Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

“There’s always room for someone to create a better metric. That creates an opportunity for active managers,” says Mozaffar Khan, PhD, Causeway’s Director of ESG Research. Khan is discussing the heterogeneity of views among providers of Environmental, Social and Governance (ESG) stock ratings, who often assign vastly different scores to the same companies. Rather than lament this disparity, he welcomes it as proof that ESG is multi-dimensional. The varying interpretations of ESG create potential for alpha.

Khan has used an alpha-centric approach to ESG investing since he entered the field seven years ago. As a professor at Harvard Business School researching return predictability, Khan was approached by two colleagues interested in corporate sustainability. They sought to reveal a relationship between ESG factors and stock performance. Khan joined the project as a skeptic, but as he and his co-researchers studied the data, he saw evidence that certain “material” ESG issues influenced investment returns. In his view, the academic paper sharing their findings “really changed the conversation among the investment community, moving it from asking if ESG is relevant and does it matter for risk to, yes it matters—and it matters for alpha too.”

The importance of ESG for asset owners and asset managers has grown tremendously in the past several years. The United Nations-supported organization Principles for Responsible Investment reported in 2020 that its signatory base has expanded to represent a collective $100 trillion in assets under management. Nearly two-thirds of global institutional investors surveyed by MSCI last year cited ESG issues among the top three trends that will affect their organization in the coming years. And asset managers have responded to rising demand: according to Morningstar Direct, a record 71 sustainable funds launched in the US in 2020. ESG appears on track to occupy an increasingly central role in investments.

Here, Khan shares his perspective on salient ESG issues for investors: the link between ESG and alpha, how asset owners can incorporate ESG into their investment framework, ways to evaluate asset managers’ ESG practices, Causeway’s differentiated ESG approach, and what lies ahead for ESG investing.

Key insights

- We identify four pathways—consumption, regulation, litigation, and company response—between an ESG characteristic and a company's financial performance.

- Causeway’s ESG research strategy emphasizes three features: developing a differentiated framework, identifying key issues, and developing alpha signals.

- ESG momentum is likely to continue as consumers, policy makers and investors pay increasing attention to ESG issues.

Let’s begin with the basics: how does ESG impact stock price performance?

For an ESG characteristic to be potentially material to investment return, it must have what I call an impact transmission mechanism, a pathway to a company’s financial performance. Without this, it can be a bit wishy-washy to say that ESG will impact investment performance—well, how? We have identified four impact transmission mechanisms: consumption, regulation, litigation, and company response. We believe these are the fundamental drivers of the relationship between ESG and share price performance. Consumption preferences are changing as consumers align their purchasing behavior with ESG, rewarding companies that have the appropriate characteristics and penalizing companies that don’t. Similarly, policy and regulation, like the European Commission Green Deal, are beginning to favor companies exhibiting ESG characteristics that legislators find favorable, and disciplining others. A third potential mechanism is the liability that companies might face. We have seen that with tobacco companies. And fourth is a company’s own response to these trends. Major traditional energy companies are pivoting towards renewables, changing their business models, and directing increasing capital expenditures towards green technologies. These are clear implications for companies’ future cash flows and risk profiles.

How should an asset owner begin to incorporate ESG into an investment framework?

I recommend investors stay aware of ESG issues and developments in the field and remain mindful of ESG’s potential to impact portfolio returns. Asset owners can consider their portfolio’s exposure to ESG characteristics and build exposure to ESG factors as drivers of return. Given the evidence of linkage between ESG and performance, we believe an asset owner can think of ESG as a style factor, like value or growth.

The way to achieve ESG exposure can vary with overall approaches to portfolio construction. For example, a plan seeking exposure to diverse drivers of returns jointly in one strategy might use a quantitative strategy that includes multiple style factors, including ESG, in its alpha model. Alternatively, an asset owner might seek “a la carte” exposure to ESG only. Such an investor can calibrate ESG exposure within the total portfolio by allocating a certain portfolio percentage to a “pure” ESG strategy that exclusively uses ESG alpha factors in portfolio construction.

The ESG investing spectrum is broad in terms of investment objectives. For example, a values-based thematic or “impact” investor might seek more targeted investments like solutions for access to clean water. In addition to the financial aspects of the investment, such an investor might also care about measuring near-term progress on the chosen issues (e.g., growth in clean water availability).

Given the evidence of linkage between ESG and performance, we believe an asset owner can think of ESG as a style factor, like value or growth.

