Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Rising deficits and elevated debt levels in the UK and France have led some investors to question the long-term sustainability of debt in both countries. Recently, clients have asked us whether these economies could be approaching levels of fiscal stress seen in parts of the euro area during the 2010–2012 sovereign debt crisis, and what the policy framework for resolution might look like.

Key insights

- UK and France face acute fiscal pressures but remain supported by strong institutions and investor bases.

- Central bank backstops and EU safeguards reduce the risk of a debt crisis.

- Fiscal adjustment will likely involve revenue increases and spending restraint, weighing on medium-term growth.

German Chancellor Friedrich Merz recently commented, “The welfare state that we have today can no longer be financed with what we produce in the economy.” His warning reflects a broader anxiety across Europe about how to reconcile high social spending with long-term fiscal sustainability.

Against this backdrop, it is important to place the current fiscal dynamics of the UK and France in perspective, highlight the institutional safeguards in place, and consider the implications for global investors.

Fiscal pressure is acute in both the UK and France. Yet these are wealthy countries with large, diversified investor bases, institutional backstops, and a range of policy levers for adjustment. Market discipline should force their respective governments to return to a sustainable fiscal path. The adjustment appears likely to involve a mix of higher revenues and lower expenditures.

Since the sovereign debt crisis, Europe has introduced safeguards to prevent a repeat of the destabilizing cycle in which doubts about debt sustainability drove bond yields higher, further straining public finances. The European Central Bank (ECB) now has several instruments to address such risks, including the Transmission Protection Instrument, which allows the ECB to purchase government bonds in the secondary market if borrowing costs rise in a way that threatens monetary policy transmission.

The UK, outside the euro area, benefits from having an independent central bank with the capacity to act as a backstop. This was evident after the market disruption following the Truss government’s budget in 2022, when the Bank of England intervened to stabilize gilt markets.

Comparisons with the US provide useful context. UK government debt stands at roughly 100% of gross domestic product (GDP), compared with 113% in France and 124% in the US. Fiscal deficits are similarly elevated: 5.3% of GDP in the UK and 5.9% in France, compared to 7.6% in the US. The UK and France have EU fiscal rules or budget targets designed to ensure medium-term debt sustainability. No such rules exist for the US.

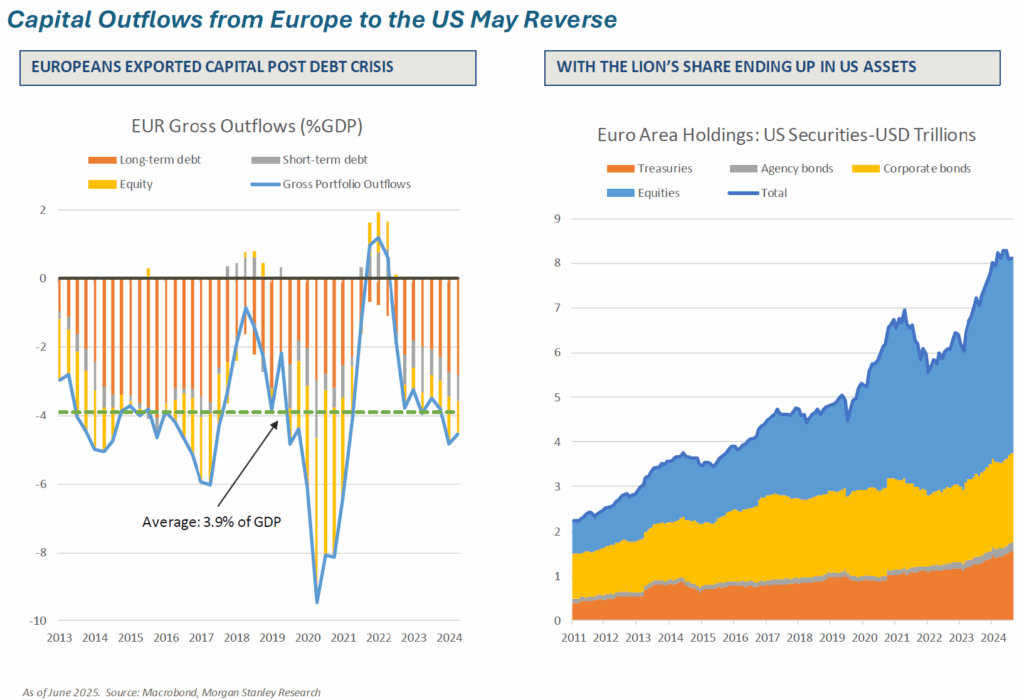

Narrowing deficits to less than 3% of GDP should create a more sustainable path for the UK, France, and the US, though this adjustment would likely weigh on economic growth. In Europe, stronger fiscal spending in Germany may provide some offset. Any attempt by the UK or US to monetize debt—funding government deficits through central bank bond purchases—would likely weaken their currencies, given their reliance on foreign capital inflows. By contrast, Europe as a bloc remains in a stronger external position, supported by its current account surplus and the significant capital it has exported to the US over the past decade.

We incorporate the prospect of subpar medium-term GDP growth into our company forecasts for firms with economic exposure to the UK and France. At the same time, our investment process emphasizes valuation discipline and stock-specific opportunities. Even in a challenging macro environment, we see meaningful potential to add value through careful security selection in these regions.

This market commentary expresses Causeway’s views as of September 2025 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.