Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Despite widespread adoption of ESG investing practices, implementation of a principled investing framework can be daunting. We examine key questions likely to be useful in navigating this new investing landscape.

In the last five years, over 1,000 asset owners, managers, and service providers have signed on to the United Nations Principles for Responsible Investment.[1] In the United States, almost one in five professionally managed dollars are invested according to socially-responsible criteria.[2]The message is clear: Environmental, Social, Governance (“ESG”) investing warrants attention. Yet, these statistics conceal the uncertainties associated with ESG investing. What are investors’ primary concerns, and how might they be addressed? Examining these questions is likely to be useful in navigating this new investing landscape.

In this paper Causeway examines some of the current salient questions surrounding ESG investing. We offer a perspective on these questions, and our main conclusions are that: (i) the available ESG ratings data appear viable for informed use; (ii) there is mounting empirical evidence from multiple independent studies of the alpha[3] potential of ESG ratings, suggesting a role for skilled alpha extraction; and, (iii) quantitative ESG investors can at appropriate times take independent engagement actions, concurrent with ESG investors who have an active engagement approach, that have the effect of lending their voice in achieving ESG impact.

1. RATINGS DATA

Two concerns about ESG ratings data are: data providers disagree about ratings; and the ratings in certain instances do not conform with some users’ own ratings assessments.

1.1. ESG ratings disagreement among data providers

ESG ratings can be sourced from a number of providers. In examining the data, we have found evidence of ratings disagreement. One interpretation of this disagreement could be that none of the ratings data are usable in the investment process. However, a more considered interpretation of this disagreement could be assisted by the following observations.

Ratings or measurement disagreement is not exclusive to ESG data. For example, sell-side analysts frequently disagree on target prices and earnings forecasts for firms they cover;[4]the Nationally Recognized Statistical Ratings Organizations sometimes disagree on bond credit ratings;[5] financial analysts commonly challenge firms’ reported earnings figures; and, a given firm’s earnings calculated under U.S. Generally Accepted Accounting Principles could differ significantly from the same firm’s earnings under International Financial Reporting Standards. These common disagreements do not appear to have rendered reported earnings, earnings forecasts, and credit ratings unusable. Rather, they appear to inform the use of these variables and to present an opportunity for users to deploy individual selection skill.

Further, rather than necessarily reflecting error, ratings disagreement is potentially a reflection of differences in scope, perspective, and methodology among data providers.[6]

Differences in scope. Comparability across data providers is likely to be hindered if they are measuring firms on different sets of issues. For example, MSCI measures ESG performance on 37 individual issues. Another data provider might measure firms on some subset, or superset, of these issues.

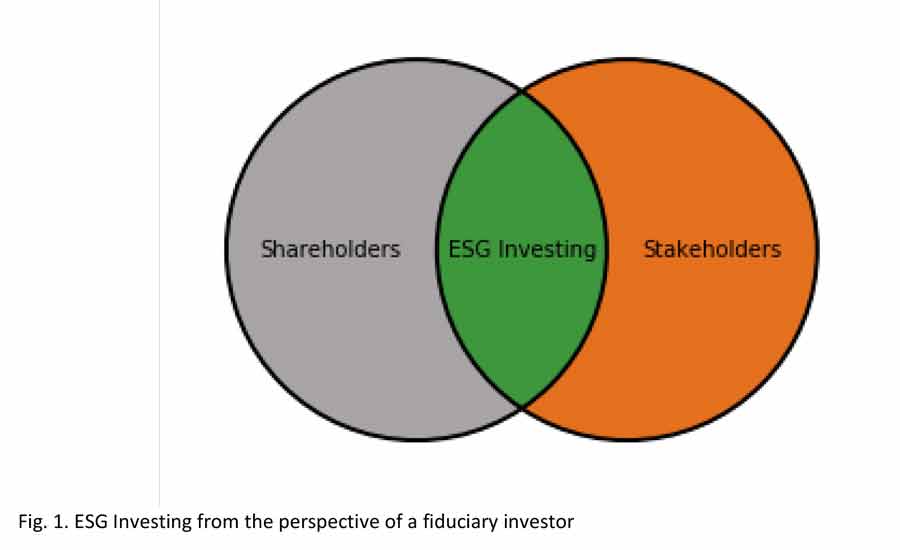

Differences in perspective. Comparability across data providers is likely further hindered if different providers adopt different perspectives in assessing firms’ ESG performance. Is the assessment based on what is relevant from shareholders’ perspective, or is it based on the interests of non-shareholders (or stakeholders)? Is it based on a perspective of what is likely to matter for specified concrete outcomes, or is it based on a normative perspective such as what might be “ethical”?

