Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

How Fundamentals Strengthen Quantitative Strategies

By Ryan Myers, Quantitative Portfolio Manager

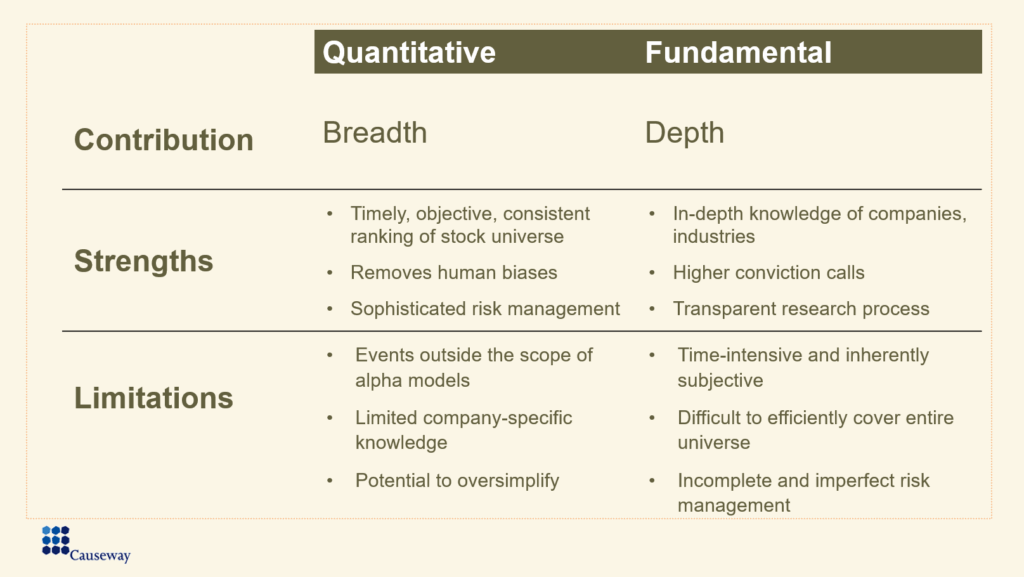

Investors face a continual challenge: how do you balance research breadth with depth? Quantitative models can quickly scan thousands of stocks across the globe, but they have blind spots. Fundamental research can uncover critical insights, but it takes time and is human-resource intensive.

At Causeway, our solution is to combine both. For nearly two decades, we have deliberately woven fundamental input into our quantitative strategies, beginning with Emerging Markets, then Small Cap, and more recently into Global Systematic Equity. Here, l will share examples of how fundamental judgment has improved our quantitative strategies.

The contributions have been in two key areas: Catching unmodeled risks and enhancing our alpha factor research.

Article continues below, or watch our video!

Catching Unmodeled Risks

One of the most important benefits of the fundamental and quantitative partnership is risk control. Our fundamental colleagues can act as early warning systems, flagging what models can’t. For example:

- A Japanese pharmaceutical company we owned looked strong by the numbers, until our healthcare analyst identified risks deriving from an FDA approval for a rival drug. We exited before the stock collapsed.

- A Swedish steelmaker seemed attractive on paper, until our materials analyst highlighted a wasteful capex plan that threatened free cash flow. We sold before the market caught on.

- A Korean insurer’s dividend looked secure quantitatively, but our insurance analyst predicted looming capital strain. He was right.

In each case, fundamental insight gave us a more complete view of risk.

Sharper Alpha Signals Through Collaboration

Fundamental insights don’t just provide an extra layer of risk control—they also sharpen our alpha factor research. I’ll share a few examples.

In 2024, we enhanced our factors with research on margin reversion in economically cyclical companies. Quant models often extrapolate the past, assuming today’s margins will persist. But our fundamental sector experts know cyclical businesses typically move in distinct patterns: expansion followed by reversion. Their perspective led us to design statistical methods that seek to identify firms with high margin variability and mean-reverting behavior, then evaluate them relative to their own cycles.

This factor has been especially effective in flagging companies at risk of becoming value traps—stocks that may appear cheap, but whose margins are set to contract. Importantly, it has also shown a low correlation with our other alpha signals, making it a valuable diversifier.

Other examples include:

- Improving sentiment measures by incorporating commodity-driven earnings shifts.

- Guiding us in building bank-specific quality metrics designed to capture unique capital risks.

This collaboration can turn good signals into better alpha drivers.

At Causeway, we view fundamental and quantitative as complementary forces. Together, they give us the breadth to cover more markets around the globe and the depth to understand what really matters. We believe that combination makes our process stronger.

This market commentary expresses Causeway’s views as of September 2025 and should not be relied on as research or investment advice regarding any stock. These views and any portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks, and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy, or completeness of such information.