It also helps to identify your desired level of ESG integration into the investment process. I see integration on a spectrum. At one end, you have investors who screen negatively, using criteria to exclude specific industries or stocks. On the other end, ESG is one input among a set of investment factors that contribute to a holistic view of a company. I see that as full integration—that is what we have at Causeway.

How should asset owners assess their managers on ESG?

It is important to gauge a manager’s commitment to ESG. This commitment should be evident in the firm’s people—research staff who have received training on relevant ESG issues, for example. Commitment also should be evident through structured, repeatable, and verifiable procedures. In my opinion, firms committed to ESG should conduct programmatic and differentiated research. For example, the use of proprietary metrics to inform a differentiated view, or at least some evaluation of external ESG metrics rather than passive reliance on vendor ratings. There should be a clear and structured process to integrate research findings in investment analysis.

It is important to gauge a manager’s commitment to ESG. This commitment should be evident in the firm’s people and through structured, repeatable, and verifiable procedures.

What differentiates Causeway’s approach to ESG?

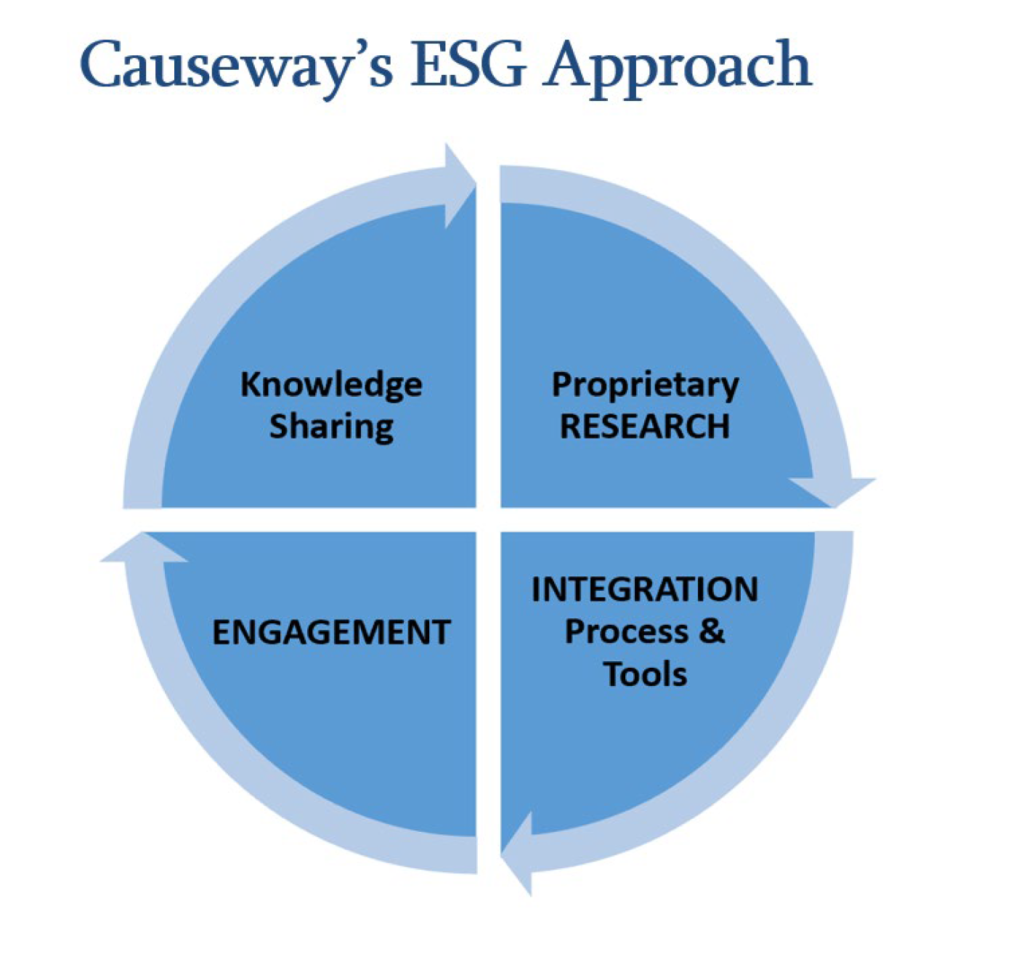

At Causeway, our commitment to ESG manifests in the research we conduct and our structured, deliberate methods of integrating ESG.