Differences in methodology. Another impediment to ratings comparability is differences in methodology across data providers. For example, there might be differences in the horizon over which ESG risk exposures are assessed, differences in issue weights depending on perspective, and differences in benchmark peer groups or benchmark industry definitions.

For long horizon equity investors who are fiduciaries, data from providers who adopt a shareholder perspective and rate firms on material ESG issues are likely to be more useful in investment decisions. For such investors, ESG investing is likely represented by the intersection of mutual interests with other stakeholders. As an example, employee development initiatives are beneficial for stakeholders (employees and community), and also for investors to the extent employee productivity improvements offset development costs.

1.2. ESG ratings disagreement between users and providers

Some users disagree with ESG ratings for specific companies based on in-depth assessment of those companies. For example, some users might consider the provider rating to be relatively low for some companies, while other users might consider the provider rating to be relatively high for some companies. For fundamental equity managers who select individual stocks, this could potentially impair the value of provider ratings.

For quantitative equity managers who have the advantage of holdings breadth, some additional considerations potentially impact the value of the provider ratings. If provider ratings are an estimate of the unobserved “true” ratings, one question is whether variation in provider ratings has good explanatory power for variation in “true” ratings. As a thought experiment, consider if we could plot provider ratings estimates against “true” ratings, or estimate a regression of estimated ratings on “true” ratings. Perfect provider estimates would imply that all observations fall on a 45° line through the origin. However, as with many regression results, we are more likely to observe many observations above and below the line, implying that many individual ratings estimates have error. Yet a quantitative manager who invests in a large number of stocks is likely interested in the portfolio-level estimation error. For stocks in a portfolio, positive estimation errors in some individual stock estimates are likely to offset negative estimation errors in other individual stock estimates, resulting in relatively lower estimation error at the portfolio level.

Despite the unobservability of firms’ “true” ESG ratings, if a quantitative manager is interested in achieving a positive “true” active ESG exposure, one way to achieve this is if the correlation between the estimated and “true” ESG ratings is positive, and if the portfolio and benchmark use the same ESG ratings provider. In practice, this implies selecting an ESG data provider who is expected to perform a diligent and methodologically acceptable, albeit imperfect, ratings assessment.

The unobservability of firms’ “true” ratings is not an issue exclusive to ESG. For example, firm-level costs of equity, used in valuation and capital budgeting, are also unobservable and could be estimated imprecisely.[7] However, many cost of equity estimates are useful because they are likely positively correlated with the unobservable “true” cost of equity.[8]

So how can a user evaluate whether an ESG provider’s ratings estimates are positively correlated with “true” ratings, or in other words how can a user evaluate the quality of providers’ ratings estimates?

1.3. Assessing ESG ratings quality

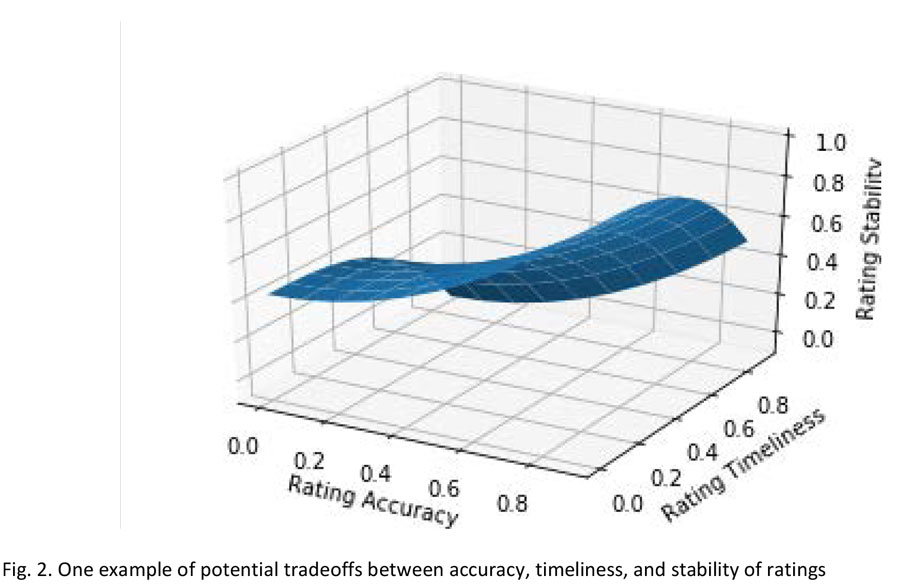

Ratings quality is likely a multidimensional construct that includes accuracy, timeliness, and stability.

