Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

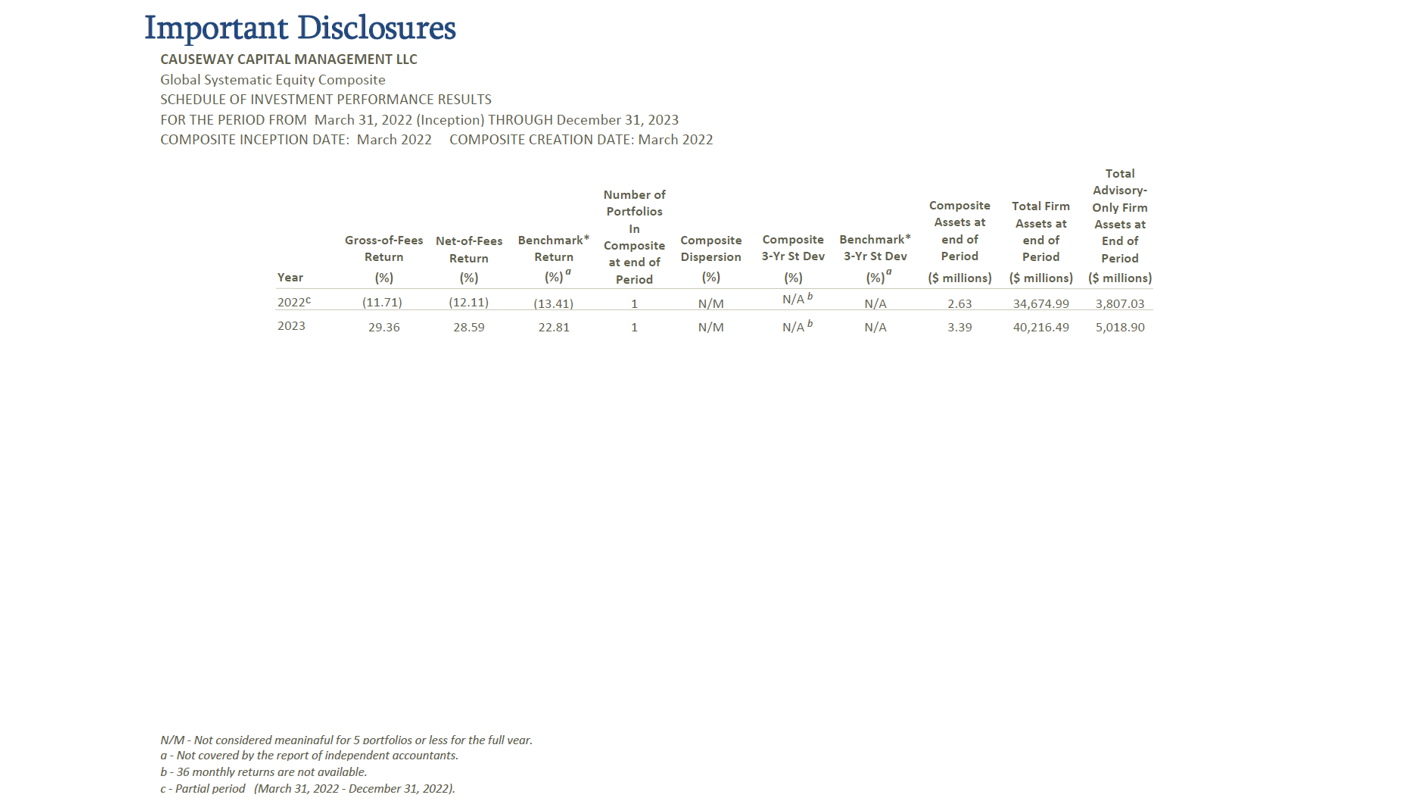

Causeway’s Global Systematic Equity (GSE) strategy recently marked its three-year milestone, delivering over 4% annualized alpha, net of fees, since inception*. Arjun Jayaraman, Head of Quantitative Research and Portfolio Manager, introduces the design and evolution of the strategy—and the differentiated elements driving its performance.

Key insights

- An active alpha model powered by diverse, uncorrelated signals

- Fundamental research integration to capture risks that models can miss

- Robust, proprietary risk management to help build resilient portfolios

- Backed by over two decades of quantitative investing experience

*Please see here for important disclosures.

GSE is a quantitative, actively managed global equity strategy built to adapt across market regimes.

Its foundation lies in a proprietary, multi-dimensional alpha model—leveraging seven uncorrelated factor groups, enhanced by insights from Causeway’s global fundamental research team. This hybrid approach enables the team to capture alpha beyond what traditional models can see—while flagging risks and opportunities such as regulatory issues, binary events, and corporate actions.

A key differentiator is GSE’s contextual factor weighting, which tailors factor relevance based on a stock’s investor profile—whether value, growth, or momentum. This targeted construction is supported by Causeway’s proprietary risk models, refined over more than two decades of research to deliver well-balanced, resilient portfolios.

With deep roots in quantitative investing and a strong record of innovation, GSE reflects Causeway’s commitment to dynamic, research-backed active management.

For information: [email protected]

This market commentary expresses Causeway’s views as of April 2025 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. For further information on the risks regarding investing in Causeway’s strategies, please go to https://www.causewaycap.com/wp-content/uploads/Risk-Disclosures.pdf.

The Causeway global systematic equity strategy uses quantitative factors that can be grouped into the following categories: valuation, sentiment, technical indicators, long-term growth, quality, corporate events, and sustainabilty.

“Alpha” is a measurement of performance return in excess of a benchmark index.

The MSCI ACWI Index captures large and mid cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 2,558 constituents, the index covers approximately 85% of the global investable equity opportunity set.

MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.