Contact Us

Subscribe to Causeway Insights, delivered to your inbox.

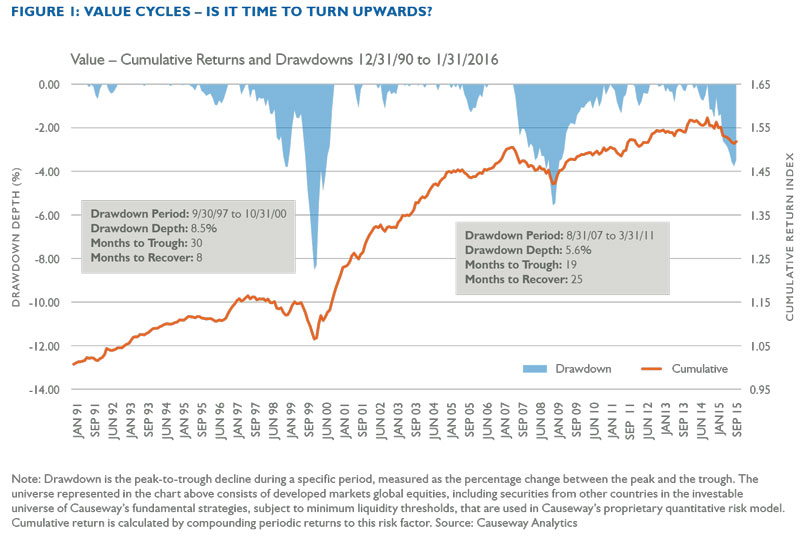

Over the past 25 years, the current weakness in value rivals even the late 1990’s technology, media and telecommunications bubble in depth. We do not need “reflation,” as some critics argue. Simple mean reversion bodes well for a recovery in value stocks.

“Value investing is at its core the marriage of a contrarian streak and

a calculator.” –Seth Klarman

When stocks become cheap, the prognosis typically improves for an equity market recovery. Despite what our emotions tell us, most bear markets decrease—rather than elevate—risk of future losses. As with stocks, commodities follow a similar rule of thumb. With sharp (70% plus) declines in many commodity prices from recent peaks, the risk/reward balance swings in favor of reward. Furthermore, not all substantial and sustained equity market declines lead to recessions. In 1988 and 2002, the US equity market swooned over many months, yet recession did not ensue. What will calm investors and spur renewed buying interest? With the US dollar giving up ground this year, depreciating versus the euro and yen, the downward pressure on commodity prices should abate. We expect that stabilization of commodity prices should alleviate concerns of demand destruction, evident in the deterioration in both credit markets and bank balance sheets. Furthermore, emerging markets equites, undervalued relative to history and mature markets, should eventually attract more buying interest. Despite concerns about the developing world, these countries generally have younger populations, the prospect of renewed productivity, and superior economic growth rates relative to Europe, Japan, and even the mighty United States. However, with a steady economy, positive bond yields, and a legal haven for fleeing capital, the United States has enjoyed a strong currency for over two years. The US Federal Reserve is likely evaluating the deflationary effects globally of US dollar appreciation. This could mark the end of the rising dollar and weak commodity price trend since mid-2014.

Simple mean reversion bodes well for a recovery in value stocks.

From Causeway’s perspective, value stocks may be poised to outperform global markets in the near future. Value moves in cycles. Over the past 25 years, the current weakness in value rivals even the late 1990’s technology, media and telecommunications bubble in depth. We do not need “reflation,” as some critics argue. Simple mean reversion bodes well for a recovery in value stocks. Given the historically wide deviation in value versus growth within industries (value is historically cheap), a stabilization in inflation expectations should encourage investors to take risk, rather than crowd into stocks with perceived quality and upward earnings momentum. Unimpeded, stock markets should eventually price correctly the fundamentals of a business; this is the cornerstone of value investing.

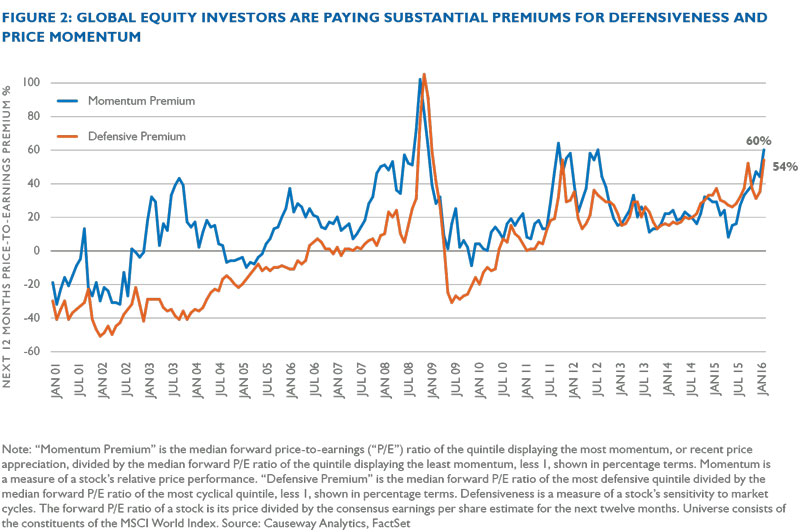

On several valuation metrics, certain equity style characteristics such as defensiveness and price momentum look expensive versus other segments of markets, with multiples well above their long-term averages.

The conundrum for beleaguered value managers (and their clients) is that value and high beta stocks (stocks with high benchmark index sensitivity) dominate the list of the greatest bargains across equity markets, especially emerging markets.

In order to understand better the opportunity in value stocks, we spoke to Causeway fundamental portfolio managers Conor Muldoon (financials and materials sectors), and Jamie Doyle (technology and telecommunications sectors), and quantitative portfolio manager, Arjun Jayaraman, for their perspectives.

