Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

“There is no terror in the bang, only in the anticipation of it.”

– Alfred Hitchcock

Markets typically discount future events many months before they occur. In our current world of massive monetary liquidity, with historically high levels of investment in all types of assets, this anticipation mechanism is working in overdrive. Some economically cyclical stocks already reflect a global recession, even though the Federal Reserve, European Central Bank (“ECB”), and other central banks are embarking on their tightening cycles. No one knows if this new monetary policy regime will lead to a recession in the United States or other developed nations, but it should slow demand. Markets are reflecting these concerns. Only energy stocks are in the black year-to-date. They have soared on supply shocks, while cyclical companies—including some in the financials and industrials sectors—have lagged versus the MSCI ACWI Index. It is worth noting “lagged” is better than the disasters of 2022 year-to-date, experienced by the most expensive companies in the technology, consumer discretionary, and communications services sectors. War in Ukraine and severe Covid lockdowns in China have exerted additional selling pressure on many economically exposed companies. We believe many will generate recovery growth in revenues and earnings in the quarters after the economic trough.

Causeway’s active, valuation-driven investment approach for our fundamental strategies often leads to a contrarian portfolio, with stocks that have encountered temporary earnings headwinds, sometimes due to an impending downturn in gross domestic product growth. But from the depths of an economic slump consistently springs the next upcycle. We have used share price weakness to add incrementally to banks and industrials positions as the valuations (in all but ultra-draconian scenarios) are astonishingly low. We believe the best of the companies most vulnerable to the pressures of higher rates, war, and lingering Covid disruptions are well-capitalized and positioned competitively. We believe these are candidates for outperformance when markets anticipate the re-start of economic growth. A disciplined strategy of buying, in our view, world-class, economically sensitive companies during the downturn may prove rewarding when markets begin to price in recovery. To complement this exposure, fundamental client portfolios hold cash-generative companies often committed to returning capital to shareholders.

Key insights

- We have used share price weakness to add incrementally to banks and industrials positions as the valuations are astonishingly low.

- Buying, in our view, world-class, economically sensitive companies during the downturn may prove rewarding when markets begin to price in recovery.

- To complement this exposure, we focus our research efforts on companies that provide a high degree of visibility on future cash flows and are committed to returning excess capital to shareholders.

Banks have transformed and await their re-rating.

We believe the banks we have identified for fundamental client portfolios are in much better financial shape this economic cycle than in others of the past two decades. They have excess capital and have vastly improved their asset quality since the 2008-09 global financial crisis (“GFC”). We look for banks with strong balance sheets, trading at significant discounts to fair value, led by management teams willing to close the valuation gap through capital returns to shareholders.

Europe’s investment in domestic manufacturing, defense, and energy must be financed, which should bode well for the European banks in Causeway global and international client portfolios.

Currently, many of the most attractively valued banks are domiciled in Europe, where concerns about recession, inflation, or the fearsome combination of the two (stagflation), weigh heavily on their outlooks. The risks stemming from the war on their continent have pushed their valuations to prior crisis lows. Although we are modeling an economic slowdown when valuing European businesses, we expect growing regional investment in domestic manufacturing, defense, and energy infrastructure. “Germany will not be cold two winters from now,” says portfolio manager Alessandro Valentini, referencing new capital projects to reduce European reliance on Russian gas.

All this investment must be financed, which should bode well for the European banks in Causeway global and international client portfolios. Relative to the stickier wage increases contributing to US inflation, inflation in Europe currently appears driven by more transitory spikes in energy prices.