One notion of accuracy is the ability of variation in ratings estimates to predict variation in future realized ESG outcomes. For example, consider sorting the relevant firms[9] into two groups based on their rating on the MSCI environmental issue “biodiversity and land use.” Based on the MSCI definition of this environmental issue,[10] we would expect to observe relatively fewer future oil spills or land use controversies for firms with high current ratings than for firms with low current ratings. Similarly, for the MSCI social issue “privacy and data security,” we would expect to observe relatively fewer future data breaches for firms with high current ratings than for firms with low current ratings on this issue. For governance, we might expect for example to observe fewer future incidences of insider trading or corporate fraud at firms with high current governance ratings than at firms with low current governance ratings. In essence, assessing accuracy would require statistically relating specific ESG ratings to specific future outcomes within the horizon underlying provider ratings.

Ratings users might also be interested in the timeliness of ratings changes. Do specific ratings changes lead, or lag, specific ESG events? Here, there might be a potential tradeoff between timeliness and accuracy. For example, consider a specific ESG event such as bribery and corruption allegations, or allegations of anticompetitive behavior. Should the change in ratings be concurrent with the headlines? What if the allegations are later disproven or found to be less severe than initially reported? Timeliness might dictate ratings changes that are more responsive to news, while accuracy might dictate a longer “vetting” period.

This raises the notion of ratings stability as another potential dimension of quality. Volatile ratings that change with every “blip” of news are likely less useful than more stable ratings, holding accuracy and timeliness constant.[11]

Overall, while accuracy, timeliness, and stability are potentially useful characteristics of ratings, it is difficult to concurrently maximize all three dimensions. Tradeoffs might be required. Therefore, evaluating data quality likely requires tests on multiple dimensions while recognizing the potential for tradeoff between the different dimensions.

A potential issue for empirical tests of data quality is the relatively short time series of ESG data available from many data providers.

Overall, we conclude that the ESG ratings data, like other commonly used ratings and estimates, appear viable for informed use by users who are familiar with providers’ ratings methodologies and limitations.

2. ALPHA POTENTIAL

A second concern about ESG investing is the potential for trading off alpha in the quest for favorable ESG practices. There is mounting empirical evidence from multiple independent studies of a positive relation between ESG and future financial performance and stock returns.[12] These studies provide evidence across time periods and regions. It is difficult to explain this evidence if (i) the ratings data are only noise, or (ii) firms’ ESG disclosures that underlie the ratings are only “cheap talk.” Both of these effects would likely bias against finding statistically significant results in terms of future financial performance and stock returns. Rather, these studies suggest the potential for skilled alpha extraction. In a September 2017 white paper, Causeway summarizes the findings of one of these studies.

3. QUANTITATIVE ESG INVESTING VERSUS ACTIVE ENGAGEMENT

Active ownership is one principle outlined by the Principles for Responsible Investment (UNPRI). Some investors adopt active ownership, whereby they actively engage with firms to advocate for ESG goals, as an investment philosophy. Can a broad-breadth quantitative approach to ESG investing align with active ownership goals?

An affirmative answer appears tenable if one considers the following. There is likely a spectrum of active ownership approaches, ranging from low to high activism. Not all investors need occupy the same place in this spectrum on a day-to-day basis. Indeed, having too many actively engaged investors might create unnecessary coordination costs and redundancies.

What likely matters more is the potential to engage with a firm, concurrently with other ESG investors, when a need surfaces. If a quantitative ESG investor does not eschew engagement and is willing to actively engage at appropriate times, the same end result is achieved as if the quantitative investor were an “active” owner in the first place. The goals of ESG investing are likely better achieved if there are more ESG investors in total, regardless of their day-to-day active ownership approach.

In this sense, the question of quantitative ESG investing versus active ownership is likely better considered as a question of how quantitative ESG investors can take actions that have the effect of helping other ESG investors who have a more active engagement philosophy. An ecosystem with both quantitative ESG investors and active owner-investors might be better if: (i) coordination costs are reduced – active owners can spearhead day-to-day engagement and quantitative investors can take their own independent actions that have the effect of lending their voice at appropriate times; (ii) the benefits of comparative advantage are maximized – those who are more skilled in day-to-day active engagement perform that task; and, (iii) the same end-result of ESG impact is achieved.