Arjun, how much longer do you expect value to continue its drawdown?

AJ: Based on history, we are due for a value rebound, although it is of course impossible to predict exactly when that rebound will occur. Investors would probably have a lot more confidence in cyclical and financials stocks if they expect stable (rather than deteriorating) Chinese and US real gross domestic product growth. With credit cheap in most regions, plus room for more fiscal spending, many developing economies will likely muddle through this period, avoiding a crisis. It would help if these governments, especially Beijing, would accelerate state-owned enterprise reform to re-invigorate investment and spark competition. Globally, especially in emerging markets, governments need to dismantle barriers to trade and foreign investment in goods and services. With adversity often comes the political will for change. Long before we see these improvements, equity markets typically rally with the prospect of rising productivity.

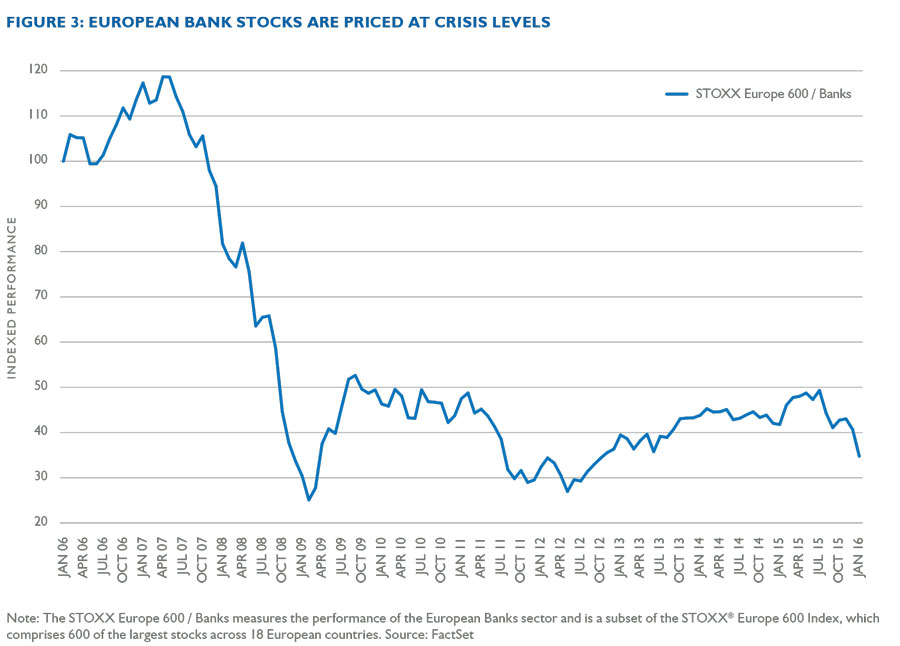

Conor, what do you see in the financials sector that should get investors’ attention?

CM: Many of the banks that interest us are trading substantially below their tangible book values (book value less goodwill). As a group, bank stocks have performed very poorly in 2016. We believe the market has overreacted. We have not seen such low bank valuations since the 2011-12 euro crisis. Some banks are even trading well below their absolute lows reached in the 2008-09 financial crisis, when investors feared spiraling credit losses, recession and severe dilution of equity capital.

On behalf of our clients, we will gladly accept higher dividend payouts while waiting for a “re-rating” upward to valuations more consistent with disciplined capital allocation and an improving return on equity trajectory.

We can understand the current anxiety evident in markets. The specter of flattening yield curves portends a likely hit to bank earnings. But it is hard to envision what would cause most banks to need capital replenishment. Capital ratios have more than doubled since the mortgage crisis and leverage has declined precipitously. Lending standards have tightened. Liquidity at banks has improved significantly. Bank oversight—with annual stress tests—is highly stringent, and banks have shed volatile businesses, especially those that consume capital. Stagnating economies will likely push up loan loss provisions, but we still expect several prominent banks (well managed or restructuring), to be able to return capital to shareholders. We like some of the cheapest US money center banks as well as several European and UK banks. On behalf of our clients, we will gladly accept higher dividend payouts while waiting for a “re-rating” upward to valuations more consistent with disciplined capital allocation and an improving return on equity trajectory.

JD: Keep in mind that bank stocks’ “leverage” works both ways. In a market rebound, banks will likely outperform overall indices by a wide margin. 2009 was a most spectacular example of this.

Jamie, last but not least, what’s happening in technology, another cyclical area of stock markets?

JD: Year-to-date to mid-February, the technology hardware & equipment industry group is still struggling, down over 13% within the MSCI World Index. The cyclical semiconductors stocks are faring the worst, then hardware, and software, and all areas of technology have declined by double digit percentages since the beginning of the year.

We typically use stock market gloom to upgrade our client portfolios to the highest quality, best-positioned competitors in every sector.

Within software, the large cap “legacy” vendors have held up relatively well, while the high-flying, high-growth companies have been crushed. We typically use stock market gloom to upgrade our client portfolios to the highest quality, best-positioned competitors in every sector. One of our current holdings is a world leader in memory semiconductors (and other technology commodities), as well as mobile phones. In semiconductors, this giant has a sustainable cost advantage over peers. Best of all, the company has committed itself to sizable share buybacks. This makes a lot of sense given the stock’s low valuation, trading currently below 10x next year’s earnings and at a discount to book value. Although not yet wildly generous, the dividend yield, combined with superior financial strength, adds to our level of patience.

Important Disclosures

The newsletter expresses the authors’ views as of 2/24/2016 and should not be relied on as research or investment advice regarding any stock. These views and portfolio holdings and characteristics are subject to change. There is no guarantee that any forecasts made will come to pass.