Causeway’s ESG research strategy emphasizes three features: developing a differentiated framework, identifying key issues, and developing alpha signals. We first applied this strategy to our study of corporate governance, where, rather than extrapolating a US-centric model to companies globally, we created a region-specific governance framework. This proprietary methodology, published in the CFA Institute Financial Analysts Journal, creates governance scores that we believe better predicted company stock returns. We then conducted similar research in E and S, identifying key issues and developing proprietary alpha signals around them. An example: we recognized material “E” issues related to the climate change transition and developed a scoring methodology that considers a company’s environmental footprint in the context of its country’s capacity to meet environmental challenges. Our research is evidence-based, examining both traditional and big unstructured data sets and employing quantitative and statistical learning techniques combined with extensive fundamental knowledge of the economic drivers of investment performance.

On the integration side, our strategy rests on Causeway analyst training, tools, and accountability. We had three internal training sessions in the fourth quarter of 2020 and one in January of this year. The sessions tend to be very active, with a lot of questions and comments. In this way, the sessions are symbiotic: the analysts’ responses feed back into our research, refining our approach. We have built tools, like a desktop application for fundamental ESG scoring, to facilitate integration. Then, once we have given the analysts training and tools, we hold them accountable. As part of their annual performance review and compensation, we assess how well they adhered to these integration procedures.

We recognized material “E” issues related to the climate change transition and developed a scoring methodology that considers a company’s environmental footprint in the context of its country’s capacity to meet environmental challenges.

How do Causeway analysts engage with a company on ESG issues?

We focus on the companies where we’ve identified the most material questions. For example, the biggest corporate contributors to our fundamental portfolios’ carbon footprints might become candidates for engagement. We plan the engagement agenda, identifying our desired outcome. We generally want to understand a company’s governance around material ESG issues, if company management has clear strategies to mitigate those areas of concern, and if management has identified goals and metrics to track the company’s progress toward concrete targets. We log our interactions and may follow-up with the company if warranted or take other action.

Our objective for our clients is to preserve and grow the funds that have been entrusted to us by the ultimate beneficiaries of client accounts. ESG is an important criterion that goes into building a holistic view. And so, from time to time, we might invest in a company that has, in our view, an unfavorable ESG characteristic, if that is more than offset by other more favorable investment attributes. I believe that many corporations are trying to take steps in the right direction. I think that’s important to recognize. Nothing will happen overnight. We want to carefully monitor the progress of client portfolio holdings, remaining faithful to our objective of maximizing investment returns while keeping ESG considerations in mind.

Some clients ask about our ESG practices outside the investment process. If you were to turn the ESG lens on Causeway as a firm, how would we score?

I would point to evidence that we continually seek to improve our ESG practices as a firm. Our commitment to diversity and inclusion is evident in our owner, employee, and board profiles, and is reinforced through our support of internal and external diversity initiatives and organizations. We have implemented sustainability practices and recently created a tool to track carbon emissions from business travel and employee commutes. We are conscious of the environmental footprint in our daily operations. I think what is important for Causeway—and for any manager being assessed on their own ESG practices—is that we’re taking steps to improve. We are on this journey, setting goals and measuring and tracking our progress.

How has Covid impacted ESG investing?

I think Covid reminded us of common fragilities, increasing awareness of the importance of ESG issues. Covid spared no one—there was such a tremendous scope of impact. It reinforced the importance of social issues including sick pay and working conditions. And because of the attention on shared vulnerabilities, it also raised the profile of climate change. Covid spotlighted social and environmental issues that affect us all.

I think Covid reminded us of common fragilities, increasing awareness of the importance of ESG.

What’s on the horizon for ESG?

I expect we will see an increasing number of consumers take an interest in ESG, to try to have an impact and move the needle on key issues. I expect more collective action. What’s coming, in my view, is increasing attention from policymakers and regulators. Investors are taking note because of the potential impact on companies’ future cash flows and risk profiles. Will these trends lead to progress on some key ESG issues? Can we see a reduction in total carbon emissions? Can we see measurable progress in diversity and inclusion? Presumably, as we tackle some of the bigger issues and start to make progress on them, other issues could rise to the fore. ESG is dynamic and continues to evolve, in depth and complexity. One thing I can say with certainty is that ESG momentum is going to continue for the foreseeable future. And Causeway will continue to deepen and refine our approach using an alpha-centric model. Being a traditional investor informs the way I look at ESG. I’m always wondering, how will this matter for investment performance?

This market commentary expresses Causeway’s views as of March 17, 2021 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented have been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

Alpha refers to performance exceeding a benchmark. MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations, and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.