Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

Technology stocks have presented two related challenges for global value investors: valuation and geographic concentration. Nevertheless, Causeway has found overlooked opportunities in the sector. To shed some light on investing in information technology (IT) stocks, we spoke to Jamie Doyle, portfolio manager, and Brian Cho, technology research analyst.

Jamie, why is it so difficult to find undervalued investment opportunities in the IT sector?

JD: The valuation challenge is easy to understand. “Interesting” companies—those with enticing technology or rapid growth in new markets that drives income statement momentum and increases margins—are typically priced very aggressively. At times, this enthusiasm reaches extraordinary levels. The technology boom of the late 1990s is the most memorable incident. Other examples over the last two decades include DRAM memory, personal computers and social media. Currently, equities exposed to “cloud”– based technology, such as Salesforce.com, have reached nosebleed valuations (although some of this appears to be correcting even as we write this in April).

Technology companies with lower valuations generally have perceived structural problems, such as exposures to a legacy business or the commoditization of what was formerly a differentiated product. The current Microsoft Windows-based personal computer market is a great example. PC volumes are declining, probably on a structural basis, and products have become indistinguishable.

In general, across all markets, IT stocks that we want to own are often too expensive, and those with reasonable valuations are often struggling to innovate.

“Interesting” companies—those with enticing technology or rapid growth in new markets that drives income statement momentum and increases margins—are typically priced very aggressively.

What is the geographic challenge?