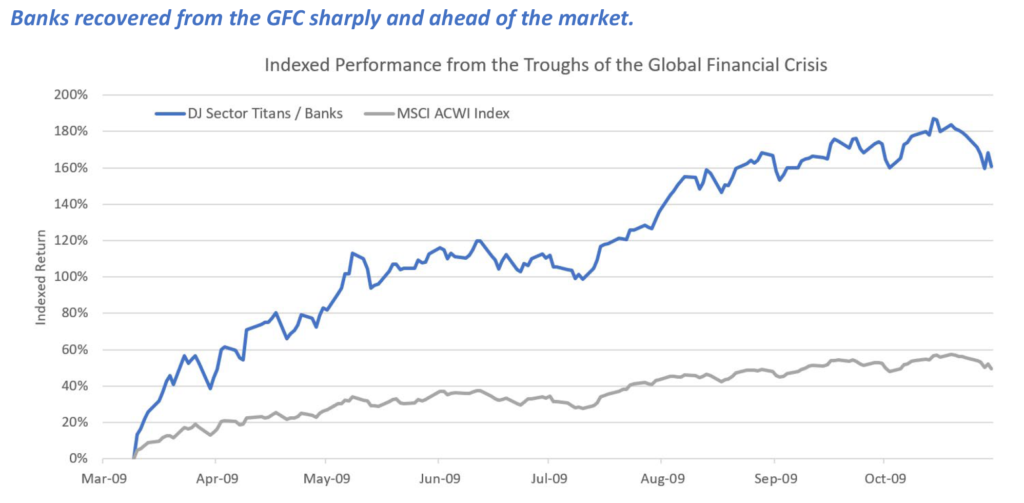

Bank stocks substantially outperformed equity markets in the months after the GFC lows, as their valuations were early to reflect the eventual (albeit not yet visible) economic recovery. Particularly as the market recognizes their improvements since then, we expect them to lead in the next cycle as well.

Source: FactSet. The Dow Jones Banks Titans 30 Index is designed to measure leading companies in the global banks sector. Performance start date: March 9, 2009.

We expect recovery ahead for industrials.

Within the industrials sector, year-to-date portfolio detractors include stocks that became ensnarled in China’s unyielding lockdowns, through supply chain disruptions and a wide array of cost increases from logistics to labor. We believe these industrials stocks are some of the most undervalued companies in Causeway fundamental portfolios, yet, ironically, their weakened earnings cause them to appear expensive on standard valuation metrics. Portfolio manager Jonathan Eng, who leads Causeway’s research in industrials and several other cyclical sectors, is accustomed to this phenomenon: “A stock at the bottom of its earnings cycle has a low return on equity and a high price-to-earnings multiple. People look at it and think it’s poor quality and expensive. We look at it the other way and say, you know what? There’s a lot of upside potential here.”

Beleaguered holdings include those that depend on Chinese air traffic. According to American Express Travel data for March 2022, global business travel has returned to an average of roughly 60% of pre-pandemic levels in all regions except Asia, where routes to Hong Kong and China are barely above zero. The reopening of the Chinese economy will likely revitalize revenue for several portfolio holdings, including one of the largest fundamental holdings in aerospace.

We have sold from fundamental client portfolios cyclical stocks we think are fully valued, like a luxury goods manufacturer that thrived during Covid lockdowns.

“I see the seeds of a very good value rally being planted. I think we will be able to find some great buys and position for the eventual upturn.” – Jonathan Eng

We also have sold industrial companies we believe are overexposed to rising input costs and will face ongoing margin pressure. We have recycled those proceeds into attractively valued companies in more defensive areas. But we have kept industrial companies we believe have substantial operational restructuring upside. “This is the most dynamic equity market I have seen in a long time,” says Eng, who believes markets may struggle in the short term. “But I see the seeds of a very good value rally being planted. I think we will be able to find some great buys and position for the eventual upturn.”

