital through investment primarily in common stocks of companies with small market capitalizations located in developed and emerging markets outside the U.S using a quantitative investment approach. New accounts are included in the International Small Cap Composite during the first full . Terminated accounts are included in the International Small Cap Composite through the last full month under management. A complete list and description of Firm composites is available upon request.

Account returns are calculated daily. Monthly account returns are calculated by geometrically linking the daily returns. The return of the International Small Cap Composite is calculated monthly by weighting monthly account returns by the beginning market values. Valuations and returns are computed and stated in U.S. dollars. Returns include the reinvestment of interest, dividends and any capital gains. Returns are calculated gross of withholding taxes on dividends, interest income, and capital gains. The Firm’s policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. Past performance is no guarantee of future performance. Composite dispersion, if applicable, is calculated using the equal-weighted standard deviation of all portfolios that were included in the International Small Cap Composite for the entire year. The three-year annualized ex-post standard deviation quantifies the variability of the composite or benchmark returns over the preceding 36-month period.

The benchmark of the International Small Cap Composite is the MSCI ACWI ex USA Small Cap Index, which is a free float-adjusted market capitalization weighted index, designed to measure the equity market performance of smaller capitalization stocks in developed and emerging markets excluding the U.S. market, consisting of 46 country indices. The Index covers approximately 14% of the free float-adjusted market capitalization in each country. The Index is gross of withholding taxes, assumes reinvestment of dividends and capital gains, and assumes no management, custody, transaction or other expenses. Accounts in the International Small Cap Composite may invest in countries not included in the MSCI ACWI ex USA Small Cap Index, and may use different benchmarks.

Gross-of-fees returns are presented before management, performance and custody fees but after trading expenses. Net-of-fees returns are presented after the deduction of actual management fees, performance-based fees, and all trading expenses, but before custody fees. Causeway’s basic management fee schedules are described in its Firm brochure pursuant to Part 2 of Form ADV. The basic separate account annual fee schedule for international small cap equity assets under management is: 0.80% of the first $150 million and 0.65% thereafter. Accounts in the International Small Cap Composite may have different fee schedules.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations, and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.