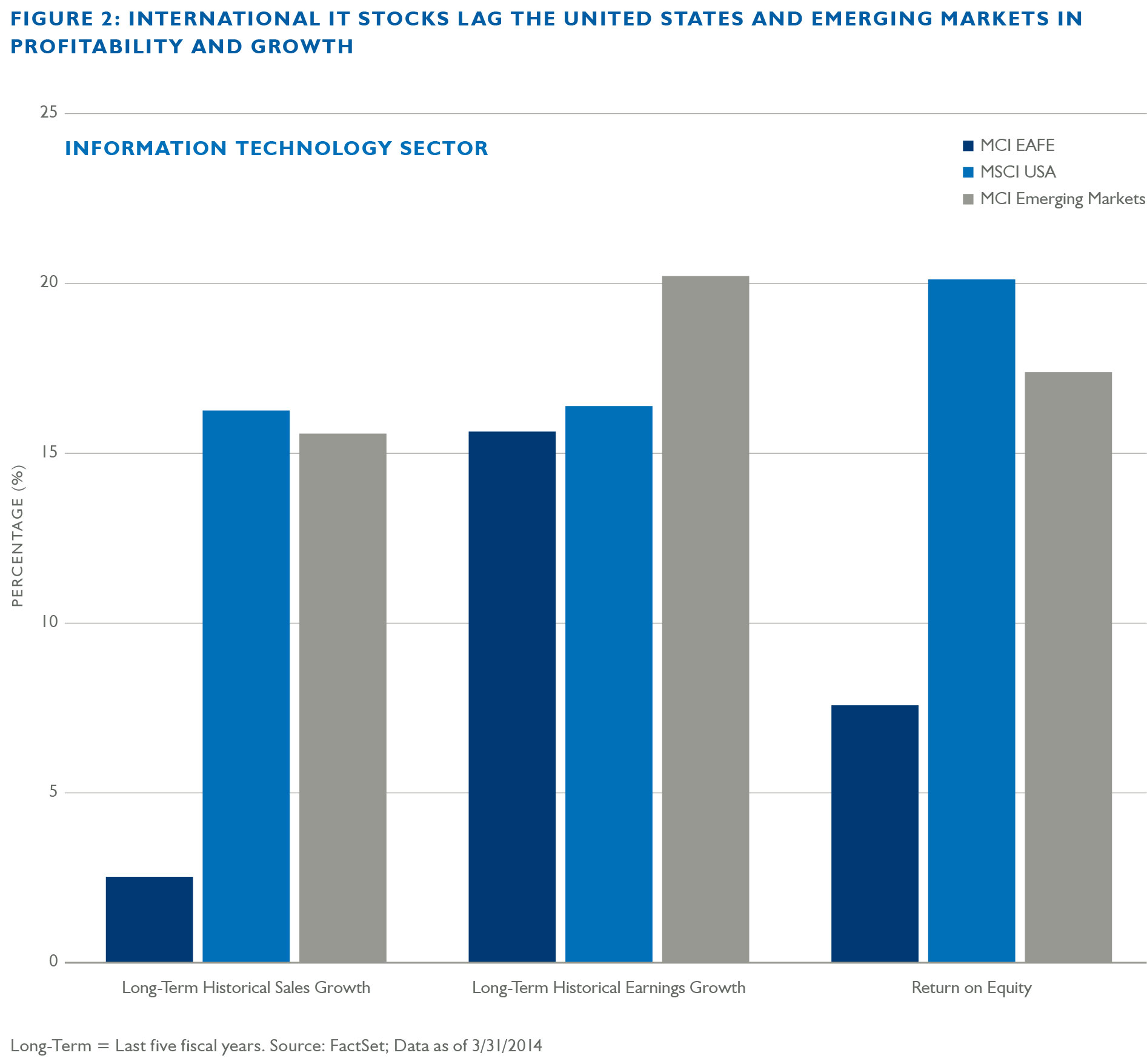

BC: The vast majority of the most innovative technology companies, especially in software and services, are US-domiciled. We all know these names: Amazon, Google, the aforementioned Salesforce.com, as well as hundreds of other perhaps less familiar companies. On the other hand, emerging markets are home to some of the dominant, ultra cost competitive technology providers, including memory and processing semiconductor producers, contract manufacturers, and outsourced labor.

Investors confining themselves only to international developed markets will have a paltry selection of technology companies. These international portfolios exclude of the majority of the world’s most innovative and fastest growing IT companies.