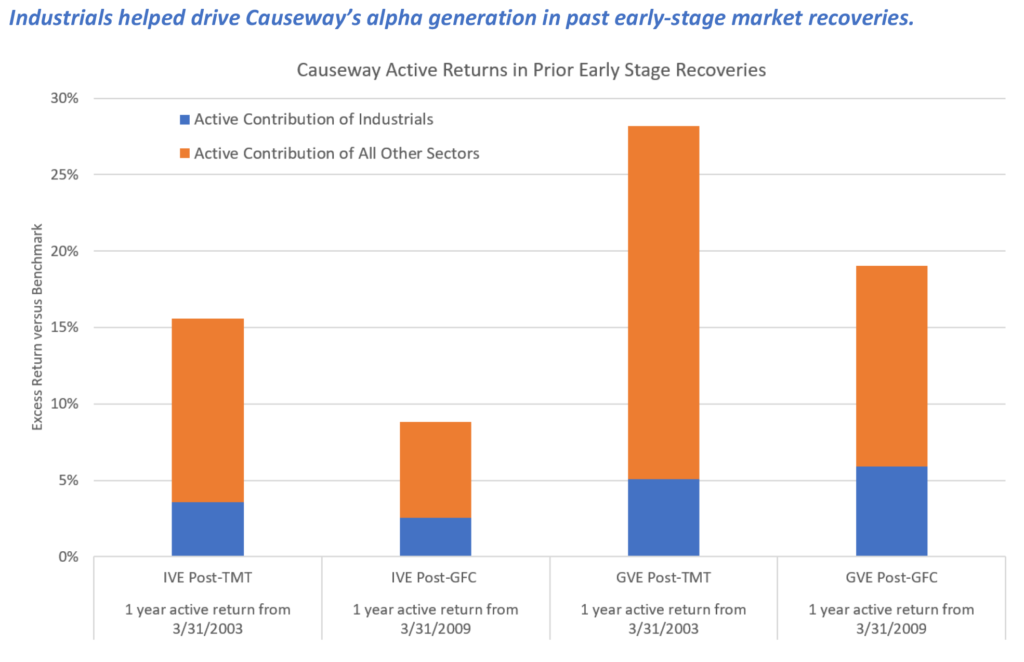

The share prices of industrials, especially those exposed to early cycle economic expansion, historically have risen in the quarters before a definite economic improvement. In prior early market recoveries, the industrials exposure of Causeway international and global value portfolios has been a key driver of alpha generation.

Source: FactSet, Causeway. The benchmark for Causeway International Value “IVE” is the MSCI EAFE Index. The benchmark for Causeway Global Value “GVE” is the MSCI ACWI Index. IVE and GVE represent Causeway’s International Value Equity Composite and Global Value Equity Composite, respectively, net of management fees. This information supplements the full composites available at 20220115_IVE_GIPS.pdf (causewaycap.com) and 20220115_GVE_GIPS.pdf (causewaycap.com). The return periods are 1 year from the end of the month with the lowest point of the MSCI ACWI Index during each downturn: 3/31/2003 for the post-technology, media and telecom (“TMT”)-crash recovery beginning, and 3/31/2009 for the post-GFC recovery beginning. Past performance is not indicative of future results.

Capital return to shareholders provides ballast.

Dividend income and share repurchase programs become especially meaningful in market downturns. We are focusing our research efforts on companies that provide a high degree of visibility on future cash flows and are committed to returning excess capital to shareholders. Across sectors and regions, many holdings in Causeway international and global portfolios are bolstering returns by paying dividends and buying back shares. Cash returned to shareholders adds to total return and creates performance ballast. In contrast, higher interest rates make long-duration cash flows (or the promise of cash flow far in the future) less valuable.

Over the next five years, we forecast our current pharmaceutical holdings to generate free cash flows amounting to roughly 30-50% of their current market capitalizations. We expect them to return about half of that cash to shareholders through dividend payments. Two current holdings have begun augmenting dividend income by initiating multi-billion dollar share buyback programs.

Within the energy sector, we emphasized large integrated firms over services or exploration companies, partly because of their demonstrated capital return commitment to shareholders. Flush with cash on oil price strength, a European oil major in Causeway fundamental client portfolios recently announced plans to expand its share buyback program and increase its dividend.

Even ultra-conservative European bank regulators are allowing the region’s largest banks to return capital to shareholders. Some banks have the balance sheet capacity to buy back over half of their market capitalization in the next four years, (remarkably) doing this at 30% of tangible book value. Assuming no cataclysm, these banks’ book values per share should rise precipitously. These changes are resulting in some of the highest dividend yields and share buybacks for banks we have seen since prior to the GFC.

“A decade ago, these banks had to pay the regulators. They had to pay litigators. Nothing was left for the equity shareholder. Valuations have returned to those very low levels, except this time we expect the shareholder will get paid.” – Conor Muldoon

Portfolio manager Conor Muldoon believes capital return alone could catalyze a recovery in bank stocks, even if investor sentiment is slow to improve. “A decade ago, these banks had to pay the regulators. They had to pay litigators. Nothing was left for the equity shareholder,” he recalls. “Valuations have returned to those very low levels, except this time we expect the shareholder will get paid.”

Strong balance sheets, ample cash flow, and generous shareholder return policies should help position Causeway fundamental portfolios for any further darkness ahead in equity markets. And when markets begin to price in the eventual dawn, the economic sensitivity embedded in these portfolios should be prepared to perform.

This market commentary expresses Causeway’s views as of May 2022 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations.

The MSCI ACWI Index is a free float-adjusted market capitalization index, designed to measure the performance of the large and mid-cap segments across 23 Developed Markets and 24 Emerging Markets countries. The MSCI EAFE Index is a free float-adjusted market capitalization index, designed to measure the performance of the large and mid-cap segments across 21 Developed Markets countries. These MSCI indices are gross of withholding taxes, assume reinvestment of dividends and capital gains, and assume no management, custody, transaction or other expenses. It is not possible to invest directly in an Index.

MSCI has not approved, reviewed, or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.