4. CAUSEWAY’S APPROACH

ESG investing is in the early stages but appears to be gathering momentum. It is helpful to examine the issues both critically and thoughtfully, weigh the accumulating evidence, consider alternative explanations, and identify which conclusions appear robust. This is likely an ongoing process, but the results appear encouraging.

At Causeway, the research teams have spent over a year examining ESG data from several providers. The analysis began with a detailed reading of the providers’ methodologies (for example, the MSCI methodology guide is almost 150 pages) with a view to determining their theoretical and practical soundness. Various statistical tests followed, guided by economic theory. In the end, we felt comfortable with MSCI ESG data as a good fit for our purposes.[13]

Causeway is also able to draw on its combination of fundamental and quantitative investment disciplines. Fundamental analysts, with deeper firm-level knowledge, serve as a resource for quantitative analysts. Causeway’s emerging markets ESG strategy, when launched, will follow a quantitative approach that seeks to draw on academic research on the alpha potential of ESG signals, complemented with in-house ESG research. We believe a combination of fundamental and quantitative resources and research likely provides favorable positioning for deploying skill in ESG investing.

Finally, Causeway is not an activist investor on a day-to-day basis but does engage with firms on certain areas of ESG, and may at appropriate times in the future use active engagement that can help to achieve common ESG goals.

This market commentary expresses Causeway’s views as of October, 2017 and should not be relied on as research or investment advice regarding any investment. These views and any portfolio holdings and characteristics are subject to change, and there is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy or completeness of such information. Information about MSCI is derived from public sources, and this commentary should not be relied on as a recommendation or endorsement of any particular data vendor. The reader should consult its own advisors before choosing a data vendor.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

[1] https://www.unpri.org/directory/

[2] http://www.ussif.org/sribasics

[3] Share price outperformance relative to a benchmark.

[4] There is a large body of academic literature on this topic.

[5] There is a non-trivial percentage of split bond ratings. See for example:

- Livingston, Miles, and Lei Zhou. 2010. Split bond ratings and information opacity premiums. Financial Management

- Bonsall, Samuel, Kevin Koharki, and Luke Watson. 2017. Deciphering tax avoidance: evidence from credit rating disagreements. Contemporary Accounting Research 34, 818-848.

[6] Other reasons for ratings disagreement include information uncertainty and opacity surrounding rated firms, and random error. Ibid.

[7] Fama, Eugene, and Kenneth French. 1997. Industry costs of equity. Journal of Financial Economics 43, 153-193.

[8] Botosan, Christine, Marlene Plumlee, and He Wen. 2011. The relation between expected returns, realized returns and firm risk characteristics. Contemporary Accounting Research 28, 1085-1122.

[9] “Relevant firms” refers to those for whom the ESG issue in question is meaningful. For example, biodiversity and land use is unlikely to be a meaningful ESG issue for electronics manufacturers, in which case they would not qualify as “relevant firms” for the purposes of this example.

[10] MSCI ESG Ratings Methodology, March 2017, 83.

[11] In a credit ratings context, see for example: Altman, Edward, and Herbert Rijken. 2004. How rating agencies achieve rating stability. Journal of Banking and Finance, 28.

[12] For example:

- Nagy, Zoltan, Altaf Kassam, and Linda-Eling Lee. 2015. Can ESG add alpha? An analysis of ESG tilt and momentum strategies. MSCI;

- Friede, Gunnar, Michael Lewis, Alexander Bassen, and Timo Busch. 2015. ESG and corporate financial performance: mapping the global landscape. Deutsche Asset and Wealth Management;

- Khan, Mozaffar, George Serafeim, and Aaron Yoon. 2016. Corporate sustainability: first evidence on materiality. The Accounting Review 91, 1697-1724;

- Varco, Chris. 2016. The value of ESG data: early evidence for emerging markets equities. Cambridge Associates;

- Laidler, Ben, Daniel Grosvenor, and Wai-Shin Chan. 2017. Global equity strategy: 10 reasons ESG matters. HSBC Global Research.

[13] Causeway will apply proprietary transformations and enhancements to the MSCI ESG data for use in its emerging markets ESG strategy, when launched.