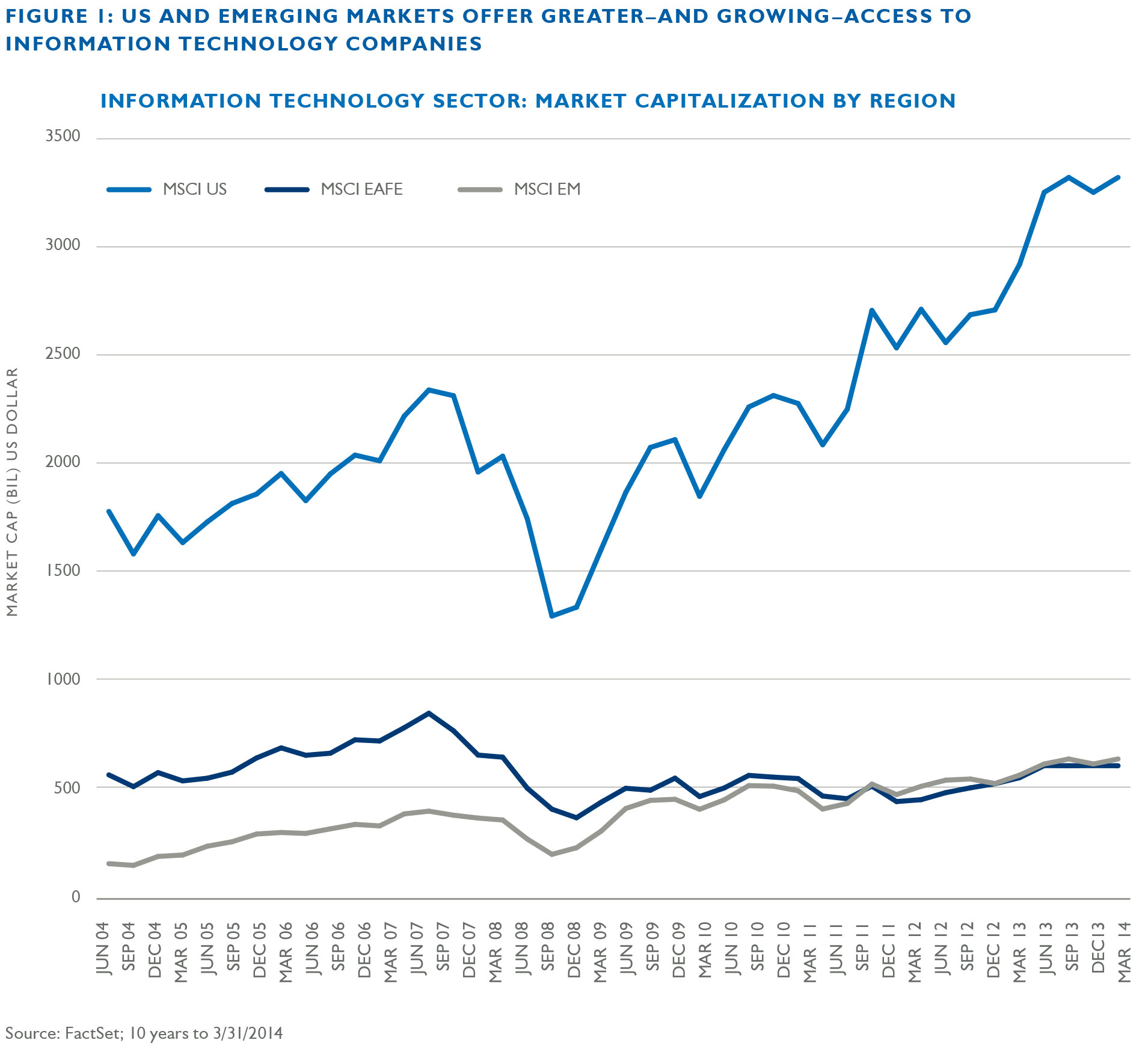

This leaves developed Europe and developed Asia (i.e., the traditional MSCI EAFE Index markets) somewhat stuck in the middle. As of March 31, 2014, IT represented nearly 19% of the S&P 500 Index. It is the single largest sector in the Index, exceeding financials by more than 200 basis points, and growing much more quickly. Analysts forecast that US technology firms will increase earnings nearly 14% over the next three-to-five years, a growth rate 26% higher than the forecast for the financial sector. In contrast, IT represents a mere 4.5% of the EAFE Index. The MSCI Emerging Markets Index has nearly 17% in IT.

JD: Investors confining themselves only to international developed markets will have a paltry selection of technology companies. These international portfolios exclude of the majority of the world’s most innovative and fastest growing IT companies. To make matters worse, the handful of truly influential EAFE-listed IT companies tend to be valued even more aggressively, because of the perception of a “scarcity value.” Emerging markets investors, or those blending emerging and developed markets in an international/global mandate, get the benefit of more and better options.

Given the lack of IT in developed international markets, do you ever find anything in the sector worth buying?

JD: We occasionally find a few unnoticed gems—typically cyclical technology businesses. I admit, it doesn’t happen very often. For instance, over the past 13 years, we have had two opportunities (the technology bust of 2000 and the global financial crisis of 2008) to buy a world-class semiconductor equipment company, based in the Netherlands. For these cyclical opportunities, we can buy the best of the best, when valuations reflect the dismal near-term cyclical problems, and discount the dominant long-term technology and market position. We have also invested in restructuring companies like a Swedish communication equipment manufacturer, or in misunderstood technologies like “smartcards” from one of France’s leading IT software companies. In fact, clients in our International Value Equity strategy currently own shares in a German-headquartered enterprise software powerhouse, which has historically traded at valuations too high to justify purchase. But, because of market concerns over cyclical weakness, as well as fears about threats from a new generation of competitors, the stock is now much more attractively valued. In contrast with the rare chance internationally to buy great IT companies, we have that opportunity frequently in our global mandates.

What US enterprise software companies have you identified for clients?

JD: We have found quite a few. For our global equity clients, who are in a strategy that gives us the geographic flexibility to include the US market, we have invested in two of the world’s largest software companies. One is currently transitioning its enterprise software to a whole new avenue of consumer

applications. The other has built an impressive software and hardware suite to enable data management for over 400,000 enterprise customers globally. Although the revenue growth rates for these two companies have slowed over the years, they still generate growth, profit margins, return on capital levels and cash flows that most non-tech companies would envy.

Cloud will deflate the long-term growth rate of the storage industry, but the massive growth in data (the advent of big data analytics) may offset much of that future shrinkage.

Brian, how about opportunities in US tech hardware? Are the challenges cyclical or structural?

BC: We invested in a large US storage technology company trading at a record low valuation. With corporate IT budgets under pressure, enterprises are trying to reduce their capital expenditures by using data storage resources longer, and at higher utilization rates than normal. The low growth IT spending environment may not return to historical levels, but we do expect a cyclical upturn in enterprise storage spending. We have evidence that organizations are evaluating new technologies and delivery models. This evaluation period has probably elongated the sales cycle. Our expectation of a partial cyclical upturn in data storage demand stems from the drawbacks of cloud (i.e., externally provided) storage. Cloud solutions can fit many needs, but some customers won’t move their mission critical data to the public cloud for reasons of perceived inferior security and inferior data management, potential problems with legal and compliance, higher cost, and reputational risk. Cloud will deflate the long-term growth rate of the storage industry, but the massive growth in data (the advent of big data analytics) may offset much of that future shrinkage.

JD: As with any sector, there is a price for everything. We will invest in technology companies that have perceived problems, but we insist that we understand the challenges, both cyclical and structural. With thoughtful analysis, we should be able to find companies with long-term, profitable franchises, supported by strong balance sheets and abundant cash flows. At the right valuation and entry price, those stocks are poised to deliver satisfying performance.

Important Disclosures

Past performance is no guarantee of future performance. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume.MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products. The market commentary expresses the portfolio managers’ views as of 4/22/2014 and should not be relied on as research or investment advice regarding any stock. These views and portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass. Any portfolio securities identified and described do not represent all of the securities purchased, sold, or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.